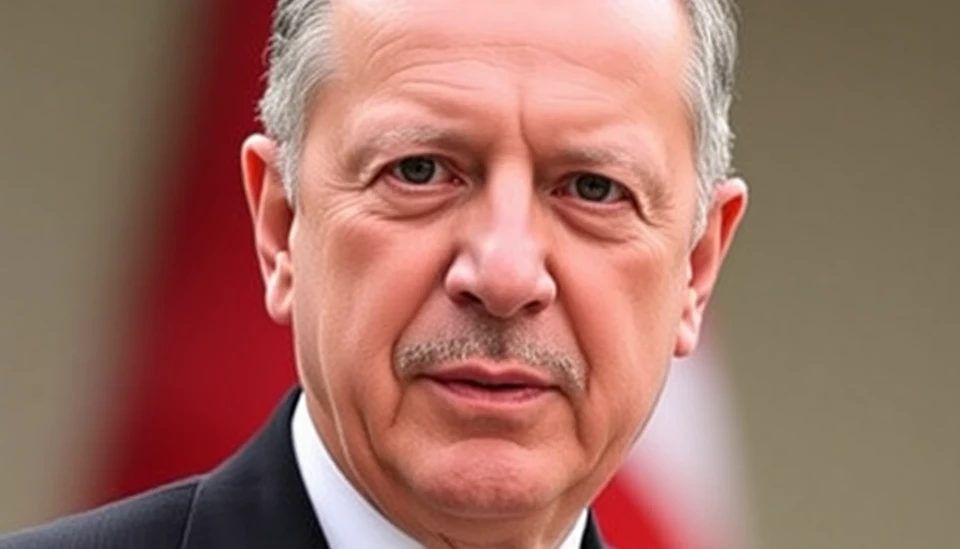

In a time of rising tensions and widespread discontent, Turkish President Recep Tayyip Erdogan is walking a fine line between addressing public protests and stabilizing the country’s financial markets. Recent demonstrations have erupted across Turkey, primarily fueled by widespread dissatisfaction with the government’s economic policies, rampant inflation, and the deteriorating living conditions that have left many citizens struggling to make ends meet.

As protests grow, Erdogan has adopted a more conciliatory approach, attempting to quell unrest while reassuring investors that the government is committed to fiscal responsibility and market stability. His administration is now facing the dual challenge of appeasing the populace tired of economic hardship and maintaining the confidence of international markets that have been jittery due to recent volatility.

In a bid to address the roots of these protests, Erdogan has promised to implement measures aimed at reducing inflation and increasing employment opportunities. His government is reportedly planning to unveil a package of economic reforms designed to boost growth and improve living standards. This announcement aims not just to stop the protests but to demonstrate to the public that their voices are being heard by the leadership.

Economically, Turkey has been grappling with soaring inflation rates, which have been exacerbated by various factors including the global economic climate and local policy missteps. The Turkish lira has plummeted in value, making imports more expensive and pushing consumer prices higher. Consequently, Erdogan's government is under pressure to show tangible results that can translate into real socio-economic improvements.

Market analysts are closely watching Erdogan’s moves, assessing the potential impacts of these protest mitigation tactics on investor confidence. Investors are particularly wary due to the political climate and economic uncertainty, which could lead to capital flight if not addressed effectively. Analysts suggest that Erdogan must act decisively to both satisfy domestic needs while projecting stability to potential foreign investors.

In conclusion, Erdogan’s current approach is indicative of a broader struggle between a government under pressure to deliver economic stability and a populace demanding accountability and change. The situation remains fluid, with protests likely to continue if citizens feel their grievances remain unaddressed. However, the administration’s responsiveness and adaptive strategy could play a crucial role in either calming tensions or further inflaming public dissatisfaction.

As Turkey navigates this challenging landscape, all eyes will remain on Erdogan and his government's next steps, as both the populace and markets await tangible results in this moment of crisis.

#Turkey #Erdogan #Protests #EconomicReform #Inflation #MarketStability #TurkishLira #InvestorConfidence

Author: Rachel Greene