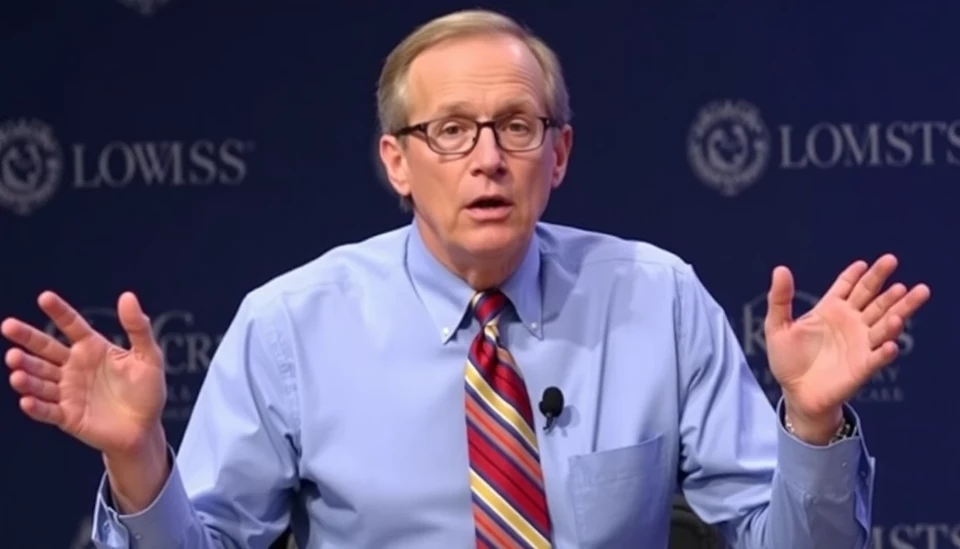

In a recent statement, Austan Goolsbee, President of the Federal Reserve Bank of Chicago, voiced concerns over how current tariff policies are contributing to ongoing economic challenges, highlighting the risk of stagflation. Goolsbee pointed to the rising prices and stagnant growth as potential outcomes of continued trade restrictions, which he describes as a “stagflationary shock” for the Federal Reserve.

Speaking at a public event, Goolsbee detailed the dual pressures that tariffs exert on the economy. First, he noted that tariffs generally lead to increases in consumer prices, meaning that households are paying more for goods. This price rise disproportionately affects lower-income families, who spend a larger share of their income on necessities.

Secondly, Goolsbee emphasized that tariffs can stifle economic growth by creating inefficiencies in the market. Businesses often face rising input costs, which can limit their ability to invest in expansion plans, ultimately leading to slower job growth. When combined with the current inflationary pressures, this situation creates an environment where stagflation could thrive, characterized by high inflation alongside low economic growth.

Economic analysts have been closely monitoring the potential for stagflation, especially as the impacts of recent tariff implementations are felt across various sectors. The Fed’s challenge becomes increasingly complex as they navigate between controlling inflation and fostering growth, especially amidst a labor market that is showing signs of weakening.

Goolsbee highlighted the role of global economic linkages, suggesting that the interconnectedness of markets means tariffs can have far-reaching effects, not only domestically but also internationally. He warned that if the U.S. continues to prioritize tariffs over trade agreements, it might lead to a more pronounced economic slowdown.

In addressing the potential responses from the Federal Reserve, Goolsbee pointed out the need for a balanced approach. While the remit of the Fed involves addressing inflationary trends through interest rate adjustments, a cautious stance is required to avoid excessive tightening that could further hinder growth.

Overall, Goolsbee’s remarks reflect a growing concern among policymakers about the economic implications of tariffs. As discussions about trade policy continue, the Federal Reserve's responses to these evolving economic challenges will be closely scrutinized by economists and market participants alike.

Goolsbee finished with a call for more dialogue about sustainable trade practices that benefit the economy without sacrificing growth potential, a sentiment that resonates as the U.S. navigates a recovering economy in the wake of a pandemic and geopolitical tensions.

As inflation rates rise and economic growth slows, the words of Goolsbee serve as a significant reminder for the Federal Reserve to carefully evaluate its strategies and the wider implications of trade policies in a globalized economy.

#Goolsbee #FederalReserve #Tariffs #Stagflation #Economy #Inflation #TradePolicy

Author: Rachel Greene