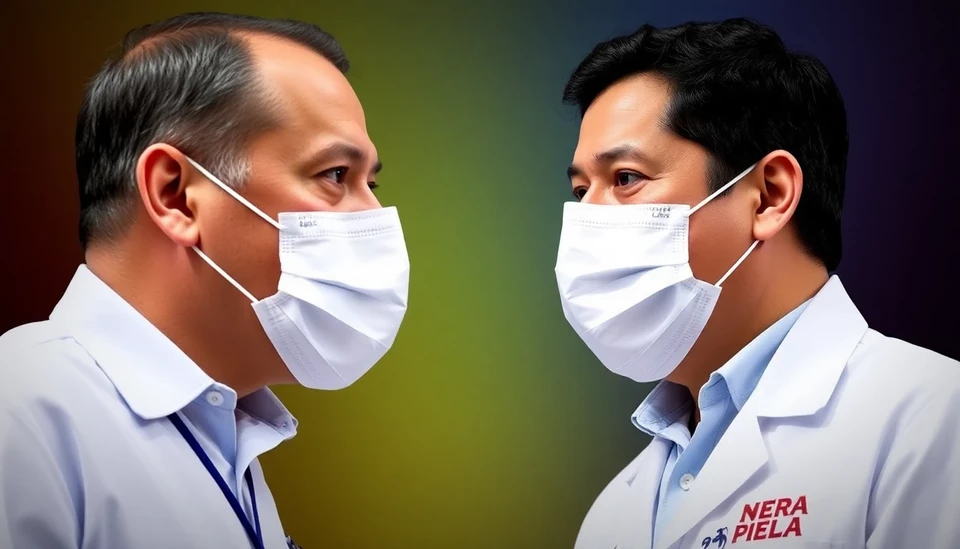

Colombia's Health Crisis Escalates Amidst Tensions Between President Petro and Insurance Companies

Colombia is experiencing a profound health crisis as the tension between President Gustavo Petro and health insurance companies reaches a boiling point. This confrontation is leading to widespread uncertainty for millions of Colombians who rely on healthcare services. The crux of the crisis lies in the conflicts surrounding healthcare policies and the functioning of the health insurance system, which many argue is under severe strain.

Continue reading

Zurich Insurance Expands Footprint with Strategic Stake in UK M&A Insurer

In a significant move aimed at bolstering its expansion into the highly competitive U.S. and European markets, Zurich Insurance Group has acquired a notable stake in a UK-based merger and acquisition (M&A) insurance company. This strategic investment reflects Zurich's commitment to enhancing its offerings in the M&A sector, especially as demand for such insurance continues to grow amid ongoing economic uncertainties.

Continue reading

The Future of Flood Insurance: What FEMA's Potential Demise Could Mean

In recent discussions surrounding the future of flood insurance in the United States, the potential dissolution of the Federal Emergency Management Agency (FEMA) has sparked significant concern among stakeholders. With FEMA playing a crucial role in the National Flood Insurance Program (NFIP), the ramifications of its possible demise could have profound effects on flood insurance availability and affordability for millions of Americans.

Continue reading

AIG Elevates Profitability Goals Under CEO Zaffino's Strategic Vision

American International Group (AIG) has announced ambitious new profitability targets as part of a transformative strategy initiated by CEO Peter Zaffino. Under Zaffino's leadership, the insurance giant is reinforcing its commitment to enhancing financial performance and shareholder value while navigating a challenging market landscape.

Continue reading

UK Plans to Increase Bank Deposit Insurance Limit to £110,000

The United Kingdom government has announced a proposal to raise the cap on bank deposit insurance from its current limit to £110,000. This move is designed to enhance consumer confidence and protect savings in an uncertain economic climate.

Continue reading

Experts Harness AI to Combat Escalating Insurance Losses from Catastrophic Events

In a groundbreaking shift, catastrophe experts and insurance companies are increasingly turning to artificial intelligence (AI) to curb the spiraling costs associated with natural disasters. This strategy comes as insurers grapple with the harsh realities of skyrocketing claims driven by extreme weather conditions and seismic events, leading to historically high financial tolls.

Continue reading

Ardonagh Group Plans $2.5 Billion in Funding to Accelerate Expansion

In a significant move signaling its aggressive growth strategy, Ardonagh Group is preparing to raise as much as $2.5 billion. This infusion of capital is expected to support the company’s ongoing expansion efforts across its diverse portfolio of businesses within the insurance sector. The fundraising initiative, announced recently, will likely involve a mix of debt and equity financing, as the company seeks to bolster its position in a competitive market.

Continue reading

California Faces Potential Insurance Bailout as Wildfire Risks Surge

California is currently contending with escalating wildfire risks that threaten not only its environment but also the insurance landscape. Recent developments signal that the state may need to consider another financial bailout for its insurance sector, reminiscent of previous incidents spurred by catastrophic weather events.

Continue reading

Insurance Innovator Ethos Teams Up with Goldman Sachs for Potential IPO

Ethos, a burgeoning player in the insurance sector, has recently enlisted the aid of Goldman Sachs as the company considers going public. This strategic partnership marks a significant step for Ethos as it aims to leverage Goldman’s expertise in navigating the initial public offering (IPO) process. The startup is focusing on expanding its market reach and increasing its valuation through public markets.

Continue reading

Prudential Faces Challenges as New Business Profits Decline Amid China Market Slowdown

In recent reports, Prudential plc, a major player in the life insurance and financial services sector, has revealed a significant downturn in its new business profits, largely attributed to a marked slowdown in the Chinese market. This trend has raised concerns among investors and industry analysts as the company navigates a tumultuous economic landscape.

Continue reading