ECB's Villeroy Signals Quick Action on Interest Rates Based on Economic Data

In a significant statement that has stirred market speculation, François Villeroy de Galhau, a member of the European Central Bank (ECB) governing council, emphasized the institution's readiness to respond swiftly to economic data that could support changes in interest rates. His remarks come in the wake of increasing concerns about inflation and economic growth in the Eurozone, which have raised questions about future monetary policy directions.

Continue reading

U.S. Job Growth Exceeds Expectations with Addition of 155,000 Positions

In a recently released report by ADP, U.S. businesses have shown a robust job growth by adding 155,000 positions in March, surpassing economists' forecasts. Experts had initially anticipated a much lower increase closer to 130,000 jobs, highlighting a stronger-than-expected labor market despite various economic pressures.

Continue reading

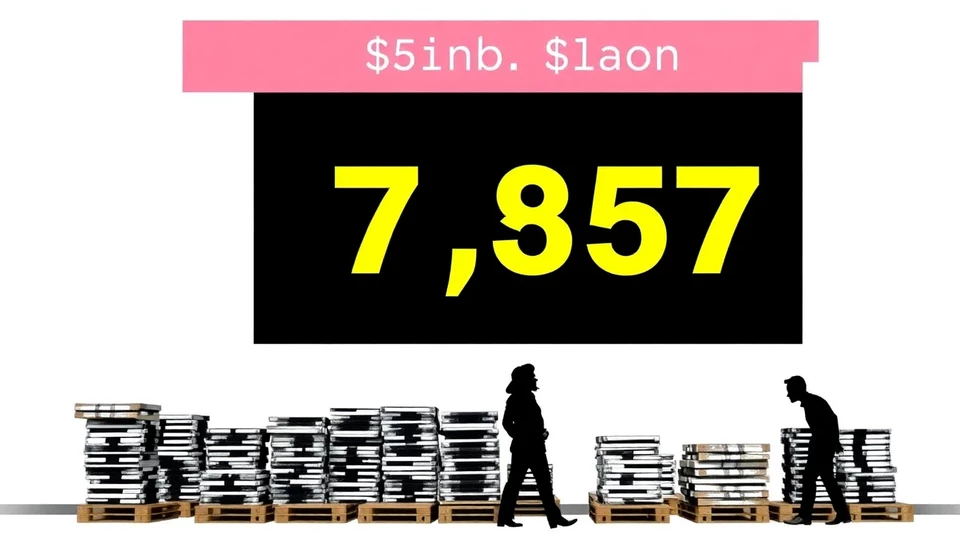

US Job Openings Plummet to 7.57 Million, Exceeding Forecasts and Spotlighting Economic Shifts

In a surprising turn within the labor market, the latest data reveals that job openings in the United States have significantly dropped to 7.57 million, a figure that is notably below analysts' expectations. This decline, reported for March 2025, signals potential shifts in the employment landscape, further complicating the ongoing recovery narrative post-pandemic.

Continue reading

Emerging Market Currencies Hold Steady Amidst Key China Data Release and U.S. Tariff Concerns

The landscape of emerging market currencies remains relatively stable as traders digest significant economic data from China. The latest figures have prompted discussions about potential shifts in U.S. tariffs, a factor that could have profound implications for international trade and currency valuations.

Continue reading

IMF Seeks Transparency on Senegal's Economic Data Ahead of Program Discussions

The International Monetary Fund (IMF) is calling for greater clarity regarding the economic data coming from Senegal, a move that is critical as upcoming discussions center on a potential financial support program. In a letter addressed to Senegalese authorities, the IMF expressed concerns over what it described as “distorted” data that could impact the effectiveness of any assistance provided.

Continue reading

UK Statistics Office Maintains Controversial 7 AM Release Time Despite Trader Pushback

The UK’s Office for National Statistics (ONS) has decided to retain its 7 AM release time for crucial economic data, a choice that has sparked a considerable backlash among traders and market analysts. The ONS made this announcement in the face of substantial lobbying from various financial sectors, including traders who argue that an earlier release could better serve the markets' needs.

Continue reading

Federal Reserve's Preferred Inflation Indicator Dips to Seven-Month Low

Recent economic data has shown that the Federal Reserve's favored measure of inflation is projected to decrease, signaling a potential easing of price pressures in the economy. The gauge, known as the Personal Consumption Expenditures (PCE) price index, is set to record its lowest level in seven months, a development that could influence future monetary policy decisions made by the central bank.

Continue reading

US Inflation Takes Center Stage: January CPI Report Unveiled

The January Consumer Price Index (CPI) report has been released, drawing considerable attention as it provides a crucial snapshot of inflation trends in the United States. Investors, policymakers, and economists alike are keenly analyzing these figures to gauge the economic outlook and the Federal Reserve's next steps regarding interest rates.

Continue reading

ECB's Elderson Emphasizes Data-Driven Policy Over Neutral Rate Considerations

In a recent statement, European Central Bank (ECB) member Frank Elderson asserted that the analysis of economic data should take precedence over the concept of a neutral interest rate in shaping the central bank's monetary policy. Elderson's remarks highlight a growing divide within the ECB regarding how to approach interest rates amid uncertain economic conditions.

Continue reading

Trump's Doge Cryptocurrency Sparks Debate Over Economic Integrity

In a surprising twist in the world of digital currency, former President Donald Trump has introduced a new cryptocurrency dubbed "Doge," which has swiftly ignited debate among economists and financial analysts regarding its implications on traditional economic indicators such as the gold standard and the accuracy of economic data.

Continue reading