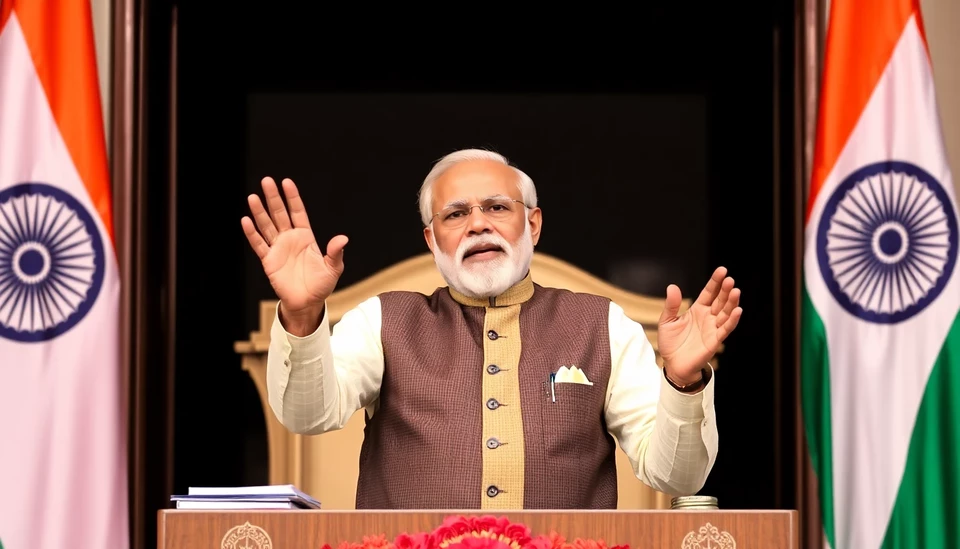

In a bold economic strategy, Indian Prime Minister Narendra Modi is turning to households across the nation to help manage and potentially resolve the country’s soaring debt, currently estimated at an astounding $346 billion. This figure represents a significant portion of the nation’s economic landscape, putting pressure on the government to implement effective solutions to mitigate financial strain on citizens and businesses alike.

During a recent policy announcement, Modi outlined an ambitious plan aimed at fostering greater financial participation from Indian families in lieu of the governmental initiatives. By encouraging households to invest in the economy, the Prime Minister aims to alleviate some of the burdens associated with public debt, thereby fostering a more sustainable economic environment in the long run.

The government's targeted approach for encouraging household investments is underpinned by various socio-economic measures, including improving access to credit, providing financial incentives for saving, and enhancing investment opportunities within the domestic market. Such initiatives are designed to empower families to contribute positively to the economy while simultaneously easing the fiscal pressures faced by India.

Experts suggest that engaging households in the economic framework is not just crucial but vital to curbing the ballooning debt. This approach is expected to stimulate local consumption and enhance financial literacy among the populace, equipping them with the tools necessary to manage their personal finances effectively and contributing to national economic growth.

Additionally, the Prime Minister's vision encompasses various sectors, including housing, education, and health care, ensuring that these areas provide ample investment opportunities for families. By linking debt management with meaningful economic participation, Modi's government hopes to create a culture of shared responsibility that not only addresses the debt crisis but also enhances the quality of life for millions of Indians.

While the challenges ahead remain significant, the call to action for households marks a new chapter in India's economic strategy aimed at fostering resilience against financial storms. The effectiveness of this approach will rely on the collective effort of both the government and the citizens as they navigate through this transition together.

As Modi’s government rolls out further details on this ambitious plan, all eyes will be on how Indian households respond to this rallying call. Will they rise to the occasion, and will this collaborative effort be enough to rein in the staggering debt? Time will tell as the country stands at a pivotal moment in its financial history.

#Modi #IndiaDebt #HouseholdInvestment #EconomicGrowth #PublicDebt #FinancialStrategy #InvestmentOpportunities

Author: Daniel Foster