South Korea's Economy Faces Shrinkage Amid Rising Political Turmoil

In a significant economic development, South Korea's economy has contracted, marking a concerning trend that suggests a deepening crisis fueled by escalating political unrest. Recent reports indicate that the nation experienced a decline in economic output, reflecting a combination of declining demand and uncertainty around governance.

Continue reading

ECB Targets Loopholes in Asset Manager Deals to Enhance Market Stability

In a strategic move, the European Central Bank (ECB) has announced plans to tighten regulations targeting what it describes as a significant loophole that has facilitated asset manager consolidation within the financial sector. This decision marks a pivotal step in the ECB's commitment to enhance the overall stability of the European financial markets amidst growing concerns over the implications of a concentrated asset management landscape.

Continue reading

Fed's Kashkari Indicates No Urgent Need for Intervention Amid Market Stability

Neel Kashkari, the president of the Federal Reserve Bank of Minneapolis, recently addressed concerns regarding the current state of financial markets, clarifying that he does not perceive any significant market dislocation that would necessitate immediate intervention by the Federal Reserve. His comments come at a time when many in the financial community are closely monitoring economic indicators amidst a backdrop of interest rate adjustments and inflationary pressures.

Continue reading

Peru's Central Bank Maintains Key Interest Rate Amid Trade War Concerns

In a decisive move to stabilize the economy and manage ongoing international pressures, Peru's central bank has opted to keep its key interest rate unchanged at 7.75%. This decision comes as policymakers navigate the complex implications of escalating trade tensions that pose potential risks to the country's economic stability.

Continue reading

China's PBOC Commits to Fund Sovereign Wealth Fund in Market Stabilization Efforts

The People's Bank of China (PBOC) has made a significant announcement concerning its plans to support the country’s sovereign wealth fund amid rising challenges in the financial markets. This proactive measure aims to bolster investor confidence and stabilize the economy in the face of fluctuating market conditions.

Continue reading

Italy's Giorgetti Urges Calm Amidst Trump's Tariff Announcements

In a recent address, Italian Minister of Economy and Finance, Giancarlo Giorgetti, sought to quell rising concerns among investors and the public regarding the potential impact of new tariffs announced by former President Donald Trump. The tariffs, which could affect a range of goods and industries, have stirred fears of escalating trade tensions and economic disruption.

Continue reading

U.S. Government Exempts Key Metals from Reciprocal Tariffs to Boost Industry

In a significant move aimed at bolstering American industries, the U.S. government has announced the exclusion of several critical metals from its recently introduced reciprocal tariffs. The decision, which impacts steel, aluminum, copper, and gold, is designed to alleviate pressure on sectors reliant on these materials, providing them with a competitive edge in both domestic and international markets.

Continue reading

Colombia's Central Bank Chief Remains Unfazed by Presidential Criticism

In a notable display of determination, Colombia's central bank governor, Leonardo Villar, has publicly responded to recent criticisms issued by President Gustavo Petro regarding the bank's monetary policy. The tension between the executive branch and Colombia’s monetary authority has escalated, but Villar has shown resilience, emphasizing the independence of the central bank in his latest statements.

Continue reading

The Erosion of Trust: A Deep Dive into U.S. Economic Data Integrity

In an era where reliable economic data is crucial for decision-making, a growing concern has emerged regarding the trustworthiness of U.S. economic indicators. Recent podcast discussions have shed light on the implications of these trust issues for policymakers, businesses, and the general public. This revelation comes at a time when economic analysts rely more than ever on these indicators to gauge the health of the economy and project future market behaviors.

Continue reading

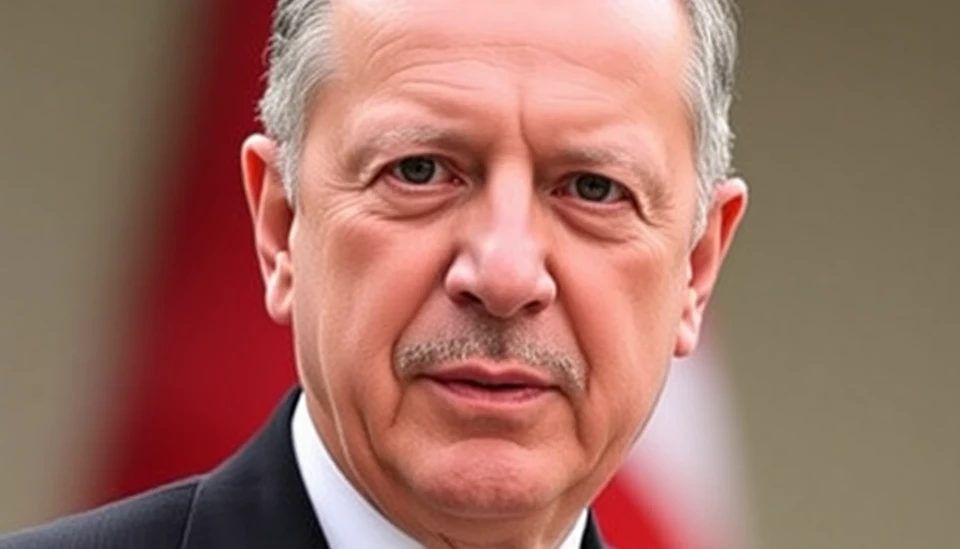

Turkish President Erdogan Navigates Protests and Market Instability

In a time of rising tensions and widespread discontent, Turkish President Recep Tayyip Erdogan is walking a fine line between addressing public protests and stabilizing the country’s financial markets. Recent demonstrations have erupted across Turkey, primarily fueled by widespread dissatisfaction with the government’s economic policies, rampant inflation, and the deteriorating living conditions that have left many citizens struggling to make ends meet.

Continue reading