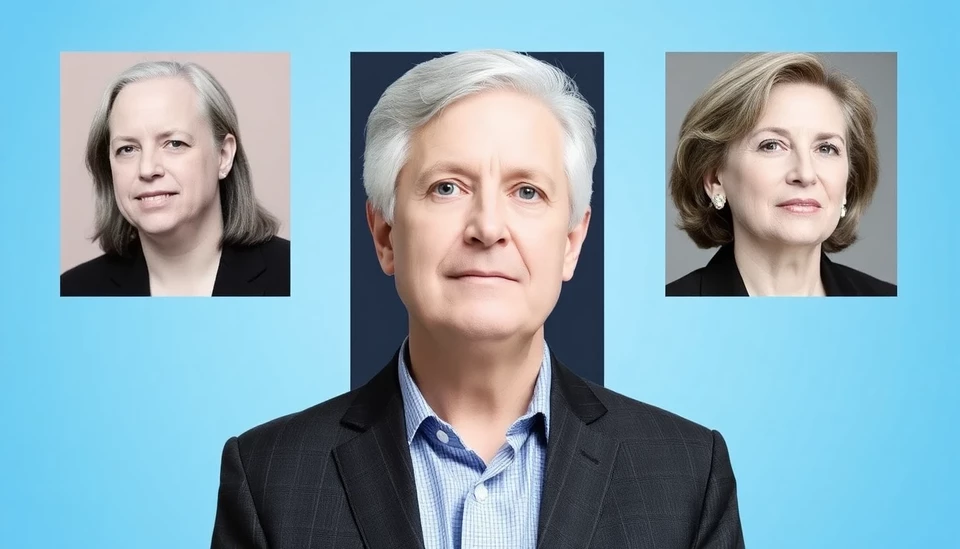

Scotiabank Economists Critique Canada's Major Political Platforms Ahead of Election

In a striking evaluation that has garnered significant attention ahead of Canada’s upcoming election, economists from Scotiabank have expressed strong criticisms of the platform policies released by both major political parties. This rare public stance comes at a time when the economic landscape is already fraught with challenges, leading experts to call for a more responsible approach to both fiscal and economic policies.

Continue reading

Canada's Election Race Tightens: Carney's Liberals Maintain Slim Lead

As Canada approaches the fateful election day in just six days, the political landscape remains intensely competitive, with Mark Carney's Liberals inching ahead in the polls. According to the latest data, the party holds a narrow lead against the opposition, emphasizing the critical impact this upcoming election will have on the country's future. Voter engagement appears to be peaking, as Canadians prepare to make pivotal decisions.

Continue reading

Conservative Party of Canada Outlines Ambitious Tax Cuts and Deficit Reduction Plans

In a bold move aimed at boosting their appeal ahead of the upcoming elections, the Conservative Party of Canada has unveiled a comprehensive economic strategy that focuses on significant tax cuts and a commitment to reducing the national deficit. This announcement comes as the party seeks to regain control of the federal government amid growing dissatisfaction with economic conditions in the country.

Continue reading

Canada's Ambitious Housing Plan: A Blueprint for Global Construction?

In a bold move aimed at addressing its ongoing housing crisis, Canada is exploring plans that could transform the nation into a leading global hub for residential construction. Former Bank of England Governor Mark Carney has presented a strategic proposal that envisions a drastic increase in the production of affordable homes, effectively positioning Canada as the "housing factory of the world." This initiative has garnered significant attention as the country grapples with soaring real estate prices and a pressing shortage of dwellings.

Continue reading

ECB Makes a Bold Move: Interest Rate Cuts Amidst Global Economic Trends

In a significant turn of events in the global economic landscape, the European Central Bank (ECB) has decided to cut interest rates, signaling a notable shift in monetary policy. This move is largely seen as a response to ongoing economic challenges within the Eurozone, as policymakers face pressures from stagnating growth and low inflation rates.

Continue reading

Bank of Canada Predicts Year-Long Economic Downturn Amid Intensifying Trade War

The Bank of Canada has issued a stark warning, forecasting a prolonged recession lasting up to a year as the nation grapples with the escalating impacts of a full-scale trade war. This development comes as international trade tensions rise, particularly involving Canada’s extensive trading partners, and is set against the backdrop of a fragile global economy already burdened by high inflation rates and shifting consumer demand.

Continue reading

Bank of Canada Maintains Interest Rate Amid Trade Uncertainty

In a pivotal announcement on April 16, 2025, the Bank of Canada has decided to hold its key interest rate steady at 2.75%. This decision comes in the wake of ongoing trade tensions and an unclear economic landscape. The central bank made it clear that it would continue to monitor developments closely, particularly regarding international tariffs that could impact the Canadian economy.

Continue reading

Canadian Auto Town Faces the Heat of Trump's Trade War

The bustling town of Oshawa, Ontario, once heralded as a powerhouse of the Canadian automotive industry, is bracing for the repercussions of heightened trade tensions stemming from the United States' ongoing trade war. This town, with roots firmly planted in car manufacturing, is experiencing a seismic shift as policy changes and economic uncertainties loom large on the horizon.

Continue reading

Canada Offers Tariff Exemption to Automotive Manufacturers Committed to Domestic Production

In a significant move to bolster the domestic automotive industry, the Canadian government announced an exemption from tariffs for automakers that maintain manufacturing operations within the country. This decision comes as part of a broader strategy to stimulate economic growth and job creation in the automotive sector, which has faced growing competition from international manufacturers.

Continue reading

Bank of Canada Set to Pause Interest Rate Hikes Amid Tariff Changes

In a pivotal move, the Bank of Canada is anticipated to pause its interest rate hikes as it evaluates the potential impact of recent tariff decisions on the country’s economy. This strategic pause is expected as officials aim to navigate through a precarious economic landscape marked by inflation pressures and external trade influences.

Continue reading