RBI Considers Interest Rate Cuts Amid Growing Economic Concerns

The minutes from the latest Reserve Bank of India (RBI) Monetary Policy Committee meeting have revealed a cautious stance among policymakers who believe there is a substantive case for easing interest rates. This discussion comes in the wake of ongoing uncertainty surrounding global tariff policies, which could heavily influence India's economic outlook.

Continue reading

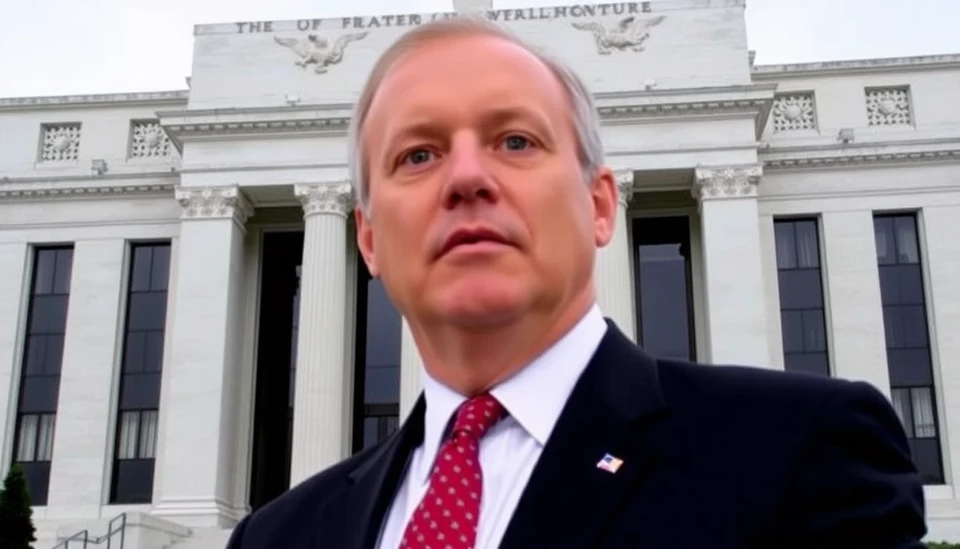

Fed's Daly Signals Steady Rates, Yet Potential Cuts Loom Ahead

In a recent announcement, Mary Daly, the President of the Federal Reserve Bank of San Francisco, indicated that the Federal Reserve plans to maintain its current interest rates. However, she also emphasized that there may still be potential for rate cuts later in the year, depending on economic conditions and inflation trends.

Continue reading

Bank of Canada Set to Pause Interest Rate Hikes Amid Tariff Changes

In a pivotal move, the Bank of Canada is anticipated to pause its interest rate hikes as it evaluates the potential impact of recent tariff decisions on the country’s economy. This strategic pause is expected as officials aim to navigate through a precarious economic landscape marked by inflation pressures and external trade influences.

Continue reading

Federal Reserve Shifts Focus: Combating Inflation Over Preemptive Rate Cuts

The Federal Reserve is making clear its stance regarding the current economic climate, emphasizing a strategy focused on combating inflation rather than preemptively lowering interest rates. In a bid to control the rising price levels that have been affecting the economy, the central bank is leaning towards maintaining higher rates for an extended period, marking a significant pivot in its monetary policy approach.

Continue reading

New Zealand Appoints Hawkesby as Interim Central Bank Governor Amid Economic Shifts

In a significant move for New Zealand's financial landscape, the Reserve Bank has officially named Michael Hawkesby as the new interim governor, a position expected to last for six months. This appointment comes amid the ongoing challenge of navigating the economic uncertainty faced by the nation.

Continue reading

RBI to Continue Record Cash Infusion Amid Global Economic Uncertainty

The Reserve Bank of India (RBI) is anticipated to maintain its unprecedented cash injection into the economy as fears of a global financial downturn loom larger. This decision comes during a critical juncture, as various economic indicators suggest a turbulent landscape not just in India, but across the globe.

Continue reading

Federal Reserve's Jefferson Assesses Interest Rates Amid Economic Uncertainty

In recent statements, the Federal Reserve's Vice Chairman for Supervision, Michael S. Jefferson, emphasized the current stability of interest rates in the face of rising economic uncertainties. Speaking at a conference, Jefferson articulated that the Federal Reserve is well-positioned to navigate potential headwinds that may arise as inflation metrics fluctuate and global economic conditions evolve.

Continue reading

Colombia's Central Bank Chief Remains Unfazed by Presidential Criticism

In a notable display of determination, Colombia's central bank governor, Leonardo Villar, has publicly responded to recent criticisms issued by President Gustavo Petro regarding the bank's monetary policy. The tension between the executive branch and Colombia’s monetary authority has escalated, but Villar has shown resilience, emphasizing the independence of the central bank in his latest statements.

Continue reading

Bank of England's Greene Advocates Ongoing Rate Restraint for Economic Stability

In a recent address, Bank of England (BoE) policymaker, Jonathon Greene, emphasized the necessity to maintain elevated interest rates to ensure that inflationary pressures in the United Kingdom are kept under control. His remarks come as the central bank navigates a complex economic landscape characterized by persistent inflation and uneven growth across various sectors.

Continue reading

Poverty Rates in Argentina Plummet as Inflation Eases Under President Milei

In a surprising turn of events, Argentina has reported a significant decline in poverty rates as inflation rates have begun to cool down under President Javier Milei's administration. This shift marks a notable improvement in the socio-economic landscape of the country, offering hope to millions of citizens who have been grappling with severe financial hardships in recent years.

Continue reading