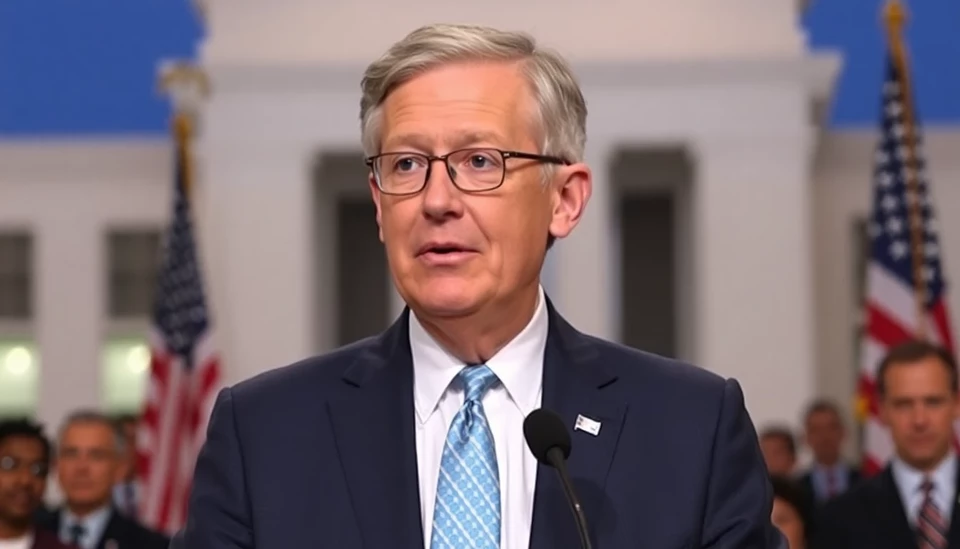

Powell Faces Pressure as Trump Challenges Fed's Independence

In a significant turn of events, Federal Reserve Chairman Jerome Powell finds himself navigating a precarious political landscape as former President Donald Trump’s recent remarks threaten to undermine the longstanding autonomy of the Federal Reserve. This dynamic is intensifying as Trump ramps up his rhetoric while preparing for his possible return to the White House.

Continue reading

Trump’s Ongoing Critique of Fed Chair Powell: What’s Next?

In a recent podcast episode, former President Donald Trump reiterated his criticisms of Federal Reserve Chair Jerome Powell. This ongoing discourse raises questions about Trump's influence on America’s economic landscape, especially as he continues to voice his disapproval of Powell’s monetary policies and decisions.

Continue reading

Trump Affirms Support for Fed Chair Powell Amid Economic Uncertainty

In a significant statement that has implications for both financial markets and the broader economy, former President Donald Trump announced that he has no intention of terminating Federal Reserve Chair Jerome Powell from his position. This declaration came during a recent gathering, where Trump was explicitly asked about his plans regarding Powell, especially in light of ongoing discussions about the Fed's monetary policy.

Continue reading

Trump Urges Rate Cuts to Prevent Economic Slowdown

In a striking comment on the current state of the U.S. economy, former President Donald Trump has publicly urged Federal Reserve Chairman Jerome Powell to consider slashing interest rates. His warning comes amid concerns that the economy is showing signs of slowing, which, according to Trump, could harm consumer spending and overall economic growth.

Continue reading

Trump Contemplates Firing Fed Chair Powell Amid Political and Economic Pressure

In a revealing scoop published by The Wall Street Journal, sources close to former President Donald Trump have indicated that he has engaged in discussions regarding the potential dismissal of Federal Reserve Chair Jerome Powell. This contemplation comes at a time of heightened economic uncertainty and ongoing political maneuvering heading into the 2024 Presidential election.

Continue reading

Fed's Powell Sends a Clear Message: Stock Market Volatility is for Investors Alone

In a recent address, Federal Reserve Chair Jerome Powell delivered a stark message to investors navigating the tumultuous waters of the stock market—essentially telling them, "You're on your own." This pronouncement underscores the challenges faced by the financial markets as they continue to grapple with uncertainty influenced by a range of economic factors.

Continue reading

Fed's Powell Emphasizes the Interplay Between a Robust Labor Market and Price Stability

In a recent address, Federal Reserve Chair Jerome Powell articulated a clear message regarding the crucial relationship between the nation's labor market and the overarching need for price stability. His remarks come amidst ongoing concerns about inflation and its impact on employment dynamics in the United States.

Continue reading

Federal Reserve Chair Jerome Powell Addresses Key Economic Issues at Chicago Event

In a pivotal address to the Economic Club of Chicago, Federal Reserve Chair Jerome Powell provided insightful commentary on a range of pressing economic issues facing the nation. Delivered on April 16, 2025, Powell's speech aimed to clarify the Federal Reserve's approach to monetary policy in light of evolving economic conditions, inflation trends, and the ongoing challenges in the labor market.

Continue reading

The Fed's Stance: Powell Signals No Immediate Rate Cuts Amidst Market Turbulence

In a decisive statement, Federal Reserve Chairman Jerome Powell reaffirmed that the central bank is in no rush to implement interest rate cuts, even as financial markets continue to face considerable volatility. During a recent press conference, Powell emphasized the need for patience and the importance of closely monitoring economic indicators before making any changes to monetary policy.

Continue reading

Federal Reserve Chair Powell Hints at Action Against Unyielding Inflation

In a significant statement early this April, Federal Reserve Chair Jerome Powell indicated that the central bank is prepared to take decisive measures in response to ongoing inflationary pressures. Powell's remarks come amidst growing concern that inflation has not only persisted beyond initial projections but may also continue to impact the economy in more profound ways than anticipated.

Continue reading