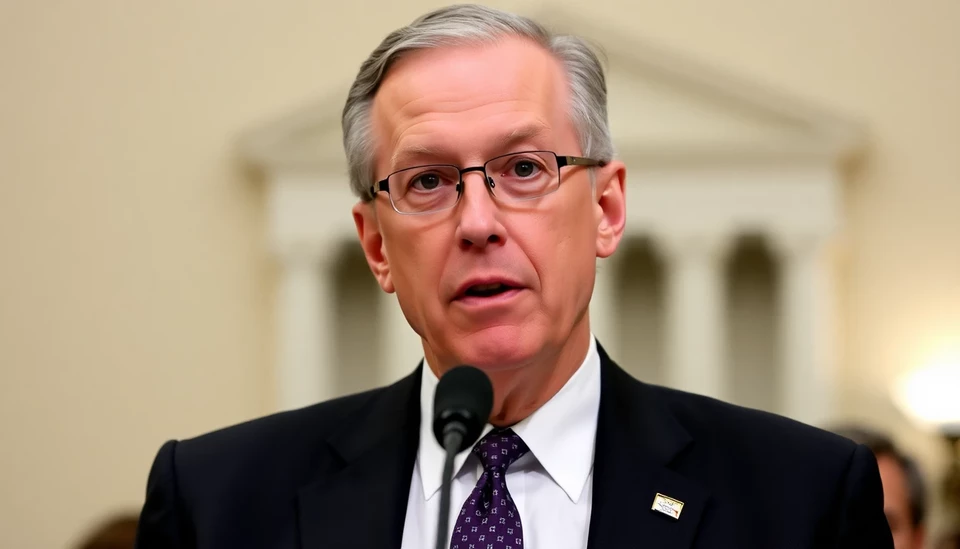

In a recent statement, Federal Reserve Chair Jerome Powell underscored the necessity for the central bank to focus on addressing inflation, following the release of the latest economic data. The remarks highlight the enduring complexities that the Fed faces in its ongoing battle against rising prices, which have remained a crucial concern for policymakers.

During a public appearance, Powell noted that the recent inflation metrics indicate that the Fed has "more work to do" to steer the economy towards its long-term target. His comments come amidst fluctuating economic indicators, which reveal that while certain sectors show signs of stability, others continue to experience significant price increases. The Fed's dual mandate—fostering maximum employment while stabilizing prices—remains a fine balancing act in the current environment.

The latest Consumer Price Index (CPI) data, which measures changes in the price level of a basket of consumer goods and services, has not met the Fed's expectations. Powell pointed out that the core inflation rate, which excludes volatile items like food and energy, continues to show resilience and suggests that there remains underlying inflationary pressure in the economy. As a result, further adjustments to monetary policy may be necessary to mitigate these pressures.

Market reactions to Powell's statements have been significant, with investors closely monitoring the Fed's next moves. Following the announcement, equities took a slight dip, while treasury yields rose, signaling that market participants are bracing for a potentially extended period of high interest rates. Powell acknowledged these concerns but reiterated the Fed's commitment to ensuring long-term stability and credibility in its approach to controlling inflation.

In light of these developments, analysts predict that continued rate hikes may be on the horizon if inflation trends do not begin to recede. The Federal Reserve has been incrementally raising interest rates since last year, aiming to curb spending and borrowing, which can help cool off inflation. However, Powell's latest remarks suggest that these measures may need to be prolonged or even intensified to achieve the desired economic outcomes.

As the situation evolves, stakeholders across various sectors are urged to remain vigilant regarding further updates from the Fed. The economic landscape is continuously shifting, and the implications of Powell's assertions will likely resonate throughout financial markets and consumer behavior in the coming months.

Overall, Powell’s emphasis on the need for ongoing action in tackling inflation reaffirms the Fed's proactive stance, aiming to restore balance in the economy while navigating the challenges that lie ahead.

#JeromePowell #FederalReserve #Inflation #Economy #MonetaryPolicy #InterestRates #CPI #MarketTrends

Author: Rachel Greene