IMF Cuts Global Growth Forecast Amid Heightened Economic Uncertainties

The International Monetary Fund (IMF) has announced a significant reduction in its global growth outlook, reflecting a myriad of challenges that have intensified since its last assessment. The latest report casts a shadow over the world economy, revealing that vital indicators and macroeconomic forecasts are under severe pressure, prompting concerns about a potential downturn.

Continue reading

Oil Prices Surge Amid Geopolitical Tensions and Supply Concerns

As the global oil market continues to experience volatility, recent developments have led to significant fluctuations in oil prices. On April 22, 2025, crude oil prices have surged, driven by increasing geopolitical tensions in key oil-producing regions.

Continue reading

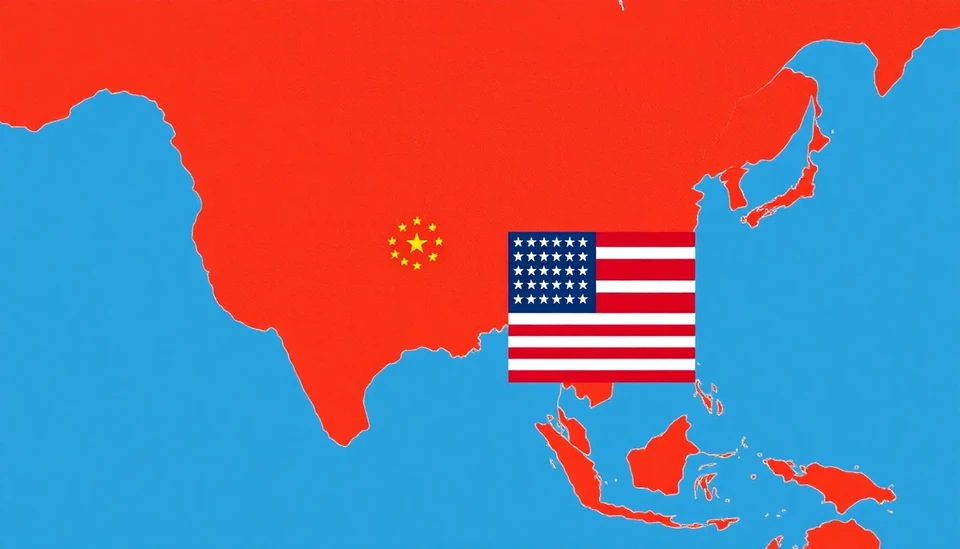

China's Key Trade Links with the U.S. Face Significant Setbacks Amid Decoupling Concerns

In a striking turn of events, recent data has revealed a collapse in trade of essential petroleum products between China and the United States, raising alarms about the ongoing economic decoupling between the two superpowers. The analysis underscores a steep decline in exports, highlighting the growing rift in trade relations as both countries navigate a complex geopolitical landscape.

Continue reading

Oil Prices Surge Amidst Geopolitical Tensions and Supply Concerns

In a significant turn of events, global oil prices have witnessed a sharp increase as geopolitical tensions escalate in key oil-producing regions. As traders navigate through a volatile market, the price of crude oil has surged over $85 per barrel, marking a peak not seen in months. This uptrend is primarily driven by factors such as ongoing conflicts, production cuts by major oil exporters, and an unexpected rise in demand.

Continue reading

Jamie Dimon Paints a Gloomy Picture for the Banking Sector Amid Global Turmoil

In a recent statement that echoes the concerns of many in the financial sector, Jamie Dimon, CEO of JPMorgan Chase, has likened the current climate of global banking to "stormy seas," highlighting the numerous challenges ahead for financial institutions worldwide. This stark metaphor encapsulates the unease that banks are experiencing due to economic uncertainties, geopolitical tensions, and market volatility.

Continue reading

Concerns in the German Defense Sector: A Call for Protection Against U.S. Tariff Discussions

The German defense industry is expressing significant anxiety regarding potential tariff discussions proposed by the United States. Industry leaders are raising alarms that these measures could severely impact their competitiveness and overall stability at a time when they are striving to enhance their capabilities and establish stronger collaborations with NATO partners.

Continue reading

European Finance Ministers Rally to Boost Defense Spending Amid Geopolitical Tensions

In a significant move reflecting the escalating global tensions, European finance ministers convened recently and reached a consensus on ramping up defense spending across the continent. This decision comes in the wake of heightened security concerns stemming from the ongoing conflict in Ukraine and the need for a robust military presence in light of potential threats from state actors.

Continue reading

April 2025 Oil Market Update: A Surge Fueled by Global Tensions and Seasonal Demand

In the latest developments within the oil market, prices have seen a significant uptick due to rising geopolitical tensions and robust seasonal demand. As reports come in, these elements are converging to create an environment ripe for change in global oil dynamics.

Continue reading

Trade Uncertainty Reaches Unprecedented Levels as Supply Chain Struggles Persist

Recent reports indicate that trade uncertainty in the global market has soared to record heights, further complicating already strained supply chains. The consequences of geopolitical tensions, evolving trade policies, and lingering effects from the global pandemic have culminated in a fraught environment for businesses and economies around the world.

Continue reading

Fed Backstop Concerns Could Undermine Dollar, Warns Deutsche Bank

Recent insights from Deutsche Bank indicate that fears regarding the Federal Reserve's capacity to support the economy could pose a significant risk to the US dollar. As market participants grapple with the implications of monetary policy and potential economic instability, the dollar’s strength is increasingly being questioned.

Continue reading