Dubai's Luxury Property Market Achieves Record Heights Amid Tariff Uncertainty

In an extraordinary turn of events, Dubai's luxury property sector has reached new milestones, flourishing remarkably before potential turmoil associated with incoming tariffs. Recent reports indicate that the demand for high-end real estate in the emirate has surged, driven by a combination of foreign investments, favorable economic conditions, and a swath of new developments that appeal to affluent buyers.

Continue reading

Dubai's Real Estate Giants Sobha and Omniyat Consider Issuing Islamic Bonds

In a strategic move poised to reshape the real estate financing landscape, Dubai's prominent developers, Sobha Realty and Omniyat, are reportedly in discussions to issue Islamic bonds, also known as sukuk. This potential move indicates a growing trend among regional developers to tap into Islamic financial markets, which have gained momentum in recent years.

Continue reading

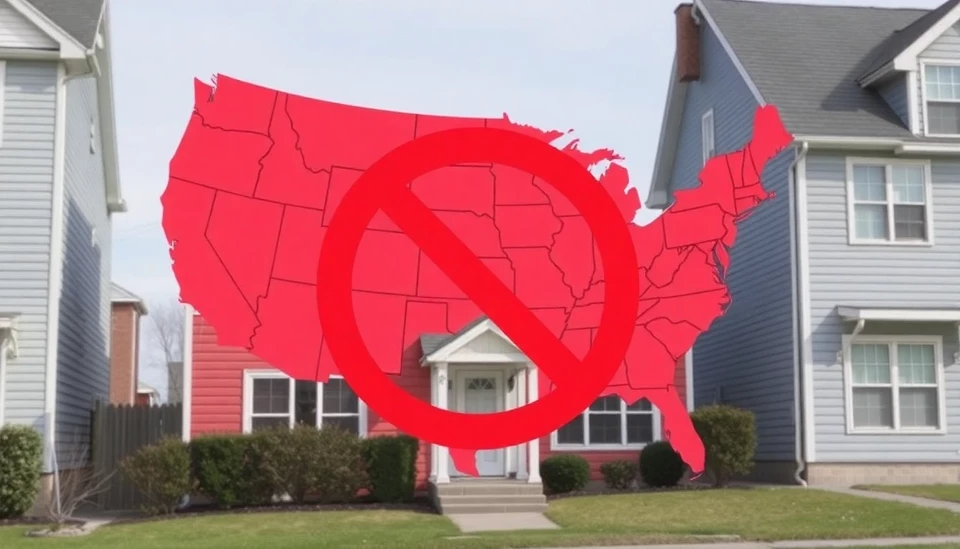

US Property Tax Increases Stabilize, Yet Counties Face Rising Burden

Recent trends indicate that the rate of growth in property taxes across the United States has started to ease, even as more counties surpass the troubling $10,000 threshold for average property tax payments. This phenomenon raises questions about the sustainability of homeownership amidst elevated costs.

Continue reading

PGIM's Ambitious $2 Billion Investment in Asian Real Estate Remains On Track

In a recent announcement, PGIM Real Estate has reaffirmed its commitment to a substantial $2 billion investment in Asian property markets, signaling confidence in the region's economic recovery and growth potential. This strategic move is part of PGIM's broader goal to capitalize on emerging opportunities in Asia's dynamic real estate landscape.

Continue reading

Unpacking Australia's Skyrocketing House Prices: What's Behind The Trends and Election Policies

Australia's housing market is once again under the microscope as prices continue to climb, leaving many to wonder about the underlying factors driving this phenomenon. Recent analysis indicates that several elements contribute to the persistent surge in property values across the country, coupled with the implications on forthcoming election policies aimed at addressing these concerns.

Continue reading

Singapore's Real Estate Market Faces Slowdown Amid Tariff Concerns

In a notable shift in Singapore's real estate landscape, the vibrant home sales that once characterized the market are experiencing a significant cooling off. Recent data indicates that the sales of new homes have dropped sharply, leading analysts to survey potential consequences on property prices as concerns over potential tariffs loom large.

Continue reading

London's Property Market Struggles Amidst Global Trade Tensions, Reports Rightmove

The London real estate market is currently facing significant pressures as ongoing trade wars and economic instability begin to take a toll on property prices, according to a recent report from Rightmove. The housing sector, which has been a pillar of the UK economy, is now grappling with the fallout from escalating trade disputes and uncertain economic circumstances.

Continue reading

Australia Unveils $460 Million Property Initiative Targeted at Fugitives

In a landmark announcement, Australian authorities have revealed a sweeping $460 million initiative aimed at addressing property acquisitions tied to individuals evading law enforcement. This bold move marks a significant step in the nation’s fight against organized crime, with the government keenly focused on disrupting the assets of fugitives who have eluded capture.

Continue reading

UK Housing Market Faces Uncertain Future Amid Rising Trade Tensions

The UK's housing market is bracing for potential turbulence as increasing trade disputes could significantly derail its growth, according to an alarming report by the Royal Institution of Chartered Surveyors (RICS). As the UK navigates an evolving economic landscape marked by international strife and potential tariffs, homeowners and prospective buyers alike may feel the ripple effects.

Continue reading

Blackstone Capitalizes on European Property Market Amidst Crisis, Securing $9.8 Billion

In a striking maneuver amid a turbulent economic landscape, real estate investment titan Blackstone has successfully amassed an astounding $9.8 billion targeted at acquiring properties across Europe. This strategic move comes at a pivotal time, as the continent grapples with significant challenges precipitated by the ongoing financial downturn. Blackstone’s ability to navigate through these trying times showcases not only its financial prowess but also its long-term vision for the European property market.

Continue reading