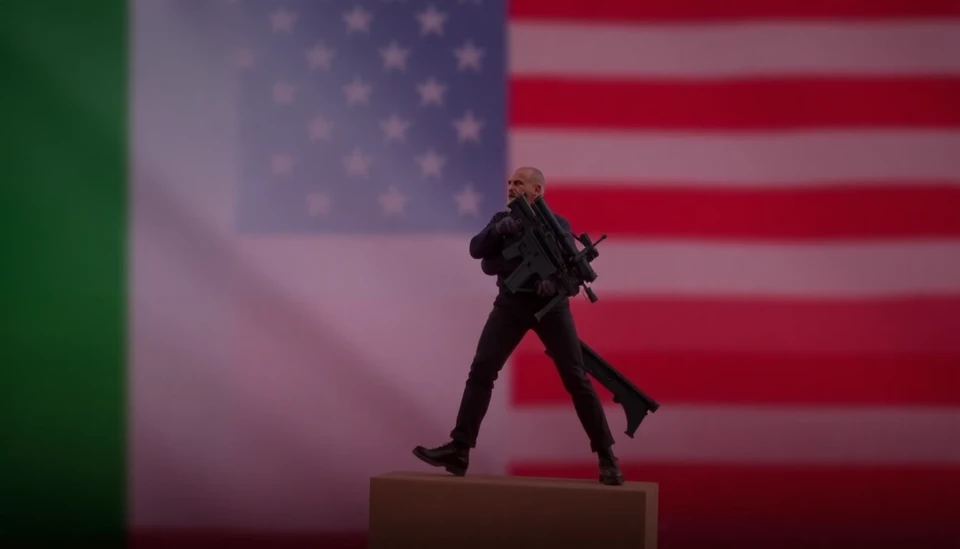

In a notable shift in the Italian economic landscape, Prime Minister Giorgia Meloni's leadership appears to be revitalizing investor confidence that had long been plagued by uncertainty and skepticism. After years of political instability and economic challenges, the country is experiencing a renaissance, as markets respond positively to a renewed sense of stability and strategic governance.

Under Meloni’s administration, Italy has initiated significant reforms aimed at attracting both domestic and foreign investments. This transformation coincides with her efforts to dispel the pervasive doubts that have historically enveloped the Italian economy. By emphasizing fiscal responsibility and political cohesion, Meloni has instilled a newfound optimism among investors, which has been reflected in the rising stock market indices and increasing foreign direct investment.

One of the critical strategies implemented by Meloni’s government is the focus on expediting bureaucratic processes. By simplifying regulations and creating a more business-friendly environment, the administration hopes to stimulate growth across various sectors. This proactive approach has already shown early signs of success, with numerous startups and established enterprises expressing greater willingness to invest and expand within Italy.

Moreover, Meloni's government has been particularly attentive to addressing Italy’s debt issues and economic disparities. Through targeted fiscal policies and ongoing negotiations with the European Union, the administration aims to secure financial support while committing to structural reforms that can elevate Italy’s long-term economic prospects.

The global economic landscape further complicates matters for Italy, but Meloni’s team seems poised to navigate through challenges, including inflationary pressures and supply chain disruptions. Their strategic focus is not only on preserving economic growth but also on ensuring a stable socio-economic environment that can withstand external shocks.

This renewed investor confidence is essential as Italy grapples with legacy issues from the past decade, including sluggish economic performance and rising public dissatisfaction. Meloni’s ability to project a strong leadership image while fostering a collaborative governance style is seen as a pivotal factor in shifting perceptions and promoting stability in the markets.

Interestingly, analysts note that the recent positive trends in Italy's bond markets are a direct reflection of improved economic outlooks. As government bonds yield lower returns amidst a climate of reduced apprehension, investors seem to be embracing a more spirited approach towards Italian assets. This sign of recovery could end up attracting even more investment inflows, thereby reinforcing the virtuous cycle of growth and stability that Italy yearns for.

As 2024 approaches, the broader implications of Meloni’s leadership for Italy's role in the European economy will be closely watched. If the upward trajectory continues, the current wave of investor confidence could solidify Italy's reputation as a resilient and attractive destination for investment in the region. This revival could potentially redefine not only Italy's market dynamics but also its influence within the larger European context.

In conclusion, while challenges remain, the early indicators under Meloni's leadership suggest a promising future for Italy's economy. As the country moves forward, a sense of cautious optimism prevails, leaving many hopeful for a sustainable, prosperous era ahead.

#Italy #Meloni #InvestorConfidence #EconomicGrowth #EuropeanEconomy #Reforms #MarketStability #ForeignInvestment

Author: Daniel Foster