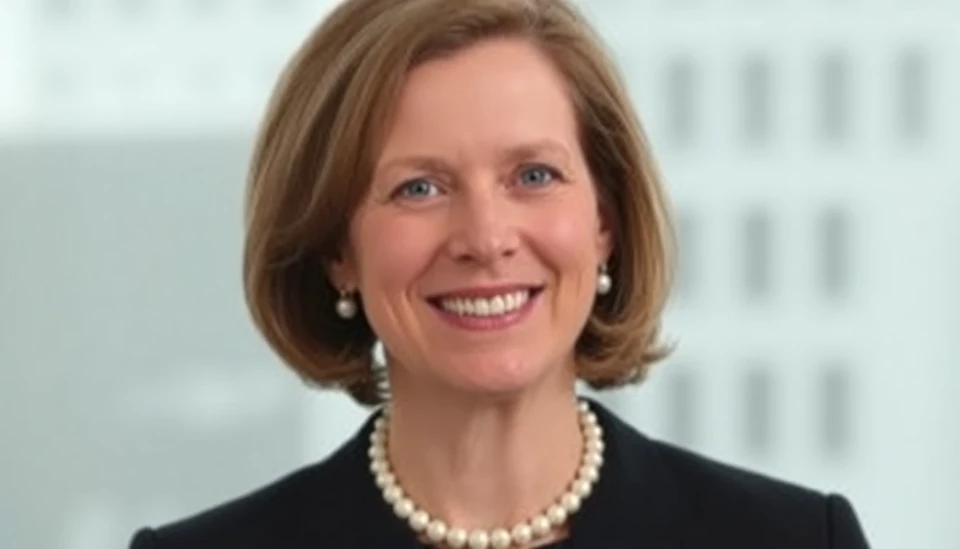

In a recent announcement, Mary Daly, the President of the Federal Reserve Bank of San Francisco, indicated that the Federal Reserve plans to maintain its current interest rates. However, she also emphasized that there may still be potential for rate cuts later in the year, depending on economic conditions and inflation trends.

Daly's remarks arrive amidst a climate of uncertainty, where the economic landscape is still adjusting following a series of previous rate hikes. These earlier measures were designed to combat inflation, which has been a persistent concern since the recovery from the pandemic. Current inflation rates have shown signs of moderation, suggesting that the aggressively high rates may soon have a diminishing effect on price levels.

During a press conference, Daly acknowledged that while the Fed is inclined to keep rates steady for the moment, the economic data received in the coming months will be crucial in shaping future decisions. Her statements reflect a cautious optimism—an understanding that while the economy shows resilience, continued vigilance is necessary to ensure inflation remains under control.

Market analysts have been closely monitoring the Fed's language and strategy. Many see Daly's comments as a signal that the Fed is not yet ready to commit to cutting rates too swiftly. There is, however, a consensus that if inflation clearly continues to decline and labor markets remain robust, rate cuts could become more feasible later in the year, achieving the dual mandate of price stability and maximum employment.

Moreover, Daly addressed the global economic factors that could influence the Fed's decisions, noting that international developments continue to affect domestic economic performance and inflation dynamics. The interconnectedness of the global economy remains a significant factor as the Fed navigates its path forward.

As we move into the second half of 2025, the indications from Daly signal that the Fed’s policy-making will heavily depend on upcoming data releases regarding inflation and employment rates. Financial markets are now bracing for upcoming economic reports, as they may shape the trajectory of interest rates and the overall economic outlook for the United States.

In conclusion, while the Fed under Daly's leadership maintains a steady course on interest rates for the time being, potential cuts are on the table should economic conditions warrant such measures. This careful balancing act will be paramount as the Fed seeks to foster sustainable growth without reigniting inflationary pressures.

As always, the dialogue surrounding these topics will be essential as we continue to see the economic narrative unfold.

#FederalReserve #InterestRates #EconomicPolicy #InflationControl #MaryDaly

Author: Laura Mitchell