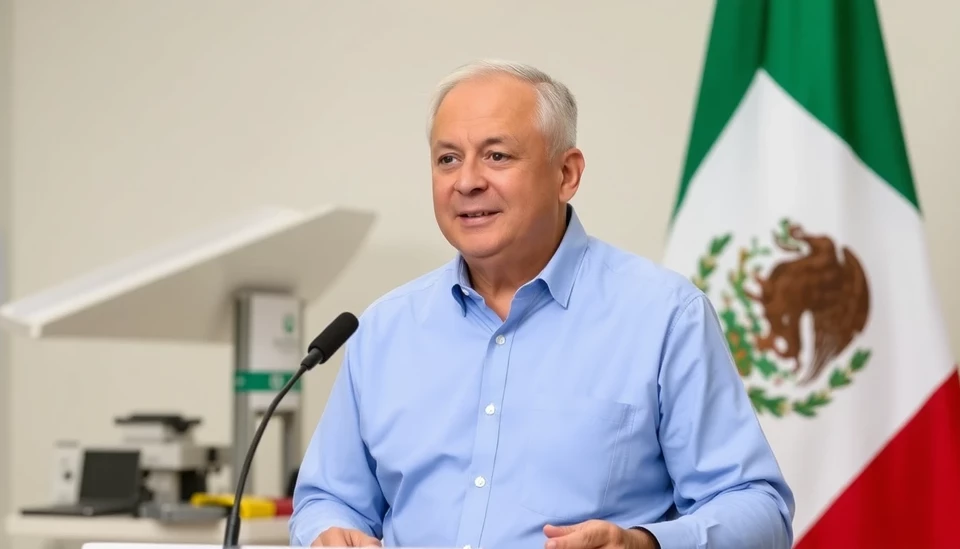

In a stark indication of the challenges facing Petróleos Mexicanos (Pemex), the state-owned oil giant reported a significant loss for the third quarter of 2024, marking a difficult start for its newly appointed CEO, Octavio Romero Rodriguez. This financial setback raises questions about the strategic direction of the company and the potential impact on Mexico's economy.

The reported loss of $1.13 billion stands in stark contrast to the gains of $1.22 billion in the same quarter of the previous year. Analysts have attributed this downturn to various factors, including declining crude oil prices, rising operational costs, and ongoing corruption scandals that have plagued the company for years. These issues are not new, but they present an urgent challenge for Rodriguez as he tries to stabilize Pemex and steer it toward recovery.

Pemex's struggles come amid a backdrop of fluctuating global oil prices, which have seen a downturn recently, largely due to slowing economic activity in key markets and oversupply issues. The company's inability to effectively navigate these market changes has raised concerns about its profitability and sustainability. Rodriguez, who took over from previous CEO Manuel Bartlett amid significant criticism, must now address these pressing issues while fostering investor confidence and operational efficiency.

Moreover, the company's mounting debt, which stands at over $106 billion, looms large. A substantial portion of this debt is due to the company’s extensive borrowing to finance its operations, which has only intensified under the weight of recent losses. Rodriguez’s leadership will be scrutinized not only on the management of these finances but also on his ability to implement necessary reforms within Pemex.

In response to the financial fallout, Rodriguez has hinted at potential restructuring plans aimed at streamlining operations and cutting excessive expenditures. However, such measures could face significant pushback from within the company, where a culture of inefficiency has been deeply rooted for decades. The question remains whether Rodriguez can effect real change in a company that has often resisted reform.

The Mexican government, which heavily relies on Pemex's revenues for its budget, has expressed support for Rodriguez but is also anxious about the ramifications of the company's setback. With upcoming elections on the horizon, the political pressures surrounding Pemex could further complicate decision-making and reform initiatives.

As the situation unfolds, industry insiders will be closely monitoring Rodriguez's moves to see if he can turn the tide. The oil sector is critical for Mexico's economy, and Pemex's revival is essential not just for the company's future, but for the country’s economic stability as a whole.

The stakes have never been higher for Pemex as it faces pressures both from the market and internal management challenges. The coming months will be crucial for Rodriguez and his team, as they seek to reassess strategies, rebuild investor trust, and ultimately restore Pemex to profitability amidst unprecedented challenges.

As this story continues to develop, stakeholders from investors to policymakers are watching with bated breath, hoping for signs of change that could lead to a more robust and sustainable future for Pemex.

#Pemex #OilIndustry #EconomicChallenges #OctavioRodriguez #FinancialLoss #Mexico #CEOLeadership #EnergySector

Author: John Harris