China's Copper Production Reaches Unprecedented Heights Amid Dwindling Smelting Fees

In a striking development within the global metals market, China has achieved a record surge in copper production. This comes at a time when smelting fees have declined, raising questions about the sustainability of such prolific output. The latest figures indicate that copper output from the country has reached new historic highs, demonstrating China's dominant position in the copper supply chain.

Continue reading

EU Considers Temporary Halt on Metals Counter-Tariffs Amid Trade Tensions with US

The European Union is contemplating a significant pause in its counter-tariffs on certain metals imported from the United States. This potential suspension could last for a period of 90 days, offering a respite in the escalating trade tensions between the two economic powerhouses. The EU's decision is expected to provide a window for diplomatic discussions aimed at de-escalating ongoing disputes related to trade practices and tariffs.

Continue reading

The European Union Considers Imposing 25% Tariffs on U.S. Goods Amid Ongoing Metals Dispute

The European Union (EU) is actively contemplating the implementation of a substantial 25% tariff on a select array of goods imported from the United States. This decision arises from a lengthy and contentious dispute centered around the metals sector, particularly targeting specific American products that the EU views as being affected by broader trade tensions. This potential move underscores the escalating economic frictions between the two major trading blocs and highlights the intricate web of international trade policies.

Continue reading

U.S. Government Exempts Key Metals from Reciprocal Tariffs to Boost Industry

In a significant move aimed at bolstering American industries, the U.S. government has announced the exclusion of several critical metals from its recently introduced reciprocal tariffs. The decision, which impacts steel, aluminum, copper, and gold, is designed to alleviate pressure on sectors reliant on these materials, providing them with a competitive edge in both domestic and international markets.

Continue reading

US Trade Deficits Surge Amidst a New Gold Rush

In a surprising twist that has the potential to reshape the economic landscape, the United States is currently experiencing a significant surge in trade deficits, largely driven by soaring gold imports. As demand for gold skyrockets, corporations and individuals alike are flocking to the precious metal, complicating the nation’s balance of trade and raising concerns about long-term economic implications.

Continue reading

Mixed Signals in the Metals Market: New Trump Tariffs Surprise Investors

In a surprising turn of events within the commodities market, metal prices have shown an upward trend as new tariffs proposed by former President Donald Trump are reported to be more strategic and measured than many analysts initially feared. This shift in approach appears to have calmed market anxieties and contributed to the recent gains in the metals sector, especially for precious and industrial metals.

Continue reading

Macquarie Predicts Gold Prices Could Soar to $3,500 by Q3 2025

In a bold forecast, Macquarie Group analysts have projected that gold prices may rise as high as $3,500 per ounce in the third quarter of 2025. This prediction has captured the attention of investors and market analysts alike, suggesting a significant potential for returns in the precious metals market amid ongoing economic uncertainties.

Continue reading

EU Responds to US Metals Tariffs with $26 Billion Retaliation Package

In a significant escalation of trade tensions, the European Union has officially launched a retaliation initiative aimed at countering the United States' imposition of tariffs on various metals. This response, which encompasses a broad range of American goods worth approximately $26 billion, underscores the EU's commitment to protecting its economic interests amidst rising global trade disputes.

Continue reading

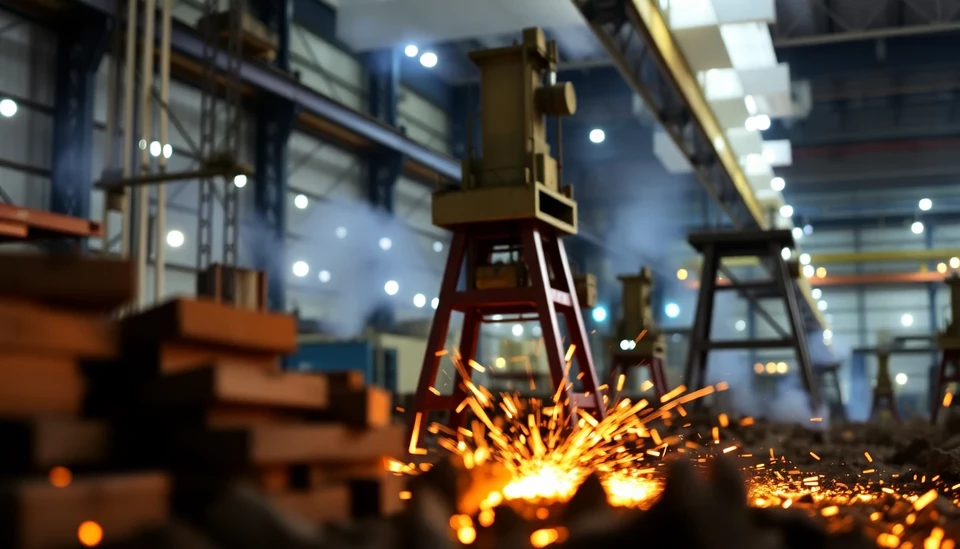

Industrial Metals Struggle as Growth Concerns Mount Before US Tariffs

The industrial metals market is currently facing a downturn, driven largely by burgeoning fears surrounding global economic growth and the looming threat of new tariffs imposed by the United States. As stakeholders across various sectors weigh the implications of these tariffs, the prices of critical metals such as copper and aluminum have seen significant declines. This situation has raised alarms about the potential ripple effects on manufacturing and construction industries that heavily rely on these materials.

Continue reading

Paul Voller, HSBC’s Head of Precious Metals, Announces Retirement

In a significant shift within HSBC's commodities division, Paul Voller, the bank's esteemed head of precious metals, has declared his retirement after a distinguished career spanning over three decades. His departure marks a pivotal moment for the bank, which has made substantial strides in the precious metal market over the years, under Voller's leadership.

Continue reading