Europe's Junk Debt Refinancing Costs Soar as Market Turmoil Intensifies

In a dramatic turn of events, the costs associated with refinancing junk debt in Europe have more than doubled in 2025, following a significant selloff in the bond market. The surge in financing costs for companies deemed speculative reflects a broader trend of financial tightening that has been rapidly unfolding across the continent, raising alarms among investors and market analysts alike.

Continue reading

Star's Struggles Deepen as Debt Refinancing Efforts Fail

In a significant development that casts a shadow over its future, Star, once seen as a promising player in its industry, encountered severe setbacks as its debt refinancing plan has collapsed. The company had been actively working to restructure its debts in a bid to avert looming financial distress; however, the failure to achieve a viable refinancing deal has raised alarm bells among investors and stakeholders alike.

Continue reading

Star Entertainment Receives Debt Refinancing Proposal from Oaktree Capital

In a significant development for Star Entertainment Group, the Australian gaming and entertainment company has attracted the attention of Oaktree Capital Management. Oaktree has proposed a debt refinancing plan aimed at addressing Star's financial obligations and improving liquidity. This proposal comes against the backdrop of the company's recent struggles following a series of regulatory and operational challenges.

Continue reading

Luxury London Hotel Successfully Secures Refinancing to Prevent Sale

In a significant development in the competitive hospitality sector, a renowned luxury hotel in London has successfully arranged refinancing aimed at avoiding a potential sale. This move comes amidst mounting pressures in the real estate market, particularly for high-end properties grappling with changing economic conditions.

Continue reading

Canary Wharf Secures Critical $610 Million Refinancing from Apollo: A Game Changer for London's Financial Hub

In a significant financial maneuver that underscores the resilience of one of London's leading business districts, Canary Wharf has successfully secured a vital refinancing package totaling $610 million from Apollo Global Management. This deal comes at a time when the property market in the UK has faced numerous challenges, further solidifying Canary Wharf's status as a cornerstone of Britain's financial landscape.

Continue reading

CVS Health Moves Forward with 30-Year Hybrid Bond Sale to Tackle Debt Refinancing

In a significant financial maneuver, CVS Health is set to issue $3 billion worth of 30-year hybrid bonds in an effort to refinance its existing debt. This strategic decision comes as the healthcare giant seeks to enhance its capital structure and manage its obligations more effectively amidst evolving market conditions.

Continue reading

Blackstone Secures Debt Refinance for Premium NYC Condo Tower Using Municipal Bonds

Blackstone, one of the world’s largest investment firms, has successfully refinanced its debt for a luxury condominium tower located in New York City. This strategic move has seen the firm leverage municipal bonds to secure a more favorable financial position amid changing market dynamics.

Continue reading

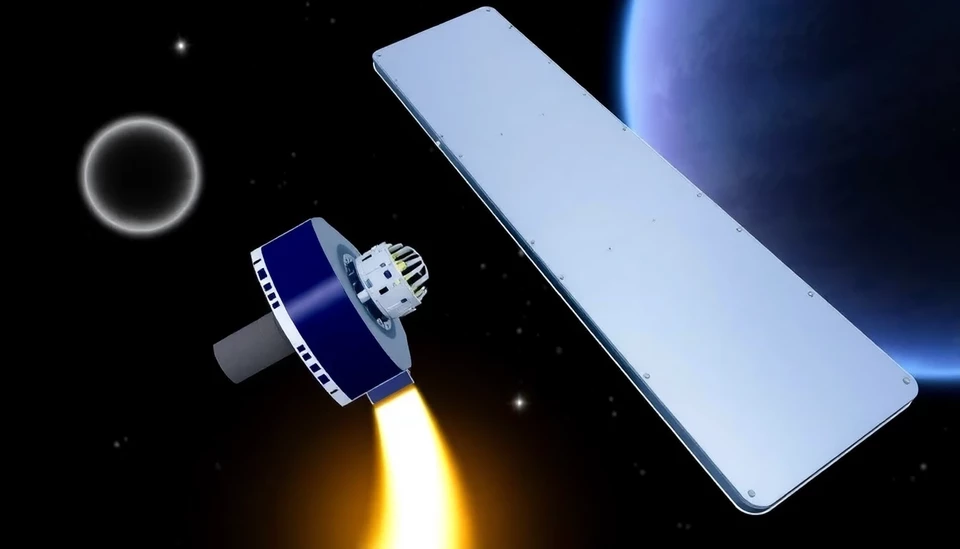

Telesat Takes Bold Steps to Refinance Debt as It Competes with SpaceX’s Starlink in the Expanding Satellite Industry

In a rapidly evolving space race characterized by technological advancements and fierce competition, Canadian satellite communications provider Telesat has announced its plans to refinance a significant portion of its distressed debt. This move comes as the company seeks to position itself more favorably against industry giants such as SpaceX and its Starlink satellite constellation, which has been making substantial inroads in the global market.

Continue reading

Mortgage Rates in the U.S. Drop for the First Time Since Late September

In a welcome turn of events for homebuyers and the real estate market, mortgage rates in the United States eased for the first time in nearly two months, providing a much-needed break for those looking to purchase or refinance their homes.

Continue reading

ECB's Schnabel Predicts Increased Bank Reliance on Refinancing Operations Amid Economic Uncertainty

In a recent statement, European Central Bank (ECB) Executive Board member Isabel Schnabel has indicated that banks across Europe may increasingly turn to the ECB’s refinancing operations as they navigate a tightening economic landscape. This insight comes amid growing concerns regarding the stability of the financial sector and broader economic challenges facing the Eurozone.

Continue reading