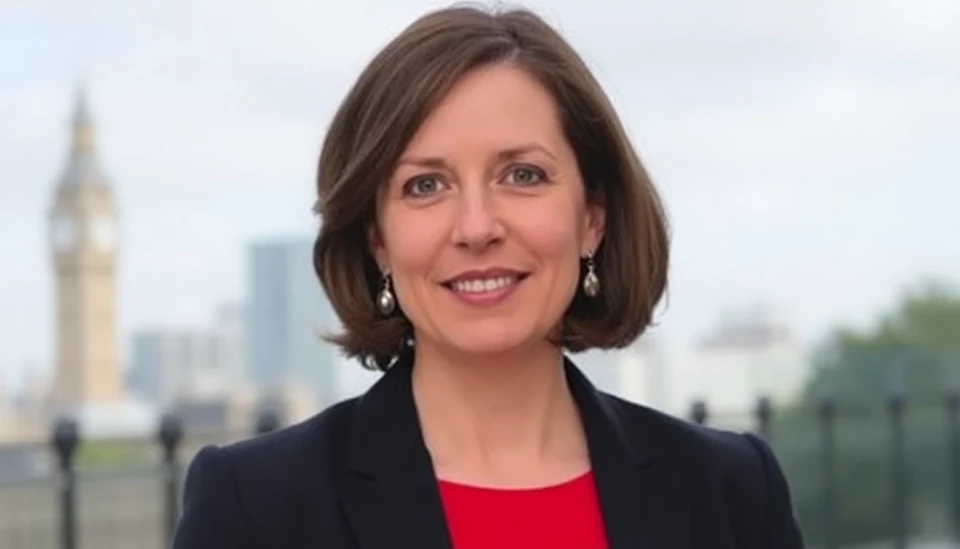

The financial landscape of the UK is under scrutiny following recent statements made by Shadow Chancellor Rachel Reeves regarding her government's investment strategy. Jim O'Neill, a notable economist and former Treasury Minister, has expressed skepticism about the feasibility of Reeves' ambitious plans designed to reinvigorate the nation's economy.

Reeves, a prominent member of the Labour Party, has put forth a comprehensive investment proposal aimed at tackling pressing economic challenges such as stagnation and inflation. However, O'Neill suggests that these plans may lack the confidence needed to sway market sentiment, as investors currently remain cautious amidst a backdrop of global economic uncertainty. He emphasizes the importance of a clear, actionable roadmap that could inspire both investor trust and public confidence.

During a recent interview, O'Neill articulated his concerns regarding the execution of Reeves' investment strategies, particularly in light of the current fiscal climate. He pointed out that while the intention to catalyze growth through infrastructure and technology investment is commendable, a robust framework is necessary to justify the proposed spending, especially when public finances are already under considerable strain.

Furthermore, O'Neill noted that investors are looking not just for ambitious plans but also for solid commitments that can translate into tangible results. He insisted that the Labour Party must provide detailed evidence and clear projections that demonstrate how these investments will lead to job creation and economic improvement, thus convincing the markets of their viability.

Adding to the complexity, the recent trends in the global economy, particularly fluctuations in energy prices and the implications of international trade policies, have compounded the challenges facing any government’s fiscal plans. O'Neill warned that in this volatile environment, markets require more than just promises; they need a comprehensive strategy that addresses these external factors, minimizing risks associated with potential overreach in public spending.

As the next general election approaches, Reeves and the Labour Party are aware that their economic strategies will become a focal point of public discourse. The pressure to not only propose but also effectively articulate a viable economic recovery plan has never been more crucial.

In conclusion, while Reeves' investment proposals have the potential to reshape the UK economy, gaining the confidence of the markets will be a significant hurdle. O'Neill’s critique serves as a reminder of the importance of clarity, detail, and actionable insights in economic policymaking, particularly during these uncertain times.

As the political landscape continues to evolve and the debate over the best path forward for the UK economy persists, all eyes will be on how the Labour Party will respond to these criticisms and further refine their budget proposals in the lead-up to the election.

#UKBudget #RachelReeves #JimONeill #InvestmentPlans #EconomicGrowth #LabourParty #MarketConfidence

Author: Daniel Foster