Italy's Credit Rating Affirmed as Positive by Morningstar DBRS

In a recent update that sends a wave of optimism through financial markets, Morningstar DBRS has confirmed Italy's long-term credit rating at BBB, indicating a stable financial outlook for the Italian economy. This assessment comes amidst ongoing discussions about Italy's fiscal policies, economic recovery, and the broader European economic landscape.

Continue reading

JD Sports Stock Jumps as Investor Fears of Tariffs Diminish

JD Sports Fashion PLC, a prominent British retailer in athletic wear, witnessed a significant boost in its stock prices following a revised outlook that has effectively calmed investor anxieties over potential tariffs. This surge marks a positive response from the market amid growing concerns about international trade tensions that could impact the retail sector.

Continue reading

Chinese Central Bank Takes Action Against Misinformation Surrounding Rate Cuts

In a move to uphold the integrity of financial communications, the People's Bank of China (PBOC) has announced that individuals spreading false rumors about interest rate cuts on social media platforms will face punishment. This decision comes amid growing concerns regarding misinformation's potential impact on financial markets and public trust in economic policies.

Continue reading

Argentina Secures $20 Billion IMF Program to Address Economic Challenges

In a significant move aimed at stabilizing its economy, Argentina has successfully reached an agreement with the International Monetary Fund (IMF) for a new financing program worth $20 billion. This announcement was made by Finance Minister Luis Caputo, highlighting a renewed effort to tackle the country's ongoing economic crisis and to restore confidence among international investors.

Continue reading

Natura Strives to Rebuild Market Trust Following Earnings Disappointment

In a bid to restore confidence among its investors, Natura & Co. is taking decisive steps after a disappointing earnings report. The beauty and personal care conglomerate, known for its sustainable products, faced scrutiny following a substantial miss in its anticipated quarterly earnings. This has led to a turbulent atmosphere in the investor community, prompting the company to rethink its strategies.

Continue reading

Germany Sparks Recovery as Euro Zone's Private Sector Gains Momentum

In a promising turn for the Euro Zone, recent data indicates a notable upswing in the private sector, largely driven by robust performance in Germany. This resurgence comes amidst ongoing global economic challenges, showcasing resilience and potential for recovery within the region.

Continue reading

RBI Steps In: A Major Cash Infusion of $21.5 Billion to Boost India’s Liquidity

In a significant move aimed at alleviating liquidity concerns in the Indian economy, the Reserve Bank of India (RBI) announced its decision to infuse approximately $21.5 billion into the financial system. This decision comes in light of the ongoing challenges faced by various sectors, particularly amid global economic uncertainties and domestic demand fluctuations.

Continue reading

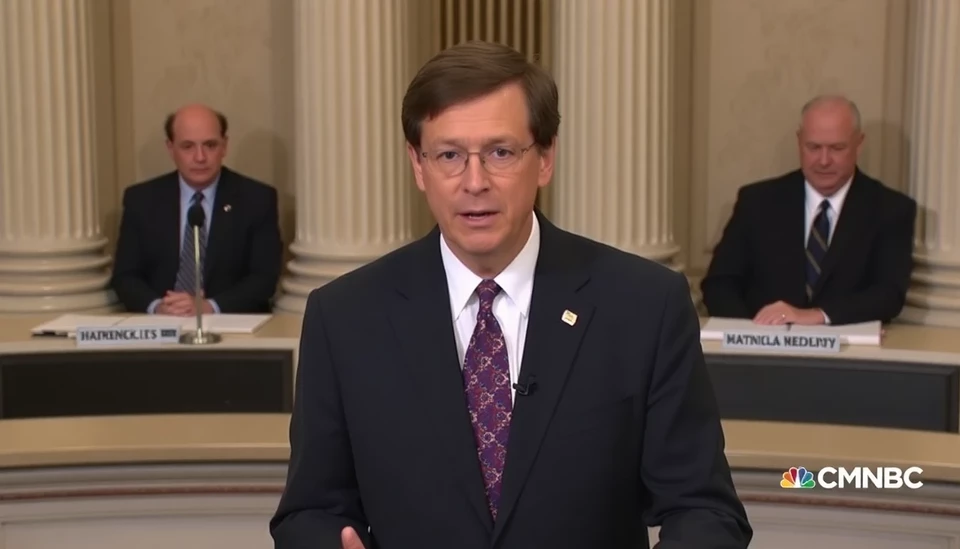

Fed’s Barkin Emphasizes a Modestly Restrictive Approach to Monetary Policy

In a recent statement, Richmond Fed President Thomas Barkin indicated that it remains appropriate for the Federal Reserve to adopt a "modestly restrictive" stance on monetary policy as the central bank continues to fight inflation. Barkin's comments come at a time when many economists and policymakers are closely monitoring the economic landscape, particularly as inflationary pressures persist and interest rate adjustments have become a focal point for the central bank.

Continue reading

Fed's Barkin Emphasizes Need for Transparency in Policy Direction Amid Economic Growth Concerns

In a recent statement, Federal Reserve Bank of Richmond President Thomas Barkin underscored the importance of clarity as the central bank grapples with policies aimed at fostering economic growth. Barkin highlighted that officials are keen on understanding the nuances that influence monetary policy, particularly as the economy navigates various challenges and opportunities.

Continue reading

KKR Raises Profit Expectations Amid Growing Confidence in Long-Term Private Equity Investments

KKR & Co., the prominent global investment firm, announced an upward revision in its earnings forecast, driven by robust performance across its long-term private equity investment strategies. This optimistic outlook emerged from their recent earnings report, showcasing the firm’s resilience and strategic adjustments in response to market dynamics.

Continue reading