UK Inheritance Tax: Farmers Gather to Discuss Financial Impact on Agriculture

As the farming community convenes for their annual conference, a significant topic of discussion has emerged: the United Kingdom’s inheritance tax and its implications for farmers. This year’s event highlights the increasing concerns of agricultural stakeholders regarding how inheritance tax affects their ability to pass down family-run farms to the next generation, amid a backdrop of rising land values and evolving economic pressures.

Continue reading

Swiss Government Declines Proposed Tax on Super-Rich Inheritance

In a significant decision, the Swiss government has rejected a proposed tax targeting the wealthy on inherited fortunes, stirring considerable debate within the country regarding wealth distribution and tax policy. This proposal, called a “super-rich inheritance tax,” aimed to impose a new financial burden on the wealthiest individuals in Switzerland, but it has met with considerable pushback from various stakeholders.

Continue reading

Windfall of $105 Million: Upcoming Inheritance Boom for U.S. Heirs

In an astonishing development, a staggering $105 million in inheritance is poised to flow into the hands of heirs across the United States. This impending financial windfall is set to reshape the economic landscape for many families as estates settle across the country. The trend of wealth transfer is becoming increasingly pronounced, with a significant number of estates ready to be distributed in the coming years.

Continue reading

Britons Divest Homes to Family Amid Escalating Tax Burdens

As the threat of rising taxes looms large over British households, a growing number of homeowners in the UK are opting to transfer ownership of their properties to family members. This trend emerges from fears that future government policies will further compound their financial burdens. During a time characterized by economic uncertainty and increasing living costs, many are proactively seeking ways to manage their wealth and safeguard their assets for future generations.

Continue reading

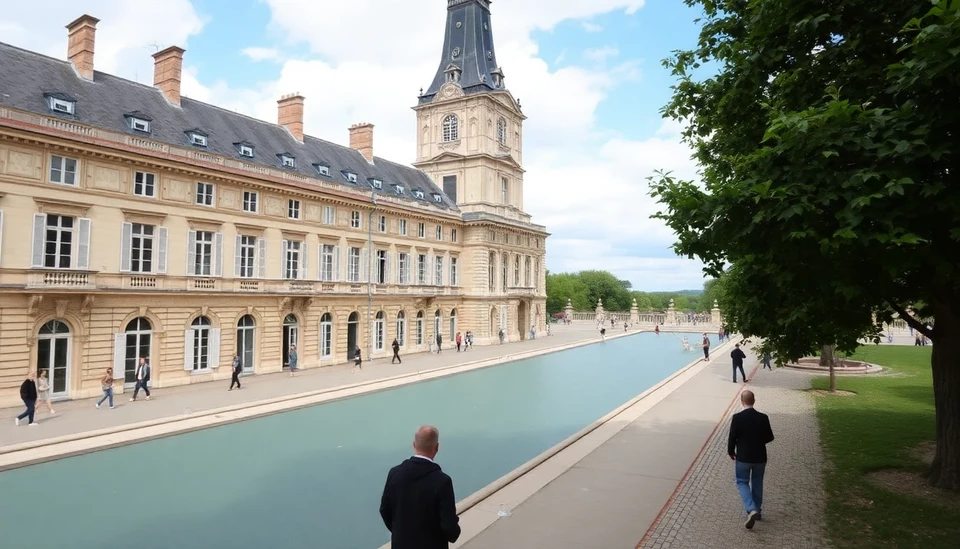

Widespread Farmer Protests Erupt Over Trade Deal and Inheritance Tax in Europe

A wave of discontent has surged across Europe as farmers rally against a controversial new trade agreement and the looming prospect of increased inheritance taxes. The protests, which have gained significant momentum in recent days, reflect deep-seated frustrations within the agricultural community regarding economic pressures and perceived governmental negligence.

Continue reading

Wealthy French Families Anticipate Significant Overhaul of Inheritance Tax Regulations

In a move poised to shake up the financial landscape for affluent households in France, the government has proposed a comprehensive revision of inheritance tax laws. This impending legislative shift has prompted wealthy families across the nation to brace themselves for the potential financial implications and strategically prepare for what could be a transformative change in the realm of estate planning.

Continue reading