In a notable shift, traders have begun to scale back their expectations for a possible interest rate cut from the Federal Reserve in December. This change comes in response to comments made by Federal Reserve Chair Jerome Powell, who expressed a cautious and measured stance regarding the current economic landscape. Investors had previously anticipated a cut, but Powell’s recent statements have instilled a sense of uncertainty about the central bank's next moves.

During a recent press conference, Powell highlighted the ongoing complexities surrounding the U.S. economy, particularly with inflation remaining above the Fed's 2% target. He noted that while there have been signs of cooling inflation, the risks of higher prices persisting continue to loom large. This has led market participants to rethink their positions and adjust their forecasts accordingly.

As a result of Powell's remarks, futures contracts linked to the Fed's policy rate showed a decline in the likelihood of a December rate cut. Previously, traders were pricing in nearly a 70% chance of a reduction, but following Powell's comments, that figure plummeted to around 50%. This substantial shift underscores the market's responsiveness to the Fed's communication strategy and highlights the importance of Powell's insights in shaping economic expectations.

The implications of this recalibrated outlook are significant, not just for traders but for the broader economy as well. With the Fed taking a more cautious approach, businesses and consumers alike may experience a shift in borrowing costs and investment strategies. Lower interest rates often stimulate economic activity, but the fading expectations of a cut could temper immediate spending and investment plans.

Moreover, Powell's remarks come against a backdrop of mixed economic indicators. While job growth has remained robust, and the unemployment rate stays low, concerns linger over consumer spending and business investment. The central bank's paradox lies in the need to support growth while simultaneously combating enduring inflationary pressures.

The Fed's next meeting, set for mid-December, will be closely scrutinized by investors for any indications of future monetary policy direction. Analysts are now weighing the likelihood of steady rates versus a potential cut, which could influence everything from mortgage rates to corporate borrowing costs across various sectors of the economy.

In summary, as traders adjust their forecasted bets for a December rate cut, the uncertainty surrounding inflation and economic growth remains a critical focal point for the Federal Reserve. Powell's cautious tone has clearly resonated, prompting a reassessment of the central bank's approach to navigating the intricate balance between growth and inflation management.

As the economic landscape continues to evolve, market participants will be keenly attuned to any further signals from the Fed that might influence their strategies and expectations in the months ahead.

#FederalReserve #JeromePowell #InterestRates #Economy #MarketTrends #Inflation #InterestRateCut #FinanceNews

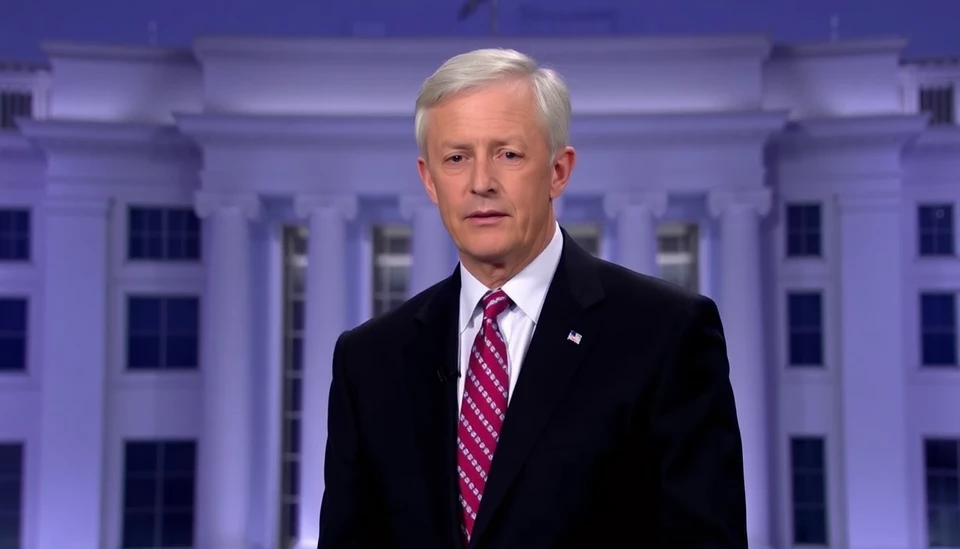

Author: Daniel Foster