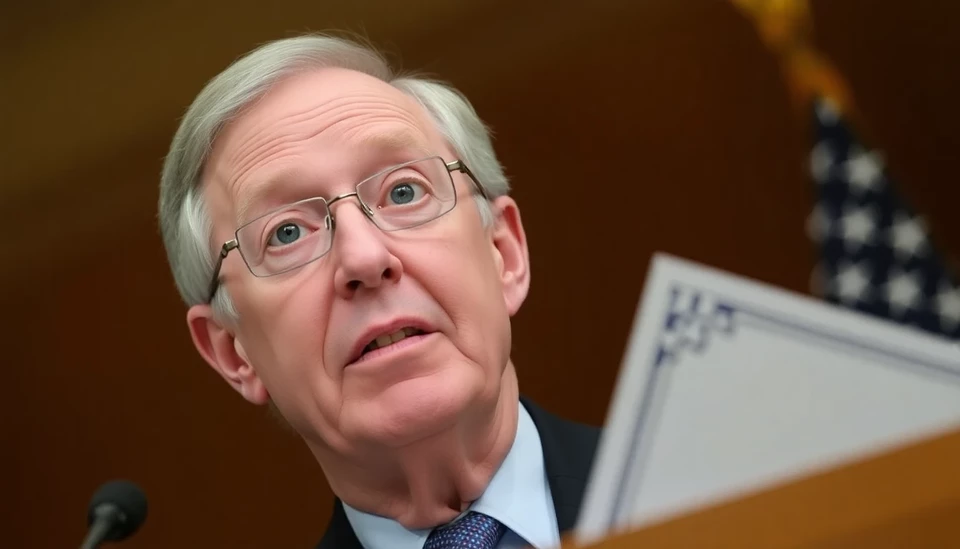

Federal Reserve's Collins Warns About Broader Impact of Tariffs on U.S. Economy

In a recent address, Federal Reserve Bank of Boston President Susan Collins emphasized the expansive consequences of tariffs on the U.S. economy, pointing out that their effects reach far beyond what many American citizens may realize. Her remarks come in the context of ongoing discussions regarding trade policies and their implications for both businesses and consumers alike.

Continue reading

Federal Reserve's Collins Warns: Tariff Price Increases May Postpone Rate Cuts

In a significant announcement, Federal Reserve Bank of Boston President Susan Collins has cautioned that rising prices due to tariffs could impede the central bank's ability to lower interest rates. Speaking at a recent economic forum, Collins emphasized the potential ramifications of escalating tariffs, which could further strain the economy and hinder monetary policy efforts aimed at supporting growth.

Continue reading

Federal Reserve Official Predicts Rising Inflation Driven by Tariffs

In a recent statement, Federal Reserve Bank of Boston President, Susan Collins, has drawn attention to an unavoidable surge in inflation consequent to tariff policies. This analysis comes amidst increasing concerns about the longer-term impact of tariffs on the overall economy.

Continue reading

Fed’s Collins Suggests Central Bank Will Ignore Tariff Price Influences

The economic landscape in the United States is continually evolving, and recent remarks from Boston Fed President Susan Collins have shed light on how the Federal Reserve is likely to navigate the complexities of trade tariffs and inflation. In a statement made during a recent economic conference, Collins indicated that the Fed is expected to take a more measured approach, potentially looking past the immediate price influences stemming from tariffs on goods imported into the country.

Continue reading

Federal Reserve's Collins Signals Slower Rate Cuts in 2025 Amid Economic Uncertainties

The President of the Federal Reserve Bank of Boston, Susan Collins, has recently expressed her views on the anticipated pace of interest rate cuts, projecting a more gradual approach as economic uncertainties loom. Speaking in a recent interview, Collins noted that while inflation pressures seem to be easing, the overall economic landscape remains unpredictable, which affects the Fed's decision-making process regarding interest rates.

Continue reading

Federal Reserve's Collins Advocates for Additional Monetary Easing Amid Economic Uncertainty

In a recent address, Boston Federal Reserve President Susan Collins highlighted the necessity for further monetary easing measures to foster economic stability. As pivotal data continues to fluctuate and inflation remains a pressing concern, Collins emphasized that navigating the current economic landscape requires a thoughtful yet proactive approach from the central bank.

Continue reading

Federal Reserve's Collins Hails Progress Towards 2% Inflation Goal

The ongoing dialogue surrounding the U.S. economy and inflation has gained new insights following recent remarks by Federal Reserve President Susan Collins. In her latest statement, she emphasized that the country's inflation rate is moving strongly in the direction of the Fed's 2% target, signaling optimistic news for financial markets and consumers alike.

Continue reading

Federal Reserve's Collins Indicates Potential December Rate Cut Still on the Table

Amid ongoing discussions surrounding the economic landscape and inflation trends, the President of the Federal Reserve Bank of Boston, Susan Collins, has conveyed that a reduction in interest rates during the December Federal Open Market Committee (FOMC) meeting remains a feasible option. Collins, known for her prudent approach to monetary policy, articulated her views in a recent interview where she highlighted the central bank's careful consideration of rate adjustments against the backdrop of fluctuating economic indicators.

Continue reading

Judicious Rate Cuts: Fed’s Collins Advocates Caution Amid Economic Data Scrutiny

In the latest insights from the Federal Reserve, President of the Federal Reserve Bank of Boston, Susan Collins, has articulated a cautious approach towards potential interest rate cuts. Speaking at a recent event, Collins emphasized the crucial need for the Federal Reserve to rely heavily on incoming economic data before making any decisions regarding rate reductions.

Continue reading