In a significant move to bolster the financial stability of Mexico’s state-owned oil company, Petróleos Mexicanos (Pemex), the Mexican government has announced a substantial cash transfer of $6.7 billion. This strategic allocation is intended to assist Pemex with looming debt payments due in 2025, reflecting the government’s commitment to ensuring the company's solvency and operational continuity.

The announcement, made public on November 15, 2024, comes at a crucial time when Pemex grapples with a staggering debt load, estimated at over $100 billion. This financial injection is expected to alleviate some of the immediate fiscal pressures on the company, allowing it to focus on its primary operations rather than being hampered by financial liabilities. The move not only underscores the government’s supportive stance toward Pemex but also reveals the challenges faced in the broader Mexican energy sector.

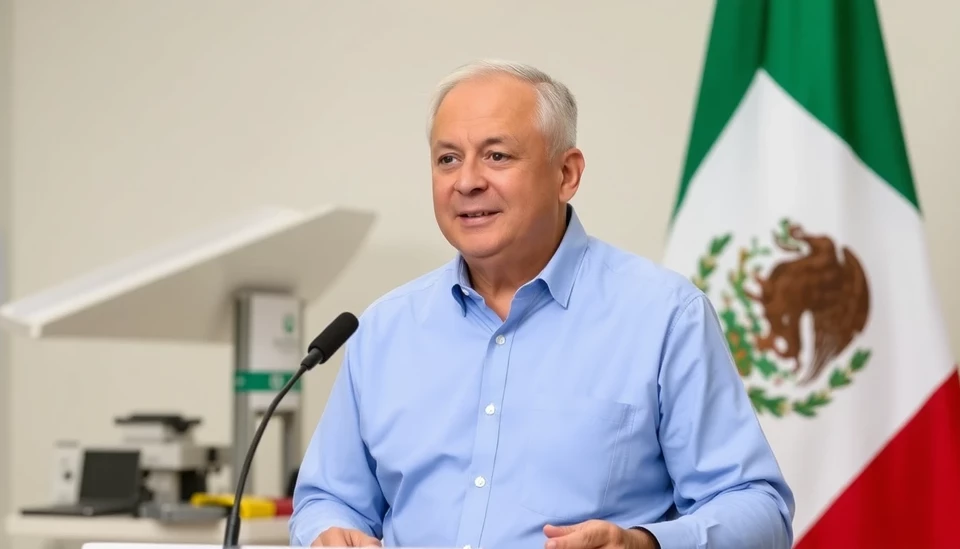

President Andrés Manuel López Obrador has been vocal about Pemex’s importance to the nation’s economy, citing it as a backbone for job creation and energy security. The government’s decision to allocate these funds appears to be influenced by the urgent need to maintain Pemex’s operational integrity, particularly in light of declining production levels and the challenges posed by fluctuating oil prices.

According to experts, while this cash transfer provides immediate relief, it raises questions about Mexico’s long-term strategies regarding its energy policy and financial management of state-owned enterprises. Critics argue that continual reliance on government bailouts for Pemex could inhibit necessary reforms and investments in the sector. Additionally, with the government fully backing Pemex, there are concerns about the impact on public finances, especially as the country navigates its own economic recovery amid global economic uncertainties.

This funding initiative is part of a broader economic plan by the López Obrador administration, aimed at revitalizing state-owned resources. The government is also expected to look into ways to enhance Pemex's operational efficiencies and generate new revenue streams. As Pemex is crucial for generating government revenues through oil production, any measures that can stabilize and potentially grow its output are paramount.

As the 2025 deadline for debt repayment nears, the Mexican government’s proactive approach highlights the ongoing interplay between national policy, economic imperatives, and the future of the state-owned oil sector. Observers will be keen to see how this financial boost impacts Pemex’s performance and the broader implications for Mexico's energy landscape moving forward.

Overall, this decisive action signals both the challenges and potentials within the energy sector in Mexico, prompting discussions on sustainable practices and the necessity for strategic reforms that will enable Pemex to thrive without the recurrent need for governmental financial assistance.

#Pemex #Mexico #EnergySector #GovernmentSupport #DebtRelief #OilIndustry #EconomicPolicy #FinancialManagement #LópezObrador

Author: Laura Mitchell