Star's Struggles Deepen as Debt Refinancing Efforts Fail

In a significant development that casts a shadow over its future, Star, once seen as a promising player in its industry, encountered severe setbacks as its debt refinancing plan has collapsed. The company had been actively working to restructure its debts in a bid to avert looming financial distress; however, the failure to achieve a viable refinancing deal has raised alarm bells among investors and stakeholders alike.

Continue reading

Star Entertainment Receives Debt Refinancing Proposal from Oaktree Capital

In a significant development for Star Entertainment Group, the Australian gaming and entertainment company has attracted the attention of Oaktree Capital Management. Oaktree has proposed a debt refinancing plan aimed at addressing Star's financial obligations and improving liquidity. This proposal comes against the backdrop of the company's recent struggles following a series of regulatory and operational challenges.

Continue reading

CVS Health Moves Forward with 30-Year Hybrid Bond Sale to Tackle Debt Refinancing

In a significant financial maneuver, CVS Health is set to issue $3 billion worth of 30-year hybrid bonds in an effort to refinance its existing debt. This strategic decision comes as the healthcare giant seeks to enhance its capital structure and manage its obligations more effectively amidst evolving market conditions.

Continue reading

Blackstone Secures Debt Refinance for Premium NYC Condo Tower Using Municipal Bonds

Blackstone, one of the world’s largest investment firms, has successfully refinanced its debt for a luxury condominium tower located in New York City. This strategic move has seen the firm leverage municipal bonds to secure a more favorable financial position amid changing market dynamics.

Continue reading

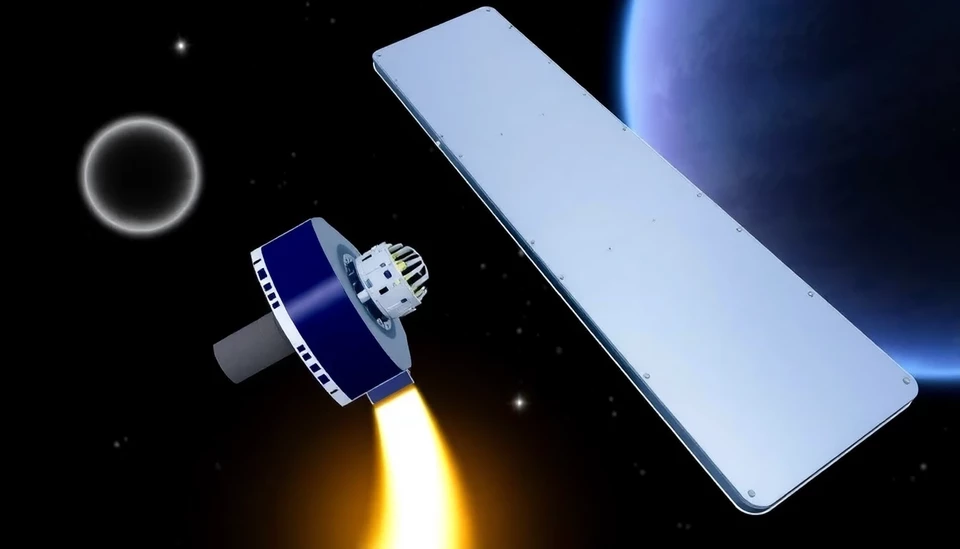

Telesat Takes Bold Steps to Refinance Debt as It Competes with SpaceX’s Starlink in the Expanding Satellite Industry

In a rapidly evolving space race characterized by technological advancements and fierce competition, Canadian satellite communications provider Telesat has announced its plans to refinance a significant portion of its distressed debt. This move comes as the company seeks to position itself more favorably against industry giants such as SpaceX and its Starlink satellite constellation, which has been making substantial inroads in the global market.

Continue reading

Indivior Secures Financial Stability with Debt Refinancing Deal

Indivior, the global pharmaceutical company known for its treatments for addiction and mental health disorders, has successfully extended the maturity of its debt through a strategic refinancing of its term loan. This maneuver is aimed at enhancing the company's financial flexibility and overall stability as it navigates the post-pandemic recovery landscape.

Continue reading