BNP Paribas Adjusts South Africa's Growth Outlook Amid Political Turmoil and Tariff Conflicts

In a notable shift in economic forecasting, BNP Paribas has revised its growth projections for South Africa, attributing this change to the complexities of the political landscape and ongoing tariff disputes. The French banking giant has reduced its growth estimate for the nation significantly, underscoring the financial repercussions these factors could impose on the country's economy.

Continue reading

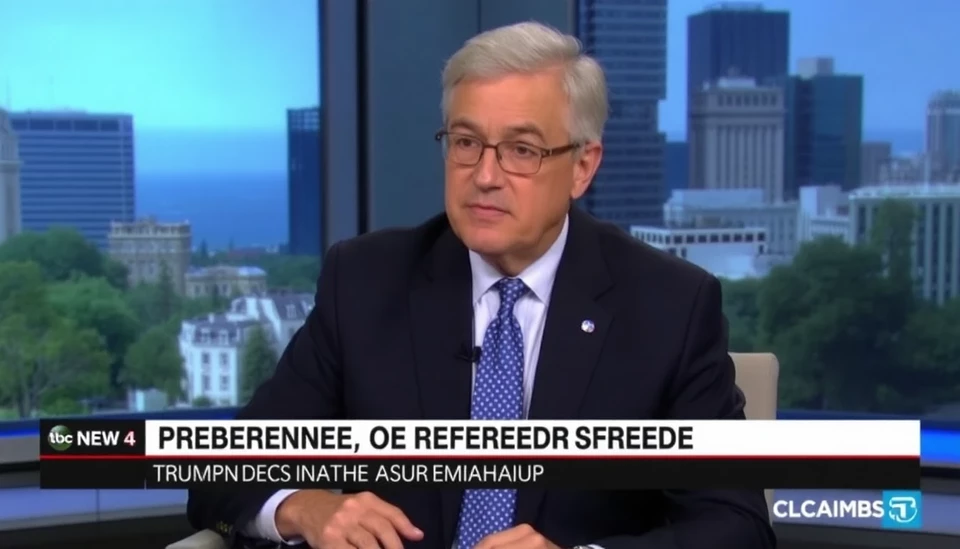

Marc Lasry Warns That Trump-Induced Economic Uncertainty Could Be Detrimental

Marc Lasry, a prominent hedge fund manager and co-owner of the Milwaukee Bucks, recently expressed his grave concerns regarding the impact of political instability on the U.S. economy. Speaking to a gathering of business leaders and investors, Lasry highlighted the damaging effects of the uncertainties surrounding former President Donald Trump’s potential run for the presidency in 2024. He emphasized that ongoing political unpredictability could lead to detrimental consequences for economic growth and market stability.

Continue reading

Bundesbank Chief Urges Swift Formation of New German Government Amid Economic Uncertainty

In a recent address, the president of the Bundesbank, Joachim Nagel, emphasized the critical need for Germany to expedite the formation of a new government. His statement comes against the backdrop of ongoing economic challenges that have been affecting Germany's financial landscape. Nagel's comments reflect growing concerns among economists and policymakers about the potential stagnation in economic recovery if a new administration is not promptly established.

Continue reading

Davos Summit Faces Uncertainties Surrounding Trump’s Return to Politics

The annual World Economic Forum in Davos is rife with speculation as delegates and world leaders converge to discuss pressing global issues. A key conversation topic this year centers around the potential implications of Donald Trump’s imminent political comeback, as he gears up for the 2024 Presidential election. The mood among international leaders and business moguls is a mixture of caution and curiosity, as they consider the unpredictable impact of Trump’s re-emergence in the political arena.

Continue reading

Bank of Korea Lowers Economic Growth Forecast Amid Political Instability

In a significant development concerning South Korea's economic outlook, the Bank of Korea (BOK) has officially revised its growth forecast for the upcoming year. This adjustment is primarily influenced by rising political uncertainties that pose challenges to the nation's economic stability. The BOK, in a recent statement, has lowered its 2026 growth expectation from a previous 2.2% to a more cautious 1.9%.

