London's Property Market Sees Surge in Demand for Larger Office Spaces

The London property market is undergoing a significant shift as companies increasingly seek to rent larger office spaces. This trend marks a departure from the downsizing and remote work strategies that had taken precedence during the pandemic. As businesses adapt to new working norms, a robust desire for more expansive and flexible work environments has emerged, igniting competition among landlords and tenants alike.

Continue reading

Major Cities Embrace Car Restrictions: The Transformative Impact on Paris, New York, and London

In a bold and transformative initiative, the cities of Paris, New York, and London have taken significant strides to reduce car use in their urban centers. This sweeping shift is not just about limiting traffic but fundamentally altering the landscape of urban life, providing a model for sustainable living that could influence cities around the globe.

Continue reading

London's Property Market Struggles Amidst Global Trade Tensions, Reports Rightmove

The London real estate market is currently facing significant pressures as ongoing trade wars and economic instability begin to take a toll on property prices, according to a recent report from Rightmove. The housing sector, which has been a pillar of the UK economy, is now grappling with the fallout from escalating trade disputes and uncertain economic circumstances.

Continue reading

State Street Eyes Expansion with $333 Million Acquisition of City of London Office

In a notable move in the commercial real estate market, State Street Corporation has announced its intention to acquire a prime office building located in the City of London for a staggering $333 million. This transaction underscores State Street's commitment to enhancing its presence in one of the world's leading financial hubs, as businesses around the globe continue to navigate the post-pandemic landscape.

Continue reading

Londoners' Rising Housing Costs Force Spending Cuts Compared to Other Brits

In a revealing analysis of consumer behavior across the United Kingdom, recent data demonstrates that Londoners are spending significantly less than their counterparts in other regions due to the escalating costs associated with housing. This trend sheds light on the financial pressures faced by residents of the capital, which has become notorious for its pricey real estate market.

Continue reading

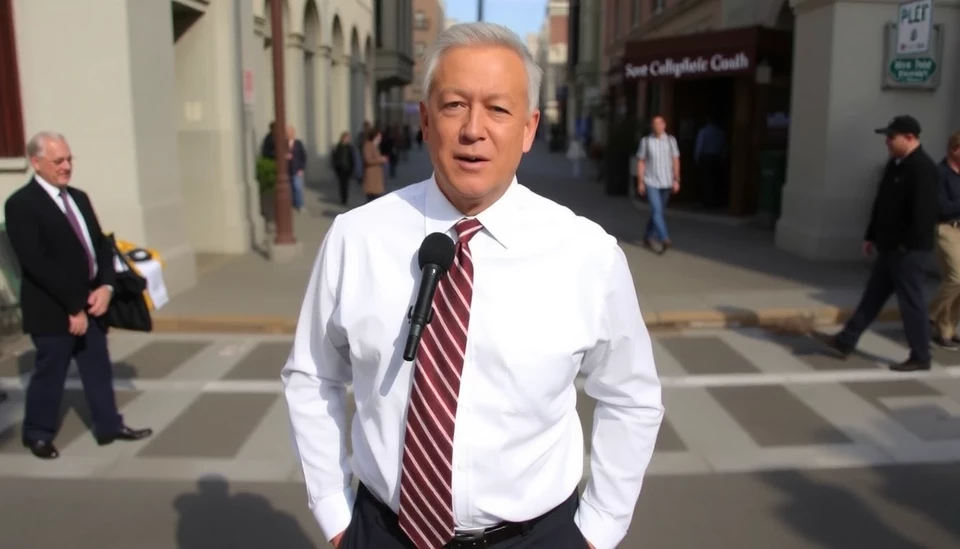

San Francisco's Mayor Takes Bold Steps to Revive City Finances Amid Economic Challenges

In a crucial move aimed at addressing San Francisco's economic downturn, Mayor London Breed has announced sweeping reforms targeting the city's financial instability, which have been exacerbated by recent tariff policies from the Trump administration. The mayor's initiative underlines the urgency to reassess fiscal strategies to bolster the city's economy and provide relief to its struggling residents.

Continue readingBrookfield Asset Management Pursues Loan Restructuring for Iconic CityPoint Tower in London

Brookfield Asset Management, a prominent player in global real estate investment, is reportedly seeking to restructure its loan for the CityPoint tower in London. This iconic skyscraper, which has long stood as a centerpiece of the city's financial district, is currently facing financial pressures that the firm aims to renegotiate with its lenders.

Continue reading

London's Housing Market: Prices Slide but Homes Remain Unaffordable

In a surprising twist, the historical trend of sky-high property prices in London is witnessing a downturn, marking a shift in the housing market dynamics. Recent reports indicate that the average cost of homes has decreased, bringing a glimmer of hope for potential buyers who have long been priced out of the competitive market. However, despite this price dip, the affordability crisis for many Londoners persists, as even the reduced prices are still out of reach for the average income earner.

Continue reading

Major Disruption: Heathrow Airport Faces Closure Following Power Outage Due to Fire

Heathrow Airport, one of the world’s busiest international airports, has been forced to close its operations after a significant power outage reportedly caused by a fire. This unexpected incident has thrown travel plans into chaos, leading to delays and cancellations for thousands of passengers.

Continue reading

UK Billionaire Spencer Sounds Alarm on Sluggish London IPOs Amid Market Concerns

In a candid assessment of London's initial public offering (IPO) landscape, UK billionaire and financier, Spencer, has raised significant alarm bells over what he describes as a "slow corrosion" in the market. His comments come at a time when the vibrancy of the city's financial sector has come under scrutiny, with many potential IPOs either delayed or abandoned amidst a broader economic uncertainty.

Continue reading