Londoners' Rising Housing Costs Force Spending Cuts Compared to Other Brits

In a revealing analysis of consumer behavior across the United Kingdom, recent data demonstrates that Londoners are spending significantly less than their counterparts in other regions due to the escalating costs associated with housing. This trend sheds light on the financial pressures faced by residents of the capital, which has become notorious for its pricey real estate market.

Continue reading

Singapore Adjusts Currency Settings in Response to U.S. Tariffs

In a significant move aimed at countering potential growth risks posed by U.S. tariffs, the Monetary Authority of Singapore (MAS) has decided to ease its currency policy. This decision is part of a broader strategy to bolster the city-state’s economy amidst increasing global trade tensions.

Continue reading

Federal Reserve's Collins Warns: Tariff Price Increases May Postpone Rate Cuts

In a significant announcement, Federal Reserve Bank of Boston President Susan Collins has cautioned that rising prices due to tariffs could impede the central bank's ability to lower interest rates. Speaking at a recent economic forum, Collins emphasized the potential ramifications of escalating tariffs, which could further strain the economy and hinder monetary policy efforts aimed at supporting growth.

Continue reading

Five Below Halts Orders Amid Intensifying US-China Trade Tensions

The escalating trade war between the United States and China has forced several retailers to reevaluate their supply chain strategies, and Five Below is no exception. In a recent announcement, the discount retailer revealed its decision to cancel numerous orders with Chinese manufacturers as economic uncertainty looms. This move comes as businesses scramble to navigate the ripple effects of tariffs and shifting trade policies that have characterized the relationship between the two largest economies in the world.

Continue reading

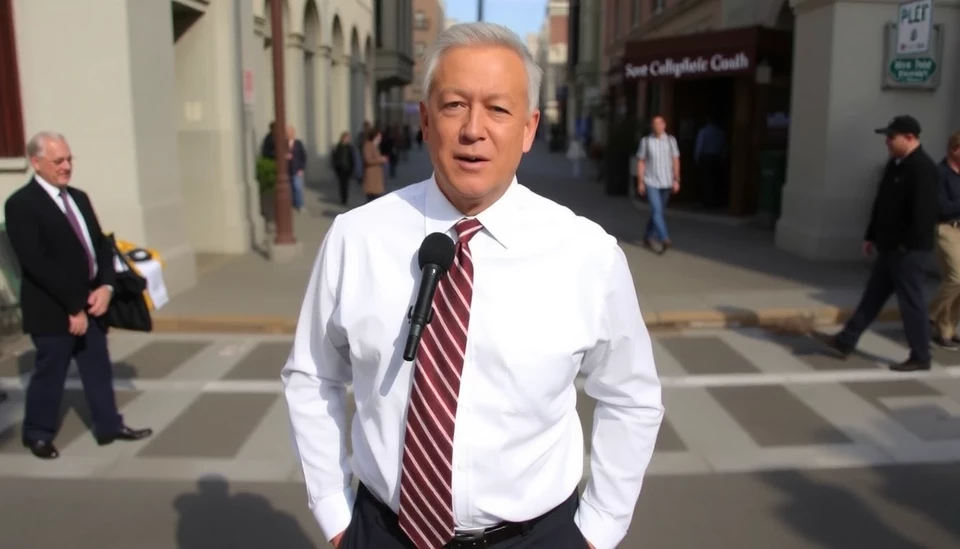

San Francisco's Mayor Takes Bold Steps to Revive City Finances Amid Economic Challenges

In a crucial move aimed at addressing San Francisco's economic downturn, Mayor London Breed has announced sweeping reforms targeting the city's financial instability, which have been exacerbated by recent tariff policies from the Trump administration. The mayor's initiative underlines the urgency to reassess fiscal strategies to bolster the city's economy and provide relief to its struggling residents.

Continue reading

U.S. Customs Duties Make a Modest Rise as Trade Deficit Grows

The United States has observed a modest increase in customs duties, as reported in recent data, correlating with an expanding trade deficit. This uptick comes at a time when the American economy grapples with various challenges, including inflationary pressures and geopolitical tensions. The increasing tariff revenues reflect broader trends in international trade dynamics and U.S. trade policy adjustments.

Continue reading

TC Energy Dismisses Mainline Sale Amidst Canada’s Oil Security Push

In a significant development for the Canadian energy sector, TC Energy has ruled out the sale of its Mainline pipeline system. This decision comes at a time when the Canadian government is prioritizing oil security and dependence. The Mainline, which plays a critical role in transporting crude oil from Western Canada to key markets in the United States, has been under scrutiny as the country navigates its energy needs and climate goals.

Continue reading

The Economic Fallout of Migrant Crackdowns: Insights from a Dallas Fed Economist

An economist from the Dallas Federal Reserve has expressed significant concerns regarding the potential repercussions of migrant crackdowns across the United States, particularly on the nation's GDP and inflation rates. In a recent analysis, the economist outlined how these policies could lead to labor shortages, ultimately jeopardizing economic growth and contributing to higher prices for consumers.

Continue reading

Mexico’s Central Bank Warns of Potential Economic Disruption from Trade Tariffs

The Bank of Mexico has issued a cautionary statement regarding the possible ramifications of trade tariffs, urging that they could significantly affect the nation's economic outlook. This comes amid ongoing fluctuations in global trade policies, fueling concerns about how such tariffs could hamper not only local markets but also the broader economic landscape.

Continue reading

Constellation Brands Faces Sales Decline Amid Pressure on Hispanic Consumers

Constellation Brands, known for its portfolio of popular beer brands including Corona and Modelo, recently reported a downturn in beer sales. This decline is attributed to significant economic pressures being felt by Hispanic consumers, a demographic that has traditionally been a strong market for the company’s offerings. The latest financial results reveal that Constellation is grappling with a complicated landscape, marked by inflation and shifting consumer preferences.

Continue reading