UK Regulators Turn Their Attention to Wall Street's Integration of AI in Trading Operations

In a significant development for the financial sector, UK regulators are closely monitoring the impact of artificial intelligence (AI) on trading practices, particularly as adopted by major banks and trading firms on Wall Street. This scrutiny marks a proactive approach by regulatory bodies to ensure that the rapid adoption of AI technology does not compromise market integrity or consumer protection.

Continue reading

The Future of Regulatory Enforcement: SEC and CFTC Leaders Outline New Directions

In a significant evolution within financial regulation, the leaders of the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) have voiced their predictions of a transformative approach towards penalty policies and enforcement strategies. During a recent exposition, both Chair Gary Gensler of the SEC and Chair Rostin Behnam of the CFTC discussed a broader vision aimed at adapting to the continuously changing landscape of the financial markets.

Continue reading

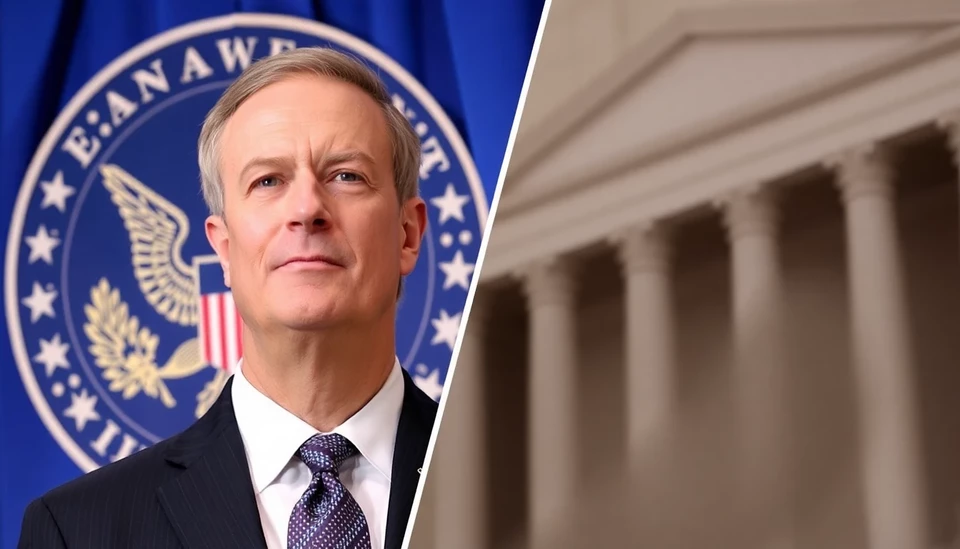

Acting SEC Chief Transforms Agency Ahead of Trump's Nominee Confirmation

In a significant move that signals a transformative era for the U.S. Securities and Exchange Commission (SEC), the acting chair has already begun to implement changes even before a confirmation vote is held for the nominee put forth by former President Donald Trump. This proactive approach aims to reshape the SEC into a more robust and adaptive institution ready to address the challenges of modern financial markets.

Continue reading

Odey Faces Heavy Penalties for Governance Breach: A Closer Look at the Fallout

In a significant move that signals a tightening of corporate governance standards, famed hedge fund manager Crispin Odey has been hit with substantial fines and a ban by the UK's Financial Conduct Authority (FCA). The ruling comes as a result of Odey's reckless disregard for compliance and governance norms, leading to a systematic failure in his oversight practices.

Continue reading

Life Sentence for Rogue Aluminum Trader in $1 Billion Fraud Case Shakes Financial Markets

In a shocking turn of events in the world of finance, a notorious aluminum trader from China has been sentenced to life in prison after being found guilty of orchestrating a staggering $1 billion fraud scheme. This high-profile case has not only sent ripples through the financial sector but also raised concerns over the integrity of trading practices within the metals market.

Continue reading

EU Raises Red Flags Over Bank Trading Rule Opt-In Proposal

The European Union is voicing significant concerns regarding a proposed opt-in system for bank trading regulations. This proposal, which has come to light amid ongoing discussions about financial stability in Europe, has sparked a debate about its potential implications on market integrity and risk management across member states.

Continue reading

Major Banks Reach $100 Million Settlement in UK Gilts Collusion Investigation

In a significant turn of events, four well-known banks have agreed to settle a case regarding collusion in the UK government bond market, known as gilts, for over $100 million. This agreement comes after various allegations claimed that these financial institutions engaged in coordinated practices that undermined market integrity and fair competition.

Continue reading

Novo Nordisk Takes Legal Action Against Biotech Firm Over Alleged Fraud, Seeks $830 Million

In a significant move that has sent ripples through the pharmaceutical industry, Novo Nordisk, the Danish pharmaceuticals giant, has filed a lawsuit against a biotech firm, demanding a staggering $830 million in damages. The lawsuit centers around accusations of fraud related to a drug that the biotechnology company developed, which Novo Nordisk claims was misrepresented in its efficacy and potential market capabilities.

Continue reading

Bank of England Scrutinizes Prime Brokerage Practices at Major Banks

The Bank of England (BoE) is intensifying its scrutiny of certain prime brokerage practices at some of the largest banking institutions in the UK. This move comes amid rising concerns about the transparency and risk management associated with these financial services, which are crucial for investment firms and hedge funds. Prime brokers are essential partners for these firms, providing a range of services, including trade execution, clearing, and custody.

Continue reading

UK Investigates Wall Street Banks Over Client Trading Practices

In a move that has captured the attention of the financial world, UK regulators are setting their sights on Wall Street banks and their trading practices with clients. This announcement comes amid growing concerns about transparency, fairness, and the ethical implications of how these financial institutions operate in the complex realm of trading.

Continue reading