Trump's Tariff Threats Stunt Chinese Investment in Mexico

In a surprising turn of events, former President Donald Trump's renewed threats regarding tariffs have negatively impacted Chinese investments in Mexico, creating uncertainty in an already unstable environment for foreign investors. As firms in China aim to broaden their global footprint, many have placed their plans on hold due to fears of potential tariffs proposed by Trump during his recent public appearances.

Continue reading

Trump's New Tariffs: How Mexico Could Be Affected

The recent announcement by former President Donald Trump regarding a series of tariffs raises significant concerns for Mexico's economy. As the U.S. reevaluates its trade policies, the implications for neighboring Mexico could be profound and far-reaching. This article delves into the consequences those tariffs may wield on Mexico's economy, as well as its trade relationships.

Continue reading

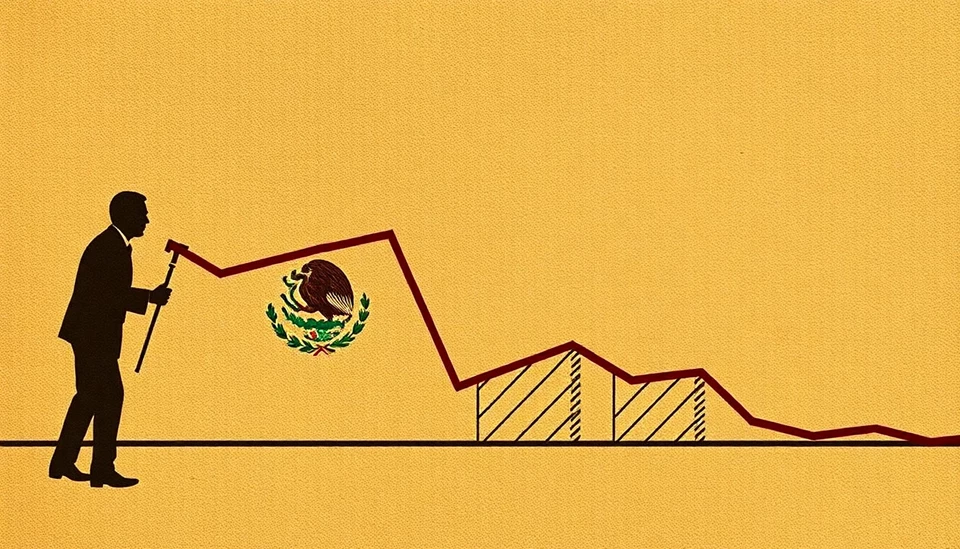

Trump's Tariff Threat: The Unraveling of Mexico's Economic Aspirations

In a significant economic shift, Mexico's dreams of robust growth and expansion are facing severe challenges due to the looming threat of punitive tariffs imposed by the Trump administration. The nation's ambition to cement its position as a manufacturing powerhouse in North America now hangs in the balance, as uncertainty casts a long shadow over its economic landscape.

Continue reading

Mexico's Central Bank Considers Easing Monetary Policy Under U.S. Tariff Pressure

In a significant economic shift, Mexico's central bank is exploring the possibility of easing its monetary policy in response to the rising pressures from tariffs imposed by the United States. As trade tensions escalate, the Bank of Mexico faces a complex dilemma that could impact the nation's economic trajectory in 2025.

Continue reading

Banxico Accelerates Easing Cycle with Significant Half-Point Rate Cut

In a decisive move aimed at stimulating the Mexican economy, Banxico—the Bank of Mexico—announced on February 6, 2025, that it would implement a half-point cut to its benchmark interest rate. This bold decision signifies a notable shift in the central bank’s monetary policy, doubling the pace of its easing cycle which had previously been more cautious.

Continue reading

Banxico Moves Towards Aggressive Rates Cuts as Growth and Inflation Slow

In a notable shift in the monetary policy landscape, Banxico, Mexico's central bank, appears poised to accelerate interest rate cuts in response to declining economic growth and easing inflation rates. This development comes as experts continue to analyze the implications for the Mexican economy and the potential benefits it could bring to various sectors, especially as businesses seek to adapt to changing economic conditions.

Continue reading

Mexico’s Economic Contraction: A Closer Look at the Decline

Mexico’s economy has experienced a significant downturn, contracting for the first time since 2021, as various economic pressures mount. The preliminary figures released by the national statistics agency indicated a notable shrinkage of 0.2% in the fourth quarter of 2024. This downturn has raised alarms among economists and policymakers alike, signaling that the country is at a critical juncture in its economic trajectory.

Continue reading

Mexican Inflation Slows Less Than Anticipated, Banxico Responds with Rate Cuts

The latest economic data from Mexico has revealed that inflation is easing, though not as significantly as analysts had predicted. In a landscape marked by economic shifts and policy adjustments, the Bank of Mexico (Banxico) has taken decisive action by lowering interest rates in response to this gradual decline in inflation rates.

Continue reading

Banxico Officials Consider Larger Key Rate Cuts Amid Evolving Inflation Landscape

In a significant development for Mexico's economic landscape, members of the Bank of Mexico (Banxico) have hinted at the possibility of more substantial cuts to the key interest rate, driven largely by a favorable inflation outlook. This revelation came during recent discussions among the bank's board members, as they assess the trajectory of inflation and its impact on the economy.

Continue reading

Mexico's 2025 Economic Outlook Dims Amid Looming Trump Tariffs

As we approach the end of 2024, experts are expressing growing concerns about Mexico's economic trajectory for 2025, primarily influenced by the potential reinstatement of tariffs by former President Donald Trump. This development signals a significant shift for Mexico, which has enjoyed a period of relative economic stability and growth.

Continue reading