Continue reading

Trudeau Faces Pressure Amidst Uncertainty in Canadian Politics

In a climate charged with anticipation and concern, Prime Minister Justin Trudeau has left Canada and its Liberal Party in a state of suspense as 2025 begins. With significant discussions around his potential departure from the political stage, party members and constituents alike are grappling with uncertainty about the future leadership of the country.

Continue reading

Japan's Economic Outlook for 2024: Rebound on the Horizon Amid Political Uncertainties

As Japan steps into 2024, the nation finds itself at a pivotal moment, where expectations for economic recovery are intertwined with the unpredictable currents of both domestic and international politics. Analysts project an optimistic rebound, supported by ongoing government stimulus measures and a gradual return of consumer confidence.

Continue reading

Colombia on the Brink: Are Fiscal Missteps Setting the Stage for Brazil's Costly Errors?

In a stark warning that resonates throughout the South American continent, Colombia finds itself increasingly vulnerable to fiscal missteps similar to those that recently plagued Brazil. The Colombian government is facing escalating debt levels and public sector spending that could lead the nation's economy into a precarious state, reminiscent of Brazil's turbulent financial environment.

Continue reading

Sweden's Economic Growth Projected to Slow in 2024, According to Recent Bloomberg Survey

In a recent poll conducted by Bloomberg, analysts have indicated a softened forecast for Sweden's economy in 2024. This assessment reflects a growing caution among economists about the nation’s economic trajectory, primarily stemming from challenges posed by inflation, rising interest rates, and potential geopolitical uncertainties that could impact trade and investment.

Continue reading

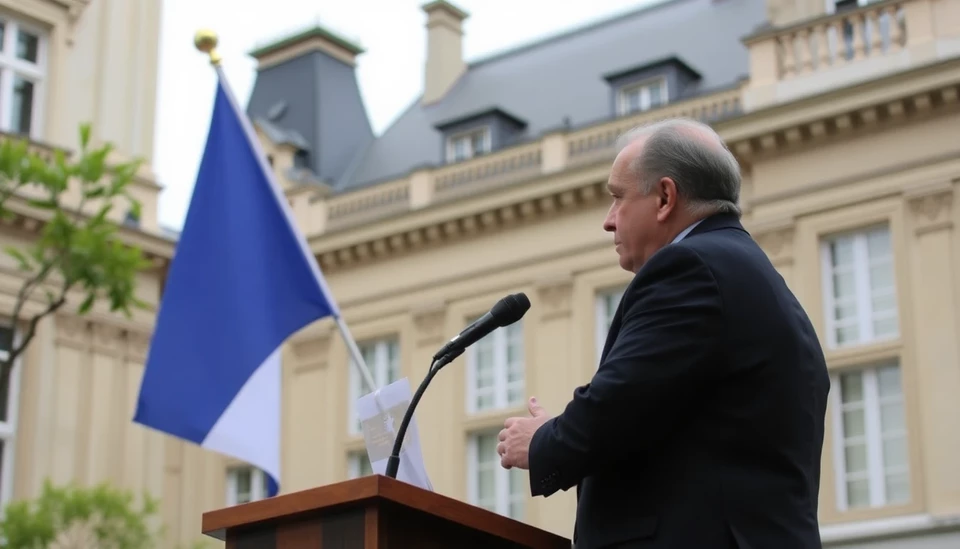

France Faces Economic Headwinds Amid Political Instability as Growth Prospects Deteriorate

Recent analyses of France’s economic landscape indicate a notable decline in growth expectations, largely attributed to the increasing political uncertainty that is currently gripping the nation. This shift presents significant challenges for a country that has been depicted as a central player in the European Union’s economic narrative.

Continue reading