Groundbreaking Research on Tax Policy Earns Stantcheva Prestigious Young Economist Award

In a remarkable achievement, economist Gabrielle Stantcheva has been awarded the Young Economist Award for her influential contributions to the field of tax policy. The award, which honors outstanding research by economists under the age of 40, recognizes Stantcheva's innovative work that aims to reshape how tax systems can be designed to address societal inequalities and promote economic efficiency.

Continue reading

US Tax Collection Slowdown Fuels Concerns Over Debt Ceiling Deadline

In a significant development that has drawn attention from policymakers and taxpayers alike, the United States is experiencing a noticeable slowdown in tax collections. This downturn is causing increasing anxiety about the looming debt ceiling and the potential repercussions of hitting the X-date—a term that describes when the government will no longer be able to meet all of its financial obligations.

Continue reading

German Supreme Court Upholds Controversial Solidarity Surcharge, Striking Down Challenges

In a significant ruling that impacts fiscal policy and Germany's financial landscape, the Federal Constitutional Court of Germany (Bundesverfassungsgericht) has dismissed multiple legal challenges against the country's solidarity surcharge, commonly referred to as "Solidaritätszuschlag." This surcharge, implemented in the wake of German reunification, adds a financial burden on high-income taxpayers and has been a source of contention over its fairness and long-term relevance.

Continue reading

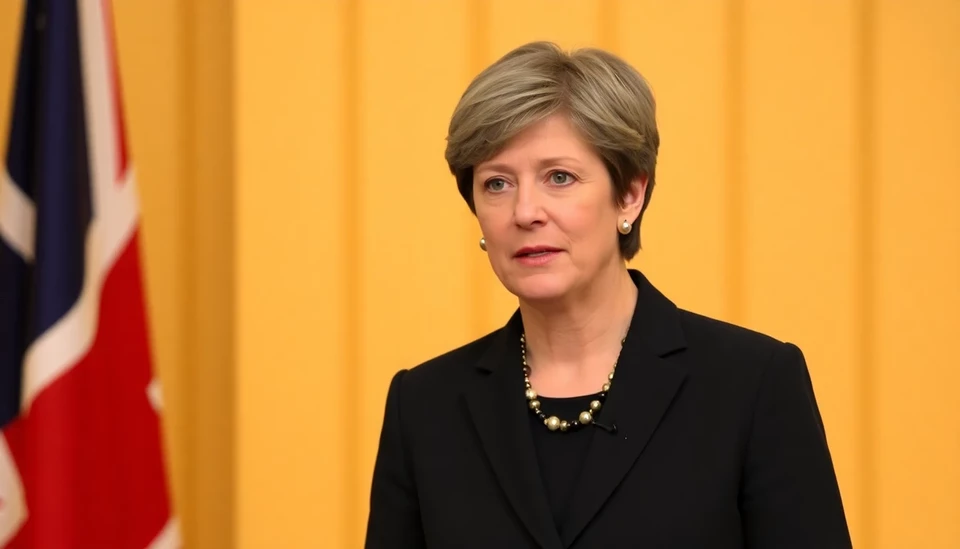

UK Chancellor Reeves Declares No Tax Increases Ahead of Spring Statement

In a bold move ahead of the forthcoming Spring Statement, UK Chancellor Rachel Reeves has firmly ruled out any tax increases for the upcoming fiscal policy adjustments. This announcement underscores the government's commitment to economic stability as it navigates the complexities of managing public finances post-pandemic.

Continue reading

South African Budget Changes Loom as Political Parties Stand Firm Against Tax Increases

The South African fiscal landscape is brimming with uncertainty as political factions within the country mount strong opposition against proposed tax hikes, prompting a crucial re-evaluation of the national budget. This development signals a pivotal moment not only for the administration's financial strategy but also for the nation’s economic trajectory.

Continue reading

U.S. Budget Deficit Reaches Record $1.1 Trillion Mark for Fiscal Year 2025

The U.S. government has reported a staggering budget deficit of $1.1 trillion for the fiscal year 2025, marking a significant increase that raises concerns about fiscal sustainability. This gap has been attributed to a combination of rising government expenditures and sluggish revenue growth, highlighting the ongoing challenges faced by policymakers.

Continue reading

South Africa's Planned VAT Increase Eases Amid Budget Stalemate

In a significant development in South Africa’s economic landscape, the government has put forth a proposal to moderate the anticipated increase in the Value Added Tax (VAT). The adjustment comes amidst ongoing budget discussions, aiming to resolve a pressing financial impasse that has been affecting national fiscal planning and economic stability.

Continue reading

Bank of England’s Bailey Warns: Labour’s Northern Ireland Tax Increase Could Fuel Inflation

In a recent statement, Bank of England Governor Andrew Bailey addressed concerns regarding the potential inflationary impact of a proposed tax increase by the Labour Party in Northern Ireland. This tax change, which aims to address budgetary pressures, has raised eyebrows among financial analysts and economic policymakers alike. Bailey’s comments underscore the delicate balancing act that the government faces in managing fiscal policy against the backdrop of ongoing inflationary trends in the UK.

Continue reading

UK Abandons Tax Crackdown on Buyout Firms Amid Backlash

In a significant policy reversal, the UK government has decided to discontinue its proposed tax crackdown on private equity firms and buyout companies. Initially aimed at increasing revenues and addressing perceived tax loopholes, the move reflects growing pressures from investment groups and industry leaders who warned that the crackdown could discourage investment and harm the economy.

Continue reading

Carney Champions Bold Move: Proposal to Eliminate Canada's Capital Gains Tax Increase

In a significant development in Canada’s financial landscape, former Bank of Canada Governor Mark Carney is gearing up to make a compelling proposal aimed at abolishing the planned increase in the capital gains tax. This move is poised to stir considerable debate as the nation navigates its post-pandemic economic recovery.

Continue reading