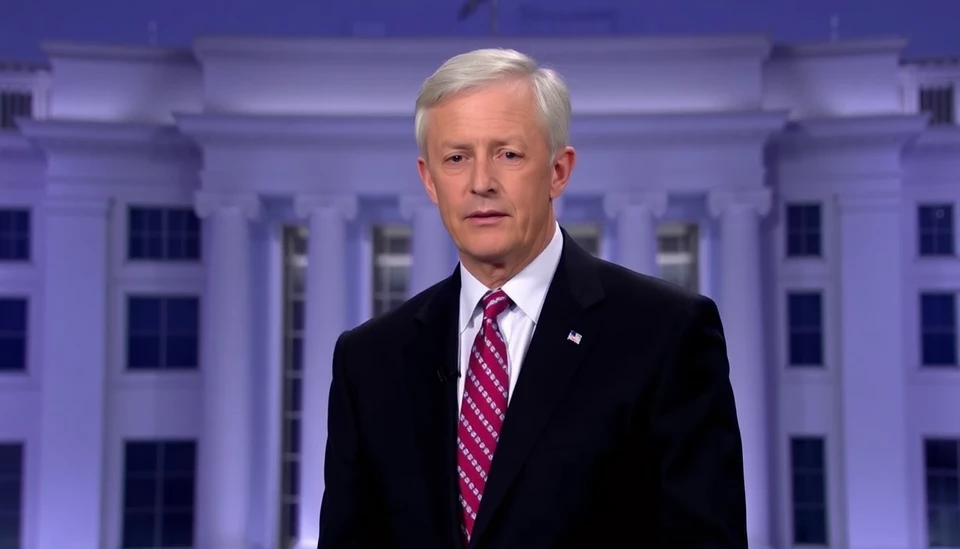

Concerns Over Expanding the Federal Reserve's Balance Sheet: Insights from Fed's Hammack

In recent communications, Federal Reserve official Jon Hammack expressed his apprehensions regarding the potential repercussions of an excessively large balance sheet. Hammack, a key figure within the Fed's financial ecosystem, articulated that scaling up the balance sheet beyond what is necessary could impose significant costs on the economy and financial markets. His remarks come amidst an ongoing discourse about how the central bank is managing its assets and liabilities in a post-pandemic environment.

Continue reading

IMF Raises Alarm Over Trump’s Trade War Impact on Global Financial Stability

The International Monetary Fund (IMF) has issued a stark warning regarding the ongoing trade war initiated by former President Donald Trump, emphasizing that the escalating tensions are undermining the foundational structures of the global financial system. This assessment highlights the urgency of the situation as trade disputes not only affect economic relations between the United States and other nations but also pose a potential threat to international market stability.

Continue reading

Italy's Credit Rating Affirmed as Positive by Morningstar DBRS

In a recent update that sends a wave of optimism through financial markets, Morningstar DBRS has confirmed Italy's long-term credit rating at BBB, indicating a stable financial outlook for the Italian economy. This assessment comes amidst ongoing discussions about Italy's fiscal policies, economic recovery, and the broader European economic landscape.

Continue reading

Cinven's Netceed Secures Crucial Creditor Agreement to Enhance Financial Stability

In a strategic move to bolster its financial standing, Cinven's software company, Netceed, has successfully negotiated a new agreement with its creditors. This pivotal deal is aimed at enhancing the company's liquidity, ensuring it can navigate the challenges posed by the current economic landscape.

Continue reading

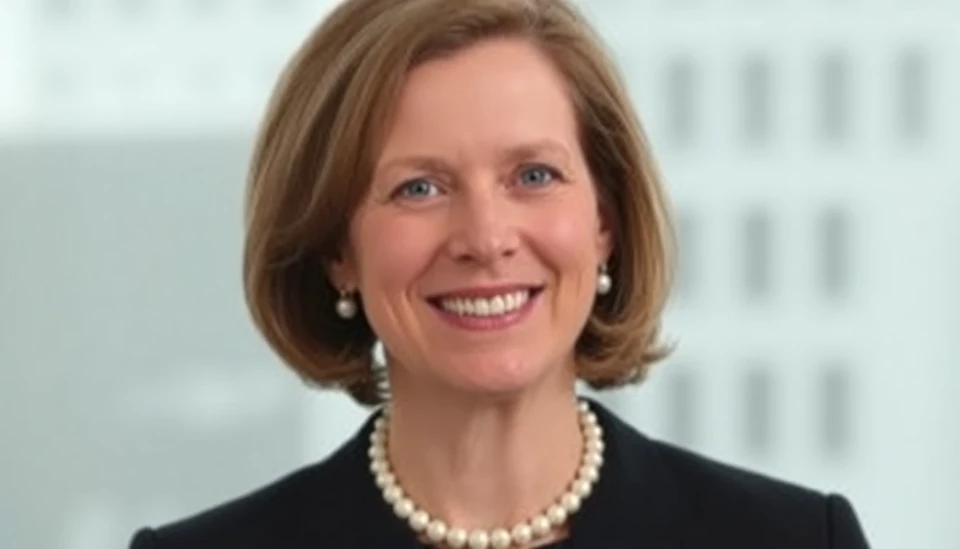

Chicago Fed's Anna Paulson Appointed as New President of the Philadelphia Fed

In a significant development in the world of central banking, the Philadelphia Federal Reserve Bank has announced the appointment of Anna Paulson, the current executive vice president and director of research at the Federal Reserve Bank of Chicago, as its new president. This decision marks a strategic move as the Fed seeks to enhance its leadership team in the face of ongoing economic challenges.

Continue reading

Zambia's Inflation Target Achievement Marks Economic Milestone

Zambia is on track to meet its annual inflation target for the first time since 2019, a positive sign amidst a backdrop of economic recovery efforts initiated by the government. The Central Statistical Office of Zambia has reported that the inflation rate has significantly decreased, currently standing at around 9% as of April 2025, which is in line with the target set by authorities.

Continue reading

Ukraine Maintains Key Interest Rate Amid Anticipated Inflation Easing

In a decisive move reflecting the current economic climate, the National Bank of Ukraine has decided to keep its key interest rate unchanged at a significant 25% as of April 17, 2025. This notable decision comes in light of anticipated improvements in inflation dynamics, suggesting that the Ukrainian economy may be on the verge of stabilizing after a prolonged period of turbulence.

Continue reading

BOK Maintains Steady Interest Rates Amid Rising Inflation and Currency Fluctuations

The Bank of Korea (BOK) has decided to maintain its current interest rates, despite a notable increase in inflation and recent volatility in the South Korean won. This decision comes as the central bank aims to balance the growing economic pressures without compromising financial stability.

Continue reading

Monte dei Paschi Faces Pivotal Investor Vote on Mediobanca Acquisition

In a critical moment for Italy's troubled banking sector, shareholders of Monte dei Paschi di Siena (MPS) are preparing to cast their votes on a pivotal proposition from Mediobanca. This potential takeover bid comes at a time when MPS is grappling with a challenging financial landscape, making the outcome of this vote crucial for both institutions and their wider implications for the Italian banking industry.

Continue reading

Argentina's Milei Faces Inflation Risks by Floating Peso Against the Dollar

In a bold economic maneuver, Javier Milei, Argentina’s president, has initiated a floating exchange rate for the Argentine peso against the U.S. dollar. This decision, aimed at revitalizing the beleaguered Argentine economy, has sparked concerns among economists and citizens alike about the potential resurgence of inflation and the challenging environment in which many Argentines are trying to make ends meet.

Continue reading