Ageas Expands Its Portfolio: Acquires UK Insurer esure for $1.3 Billion

In a significant move within the insurance sector, Ageas, a prominent European insurance group, has announced its decision to acquire esure, a UK-based insurance provider, from Bain Capital for a staggering $1.3 billion. This strategic acquisition is expected to bolster Ageas's presence in the competitive UK market, particularly in the personal insurance sector.

Continue reading

Acquisition Buzz: Gerresheimer Attracts Interest from Phillips-Medisize and Bain Capital

In a significant move within the healthcare and pharmaceutical packaging sector, Gerresheimer AG, a renowned manufacturer of glass and plastic products, has reportedly caught the attention of investment groups, particularly Phillips-Medisize and Bain Capital. This potential acquisition underscores the growing competitiveness in the industry as companies seek to strengthen their market positions through strategic investments and partnerships.

Continue reading

Kestra Files for IPO Amidst Market Buzz and Future Aspirations

Kestra, a leading medical device company backed by Bain Capital and Endeavour, has officially filed for an initial public offering (IPO). This move comes at a significant time in the healthcare sector, as the demand for innovative medical technologies continues to surge. The company has positioned itself as a strong player in the industry, focusing on developing advanced medical solutions that cater to a wide range of healthcare needs.

Continue reading

Bain Capital Set to Acquire Mitsubishi Tanabe Pharma for $3.3 Billion

In a significant move within the pharmaceutical sector, Bain Capital has announced its intent to acquire Mitsubishi Tanabe Pharma Corporation in a deal valued at $3.3 billion. This acquisition marks a pivotal moment for Bain, as it expands its footprint in the biopharmaceutical industry, acquiring one of Japan's notable pharmaceutical firms.

Continue reading

CC Capital Raises Its Offer for Insignia, Outbidding Bain's Takeover Bid

In a significant development within the private equity sector, CC Capital has increased its acquisition proposal for Insignia, positioning itself above Bain Capital in a competitive bidding landscape. This strategic move not only heightens the stakes for the luxury business but also emphasizes the aggressive nature of the current market for premium brands.

Continue reading

Bain Capital's $1.7 Billion Takeover Bid Turned Down by Insignia

In a significant turn of events within the investment landscape, Insignia Financial, a prominent player in financial services, has officially rejected Bain Capital's compelling $1.7 billion takeover offer. This rejection has sparked discussions regarding the future of Insignia and Bain Capital's intentions in the market.

Continue reading

Bain Capital Sets Sights on Insignia Financial with Acquisition Offer

In a significant move within the finance sector, Bain Capital has made a substantial offer to acquire Insignia Financial, a prominent Australian investment company. This proposal, which values Insignia at approximately AUD 2.5 billion, marks a vital chapter in Bain Capital's strategy to expand its influence in the Asia-Pacific region.

Continue reading

The $4 Billion Battle Between KKR and Bain: A Spotlight on Japan's Private Equity Phenomenon

In a high-stakes clash emblematic of Japan's booming private equity market, KKR & Co. Inc. and Bain Capital have found themselves embroiled in a heated dispute over the control of a $4 billion Japanese company. The fracas is not only a reflection of the aggressive strategies employed by top investment firms in the region but also a clear indication of the growing allure of Japanese assets in the wake of economic recovery and reform.

Continue reading

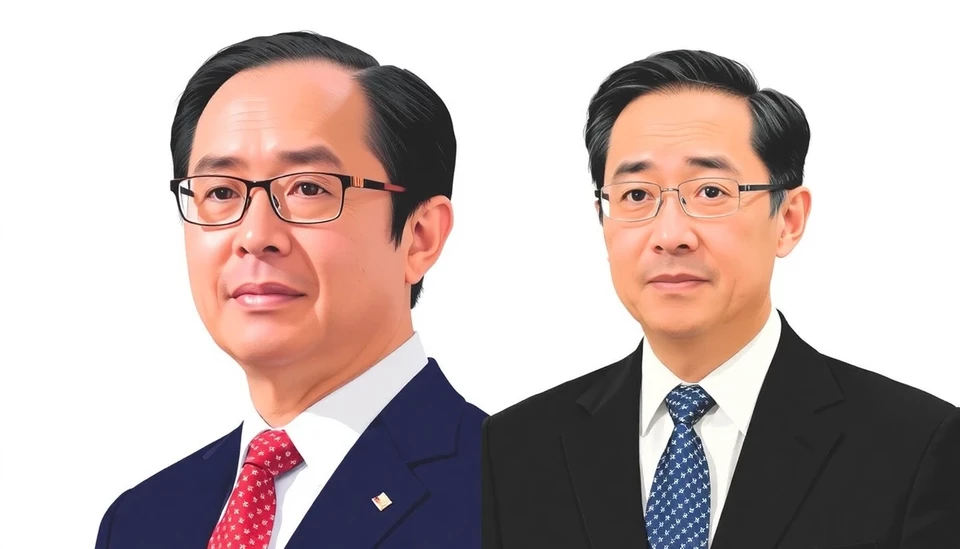

Pirelli's Major Shareholder Under Investigation for Alleged Violations of China's Regulatory Framework

In a significant unfolding in the world of corporate governance, Pirelli, the renowned tire manufacturer, finds itself at the center of a mounting investigation involving one of its top investors. The focus has shifted to a probe concerning potential breaches of regulations governing foreign investments in China. This investigation could wield considerable consequences not only for the investor in question but also for Pirelli and its operations within the lucrative Chinese market.

Continue reading

Major Leadership Change at Bain-Backed Indian Wealth Management Firm as Co-CEO Taparia Resigns

In a surprising development for the Indian wealth management sector, co-CEO Nitin Taparia has announced his departure from the company backed by Bain Capital. This news comes as the financial firm, which has rapidly expanded its footprint in the wealth management landscape, gears up to navigate a transitional period without one of its key leaders.

Continue reading