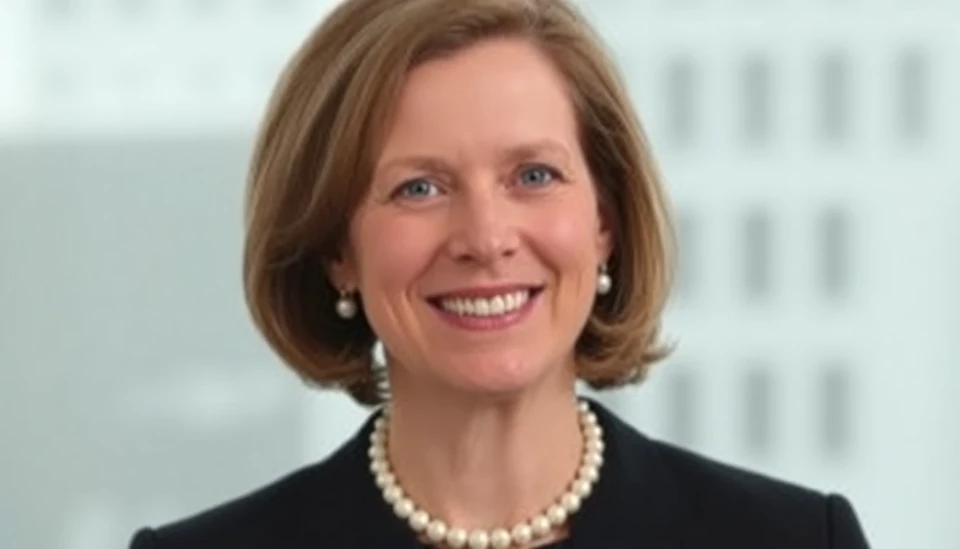

Chicago Fed's Anna Paulson Appointed as New President of the Philadelphia Fed

In a significant development in the world of central banking, the Philadelphia Federal Reserve Bank has announced the appointment of Anna Paulson, the current executive vice president and director of research at the Federal Reserve Bank of Chicago, as its new president. This decision marks a strategic move as the Fed seeks to enhance its leadership team in the face of ongoing economic challenges.

Continue reading

Riksbank Minutes Reveal Complacency Amid Recent Inflation Surge

Recent minutes released by Sweden's central bank, known as the Riksbank, indicate that policymakers remain largely unfazed by the recent surge in inflation rates. Despite concerns shared by various economists regarding the implications of inflation on the economy, the bank's members appear steadfast in their approach to monetary policy.

Continue reading

ECB's Cipollone Urges Consideration of QT in Future Rate Cuts

In a recent statement, ECB board member Fabio Cipollone emphasized the importance of incorporating quantitative tightening (QT) into discussions surrounding potential interest rate cuts. As the European Central Bank navigates a complex economic landscape, Cipollone's remarks highlight the need for a comprehensive approach to monetary policy adjustments.

Continue reading

Activist Investor Shakes Up the Bank of England's Foundations

In a bold move that is sending ripples through the British financial establishment, activist investor Jeffrey S. Spring has taken a prominent stance at the Bank of England. Known for his aggressive methods and outspoken opinions on corporate governance, Spring’s recent actions have resulted in a surprising clash with the institution that has long held a reputation for stability and predictability.

Continue reading

Federal Reserve's Diversity Initiative Faces Scrutiny Amidst Powell's Leadership

The Federal Reserve, under the stewardship of Chairman Jerome Powell, is currently navigating turbulent waters as criticism mounts over its diversity and inclusion initiatives. This comes as the nation grapples with broader conversations on equity, race, and representation in various sectors. The Fed’s recent commitment to fostering a more diverse workforce is facing harsh judgment from some factions who argue that it reflects a misplaced focus at a time when economic concerns are paramount.

Continue reading

Helmut Schlesinger, Former Bundesbank Leader, Passes Away at Age 100

Helmut Schlesinger, the influential figure who led the Deutsche Bundesbank during one of the most tumultuous periods in modern German financial history, has died at the age of 100. His passing marks the end of an era for Germany’s central banking system, which he guided through significant economic crises of the 1990s.

Continue reading

European Central Bank's Approach: Balancing Rate Cuts with Caution, Says Schnabel

The European Central Bank (ECB) remains committed to further interest rate cuts, but the pace will be measured, as highlighted by ECB board member Isabel Schnabel. In a recent address, Schnabel underscored the necessity of a cautious approach to monetary policy adjustments, particularly in the wake of prevailing economic uncertainties in the eurozone.

Continue reading

Polish Monetary Policy Committee Signals Potential Rate Cuts Ahead

In a recent development from Poland's central banking sector, a key member of the Monetary Policy Committee (MPC), Jerzy Wnorowski, has indicated that discussions surrounding interest rate cuts are likely to begin in March 2024. This statement reflects a broader sentiment within the committee about the potential easing of monetary policy to support the nation’s economy.

Continue reading

Swiss National Bank's Balance Sheet Risks: An Insight from Schlegel

In a recent statement, Thomas Schlegel, a prominent figure associated with the Swiss National Bank (SNB), raised concerns about the size of the bank's equity in relation to the risks it faces on its balance sheet. Schlegel's comments underscore the ongoing challenges the SNB faces in balancing its expansive monetary policy objectives with the inherent risks that come with significant financial exposure.

Continue reading

ECB's Elderson Emphasizes the Need for a Thoughtful Approach to Supply Shocks

In a significant statement regarding the European Central Bank's (ECB) monetary policy, ECB Executive Board member Frank Elderson has underscored that the bank cannot afford to merely disregard supply shocks. Elderson’s remarks come at a critical time as the region grapples with ongoing challenges affecting the economy, including inflationary pressures and geopolitical tensions.

Continue reading