Major Shifts in the Oil Market: Analysis and Latest Developments for April 23

As we approach the end of April 2025, recent analyses of the oil market reveal significant shifts that are reshaping the industry's dynamics. Prices have been experiencing notable volatility due to various geopolitical events, OPEC+ production strategies, and emerging economic trends. This article delves into the drivers of the current oil market conditions and provides insights on what to expect in the coming weeks.

Continue reading

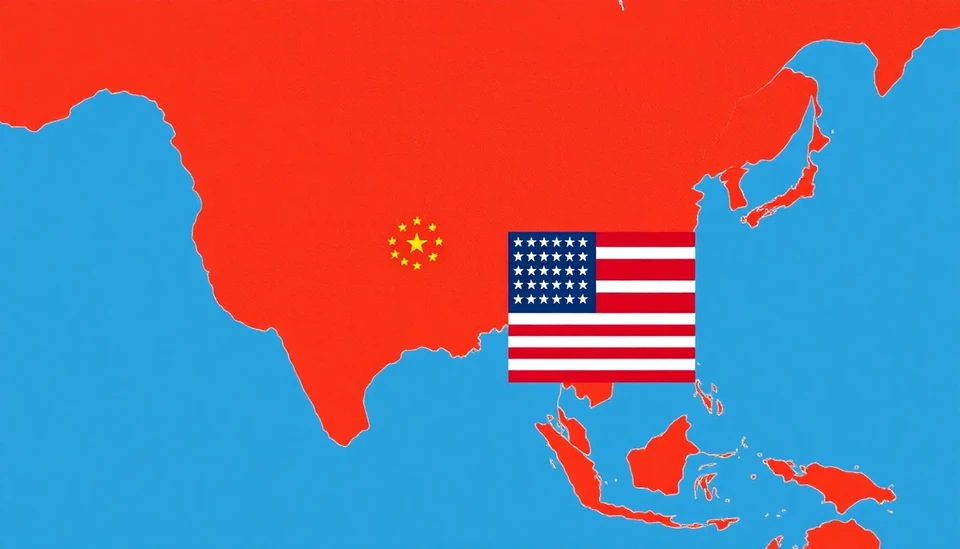

Expert Predicts De-Escalation in US-China Tensions Amid Unsustainable Conditions

In a significant analysis of the ongoing geopolitical landscape, Christopher Bessent, a prominent figure in the finance sector, has voiced optimism regarding the de-escalation of tensions between the United States and China. According to Bessent, the current situation is not only fraught with challenges but also fundamentally unsustainable for both nations involved.

Continue reading

IMF Cuts Global Growth Forecast Amid Heightened Economic Uncertainties

The International Monetary Fund (IMF) has announced a significant reduction in its global growth outlook, reflecting a myriad of challenges that have intensified since its last assessment. The latest report casts a shadow over the world economy, revealing that vital indicators and macroeconomic forecasts are under severe pressure, prompting concerns about a potential downturn.

Continue reading

Oil Prices Surge Amid Geopolitical Tensions and Supply Concerns

As the global oil market continues to experience volatility, recent developments have led to significant fluctuations in oil prices. On April 22, 2025, crude oil prices have surged, driven by increasing geopolitical tensions in key oil-producing regions.

Continue reading

Turkish Nickel Tycoon Aims for $2 Billion Acquisition Rush to Challenge Chinese Dominance

In a bold move aimed at reshaping the global nickel landscape, a prominent Turkish businessman is planning a staggering $2 billion acquisition spree. This ambitious venture is designed to position his company as a formidable competitor against Chinese firms that currently dominate the nickel market. The initiative reflects the growing geopolitical competition surrounding critical minerals, particularly as nations strive to secure supply chains for the emerging electric vehicle (EV) industry.

Continue reading

US-China Trade Conflict Fosters Sodium-Ion Battery Innovation

The ongoing trade tensions between the United States and China, which have escalated over recent years, have inadvertently opened new doors for technology advancements, particularly in the field of battery development. Analysts and industry experts are noting a significant shift towards sodium-ion batteries as a viable alternative to lithium-ion systems, highlighting how geopolitical factors can spur innovation.

Continue reading

China's Key Trade Links with the U.S. Face Significant Setbacks Amid Decoupling Concerns

In a striking turn of events, recent data has revealed a collapse in trade of essential petroleum products between China and the United States, raising alarms about the ongoing economic decoupling between the two superpowers. The analysis underscores a steep decline in exports, highlighting the growing rift in trade relations as both countries navigate a complex geopolitical landscape.

Continue reading

Oil Prices Surge Amidst Geopolitical Tensions and Supply Concerns

In a significant turn of events, global oil prices have witnessed a sharp increase as geopolitical tensions escalate in key oil-producing regions. As traders navigate through a volatile market, the price of crude oil has surged over $85 per barrel, marking a peak not seen in months. This uptrend is primarily driven by factors such as ongoing conflicts, production cuts by major oil exporters, and an unexpected rise in demand.

Continue reading

ECB Issues Caution: Regulatory Incentives for Defense Lending Could Be Risky

The European Central Bank (ECB) has recently raised alarms regarding potential regulatory incentives aimed at boosting lending to defense sectors within the Eurozone. This announcement comes amid broader discussions about the need for increased military spending in light of geopolitical tensions, particularly regarding the conflict in Ukraine and other global security concerns.

Continue reading

Jamie Dimon Paints a Gloomy Picture for the Banking Sector Amid Global Turmoil

In a recent statement that echoes the concerns of many in the financial sector, Jamie Dimon, CEO of JPMorgan Chase, has likened the current climate of global banking to "stormy seas," highlighting the numerous challenges ahead for financial institutions worldwide. This stark metaphor encapsulates the unease that banks are experiencing due to economic uncertainties, geopolitical tensions, and market volatility.

Continue reading