Gramercy Targets $1 Billion in Private Debt Investments in Peru

Gramercy, a prominent investment firm, is making strategic moves to enhance its presence in the Peruvian market as it aims to reach a significant milestone of $1 billion in private debt investments. This bold push comes amid a growing interest in alternative investments across Latin America, propelled by the region's necessary recovery and economic improvements.

Continue reading

RBC Remains Steadfast on Growth Objectives Despite Ongoing Trade Disruptions

In a bold affirmation of its long-term strategy, Royal Bank of Canada (RBC) has announced that it will continue to pursue its ambitious growth targets, even as global economic conditions remain volatile due to escalating trade conflicts. The commitment comes as various forecasts indicate increased uncertainty in the international market, which poses significant challenges for many financial institutions.

Continue reading

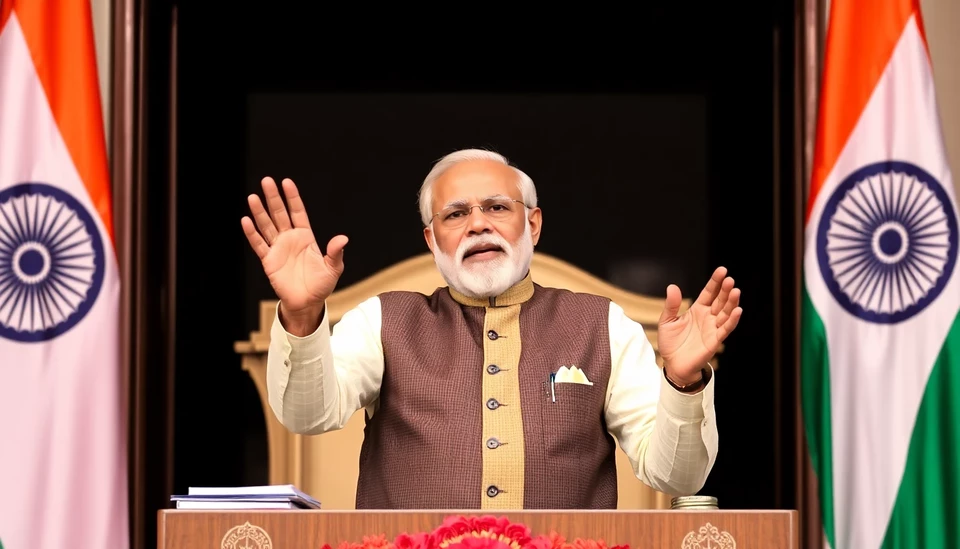

Modi's Strategic Move: Households to Tackle India's $346 Billion Debt Crisis

In a bold economic strategy, Indian Prime Minister Narendra Modi is turning to households across the nation to help manage and potentially resolve the country’s soaring debt, currently estimated at an astounding $346 billion. This figure represents a significant portion of the nation’s economic landscape, putting pressure on the government to implement effective solutions to mitigate financial strain on citizens and businesses alike.

Continue reading

Poland's Unique Financial Landscape: A Dependence on the ECB Without Adopting the Euro

In an interesting development that highlights Poland's economic landscape, the nation's decision to retain its currency rather than adopting the euro has resulted in a complex relationship with the European Central Bank (ECB). This situation was articulated clearly by Croatian National Bank Governor Boris Vujcic during a recent financial conference. Vujcic emphasized that, despite Poland's non-member status of the eurozone, it still finds itself significantly reliant on the monetary policies administered by the ECB.

Continue reading

Kraken Eyes $1 Billion Debt Package Amid Market Challenges

In a bold move reflective of the shifting landscape within the cryptocurrency sector, Kraken, one of the leading cryptocurrency exchanges, is reportedly exploring the possibility of securing a debt package valued at up to $1 billion. This potential financial maneuver comes as the company navigates through a period marked by significant market volatility and regulatory hurdles.

Continue reading

HSBC in Negotiations to Divest Fund Administration Unit to BlackFin

In a significant shift for HSBC Holdings Plc, the banking giant is reportedly in discussions to sell its fund administration business to BlackFin Capital Partners, a move that could reshape its asset management strategy. This transaction highlights HSBC’s efforts to streamline operations and focus on its core banking services amid an evolving financial landscape.

Continue reading

Santander's Strategic Shift: Emphasis on the Americas, Less Focus on Europe

In a significant revelation, Ana Botín, the Executive Chairman of Banco Santander, has articulated the bank's strategic pivot toward enhancing its operations in the Americas, particularly in the United States and Latin America. This development comes amidst a broader reassessment of the bank's priorities, indicating a shift away from Europe which has historically been a cornerstone of Santander's operations.

Continue reading

BBVA Unveils Ambitious Strategy to Double Investment Banking Revenue

In an exciting move for its financial strategy, BBVA has announced plans to double its investment banking revenue as part of a comprehensive new approach aimed at strengthening its position in the market. This decision reflects the bank's commitment to capitalize on evolving market dynamics and expand its service offerings across various financial sectors.

Continue reading

Zurich Insurance Boosts Investment in Sabadell Amid BBVA Acquisition Discussions

In a significant development within the European financial landscape, Zurich Insurance Group has announced its decision to expand its stake in Banco Sabadell. This strategic move comes in the context of ongoing negotiations involving Sabadell's potential acquisition by Banco Bilbao Vizcaya Argentaria (BBVA). As Switzerland's largest insurer, Zurich is strategically positioning itself to gain from the evolving dynamics within the banking sector.

Continue reading

Ex-Brevan Trader Rakes in Huge Returns from Geopolitical Bets

In a compelling display of market acumen, a former trader from Brevan Howard has reportedly garnered returns of up to 40% in just a matter of weeks, driven by strategic investments amid escalating geopolitical tensions. This windfall comes as investors are increasingly looking for opportunities in a volatile global economic landscape that has raised the stakes for many players in the financial arena.

Continue reading