Israel Maintains Steady Interest Rates for a Decade: Economic Stability or Stagnation?

In a significant monetary policy decision, Israel’s central bank has decided to keep its key interest rates unchanged for the tenth consecutive meeting. This decision, announced on April 7, 2025, reflects the Bank of Israel's ongoing strategy to navigate the complexities of the current economic climate while aiming to sustain growth and manage inflationary pressures.

Continue reading

Israel's Central Bank Faces Tough Decisions Amid Trump's Tariffs and Regional Instability

As economic pressures mount due to rising U.S. tariffs on imports and escalating regional conflicts, Israel's central bank is preparing to maintain its current interest rates. The move signals a cautious approach as the nation grapples with the impacts of external economic policies and domestic tensions.

Continue reading

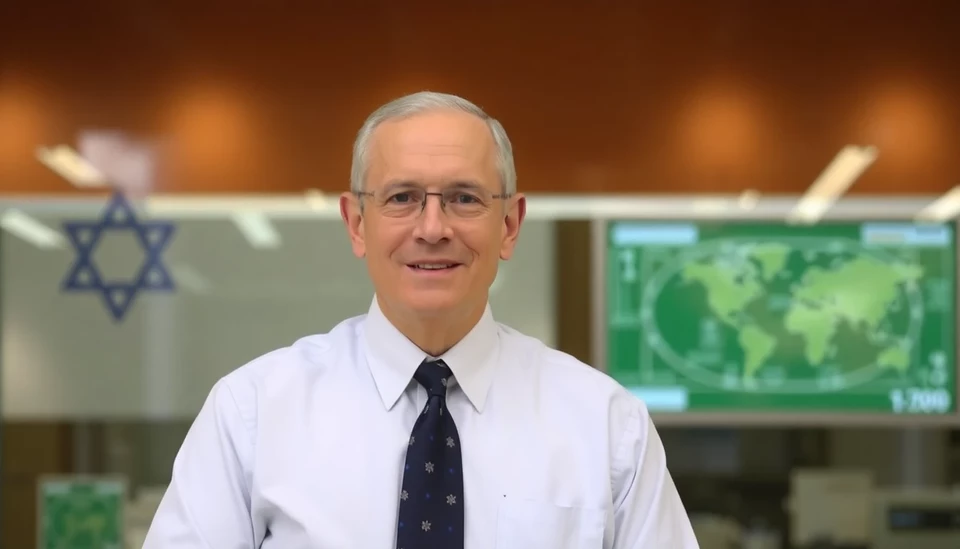

Bank of Israel's Deputy Governor Secures New Term After Protracted Approval Process

In a significant development for the Israeli financial sector, the Deputy Governor of the Bank of Israel, Andrew Abir, has officially received approval for a new five-year term following an unexpected delay in the approval process. Abir's reappointment is poised to bolster the central bank's efforts to navigate the complexities of the current economic landscape.

Continue reading

Israel's Central Bank Urges Strategic Allocation of $841 Million in War Aid

Israel's central bank has made a pivotal recommendation to the government concerning the use of approximately $841 million received in war aid. This funding, allocated by the United States to help Israel in its ongoing conflict, is being advised for a focused deployment that aims to bolster the nation's economy and secure its financial stability amidst the challenges posed by the war.

Continue reading

Israel Maintains Steady Interest Rate Amid Inflation Concerns

The Bank of Israel has decided to keep its key interest rate unchanged at 4.5%, signaling a cautious approach as the nation closely monitors inflationary pressures that could affect future economic decisions. This decision comes as the central bank seeks to navigate the delicate balance between fostering economic growth and combating rising prices.

Continue reading

Israel's Interest Rates Steady as War and Inflation Impact Economic Policy

As Israel continues to navigate through complex geopolitical circumstances, the Bank of Israel is projected to maintain its current interest rates. This decision is rooted in ongoing conflicts and inflationary pressures impacting the economy. Analysts speculate that the stabilization of interest rates will remain a key strategy as the nation contends with the fallout of warfare, which has dramatically influenced consumer and business activities.

Continue reading

Israel Maintains Interest Rates Amid Ongoing Conflict and Inflationary Pressures

In a significant decision reflecting the current economic climate, Israel's central bank has opted to hold its key interest rate steady at 4.75%. This move comes as the nation grapples with the financial ramifications of ongoing conflicts that have exacerbated inflationary pressures throughout the economy. The Bank of Israel’s announcement has drawn attention as the global economy faces similar challenges emerging from geopolitical tensions.

Continue reading

Is Israel's Economy Turning the Corner After Conflict-Related Turmoil?

The Israeli government is expressing a sense of cautious optimism regarding the nation's economic recovery, suggesting that the most challenging phase of its war-affected economy may soon be behind it. Following a tumultuous period marked by conflict, officials claim signs of stabilization are becoming increasingly evident.

Continue reading

Israel Maintains Interest Rates Amidst Inflation Surge and Economic Deceleration

In a decisive move reflective of the current economic landscape, the Bank of Israel has opted to keep its benchmark interest rate unchanged at 4.75%. This decision comes at a time when the nation is grappling with heightened inflation and the adverse impacts of an ongoing war, which collectively pose significant challenges to the stability of the economy.

Continue reading

Israeli Central Bank Cautions Lenders on Rising Risks in Mortgage and Construction Sectors

The Bank of Israel has issued a stern warning to financial institutions regarding the increased risks associated with mortgage lending and construction activities in the current economic climate. This advisory aims to mitigate potential vulnerabilities within the housing market as residential construction has seen a marked decline.

Continue reading