Capital Group and KKR Secure SEC Approval to Market Retail Credit Funds

In a significant development for the investment community, Capital Group and KKR have received formal approval from the Securities and Exchange Commission (SEC) to sell new retail credit funds. This decision has generated considerable anticipation, as it marks a pivotal moment for both companies in their efforts to expand their offerings to retail investors.

Continue reading

KKR Goes Big: $1.2 Billion Bid for Biotage Unveiled

In a significant move in the life sciences sector, the global investment firm KKR has announced a colossal offer of $1.2 billion for Swedish biotechnology company Biotage. This acquisition proposal comes at a time when the demand for innovative solutions in the life sciences field is surging, driven by advancements in pharmaceuticals, diagnostics, and research applications.

Continue reading

KKR Contemplates $10 Billion Sale of Atlantic Aviation: Major Shift for Private Equity Firm

Private equity giant KKR & Co. Inc. is reportedly considering a significant divestment, with plans to potentially sell Atlantic Aviation, a subsidiary specializing in ground-support services for private aircraft. This strategic move could land a hefty valuation of approximately $10 billion for the aviation company, signaling a possible reallocation of resources within KKR’s extensive investment portfolio.

Continue reading

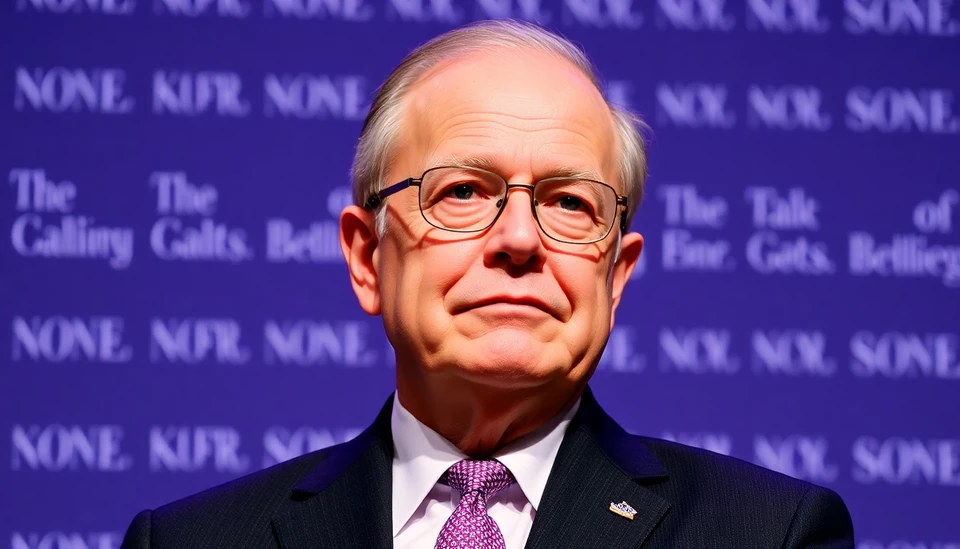

KKR Appoints Petraeus as Mideast Chair and Establishes Local Investments Team

In a strategic move to deepen its involvement in the Middle Eastern market, KKR, the global investment firm, has officially appointed former U.S. Army General David Petraeus as the chair of its newly established regional office. This initiative is being viewed as a significant step forward in enhancing KKR's investment potential in the vibrant and rapidly evolving Middle East region.

Continue reading

KKR Enters UK Healthcare Market with $1.6 Billion Acquisition of Assura

In a significant move within the healthcare sector, KKR, a leading global investment firm, has reached an agreement to acquire Assura, a prominent UK-based medical landlord, for an impressive $1.6 billion. This acquisition marks a strategic entry for KKR into the burgeoning healthcare real estate market in the United Kingdom, showcasing the growing demand for healthcare facilities driven by an aging population and increased healthcare needs.

Continue reading

Breaking: KKR Exits Consortium Aiming for Gerresheimer Acquisition

In a significant turn of events in the world of corporate mergers and acquisitions, KKR & Co. has officially announced its withdrawal from the consortium that was seeking to acquire the German pharmaceutical and medical technology manufacturer, Gerresheimer AG. This move comes as a surprising development, given the consortium's ambitious plans to streamline operations and create a formidable presence in the healthcare industry.

Continue reading

KKR's Ambitious Path: From Private Equity Giant to Mini Berkshire Hathaway

In a bid to redefine its identity and expand its influence, KKR & Co. (Kohlberg Kravis Roberts & Co.) is embarking on a transformation that resembles the diversified investment strategy of Berkshire Hathaway. This strategic pivot, spearheaded by the firm's founders, showcases their vision for KKR to become a more multifaceted investment entity, thus broadening its reach beyond traditional private equity.

Continue reading

Carlyle and KKR Offload $1 Billion in Asset-Backed Securities Linked to Discover Financial Loans

In a significant financial maneuver, leading private equity firms Carlyle Group Inc. and KKR & Co. have announced the sale of $1 billion in asset-backed securities (ABS) associated with a loan portfolio held by Discover Financial Services. This deal represents a strategic move amidst evolving market conditions and highlights the ongoing appetite for securitization in the financial sector.

Continue reading

KKR Heavyweight Takes Charge at Blue Owl to Spearhead Global Family Office Initiative

In a significant shake-up within the financial sector, Blue Owl Capital has announced that a seasoned veteran from KKR will join its ranks to lead a new ambitious initiative aimed at expanding the firm's services to global family offices. This strategic move reflects Blue Owl's intent to enhance its market presence and address the increasing demand for tailored investment solutions among ultra-wealthy clients.

Continue reading

KKR-Led Coalition Increases Bid to Acquire Assura with $1.6 Billion Offer

In a bid to acquire the UK-based healthcare property firm Assura, a consortium led by KKR has sweetened its offer, now amounting to $1.6 billion. This latest proposal marks a significant increase from prior offers and is indicative of the growing appetite for healthcare investments within the real estate sector. The revised bid highlights the strategic importance of owning and managing healthcare properties, especially in the current market environment.

Continue reading