In a bold move aimed at revitalizing the UK's economic landscape, Shadow Chancellor Rachel Reeves has unveiled plans to introduce a new law that would enable the establishment of “pension megafunds.” This initiative is part of a broader strategy to leverage the nation's pension assets for enhanced investment in infrastructure, technology, and job creation.

The proposed legislation is designed to channel billions of pounds from pension funds into ventures that can drive sustainable growth, particularly in sectors critically needed for the UK's recovery. By creating these megafunds, Reeves envisions a competitive landscape that empowers pensions to back larger projects that would have previously been out of reach.

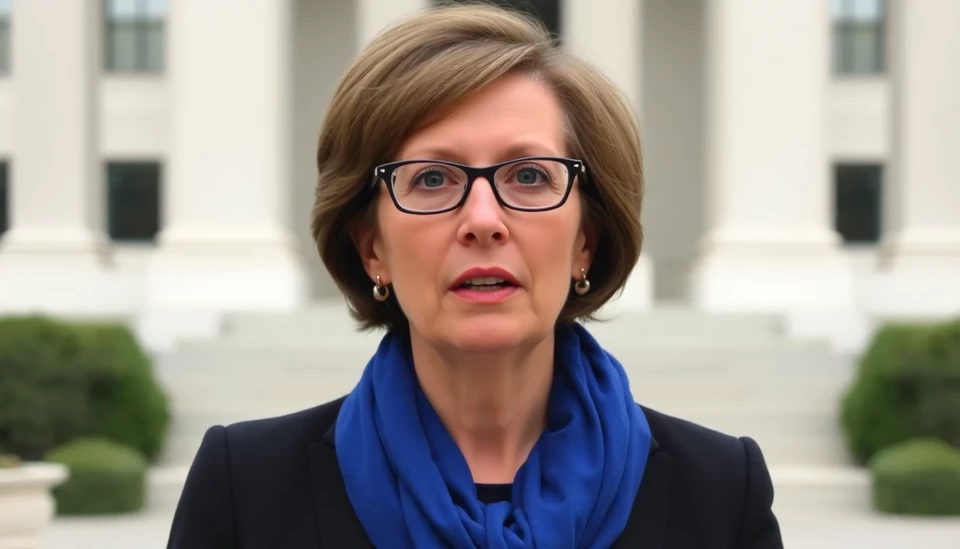

Reeves articulated her vision during her address at a recent economic summit, where she emphasized the importance of harnessing the potential of pension funds, which currently hold approximately £2.3 trillion in assets. The Shadow Chancellor asserted that by investing in the country’s future, the funds could play a crucial role in addressing the pressing challenges facing the UK economy today.

A key component of Reeves' proposal is the establishment of the Pension Fund Investment Fund (PFIF). This entity would work in collaboration with existing pension schemes to create a collective investment vehicle that aims to attract both public and private investment. The transition toward these megafunds is intended to ease the regulatory burdens that have historically limited pension funds from making larger investments.

In the face of challenges posed by inflation and sluggish growth, this strategic shift aims to harness the strength of the UK's pension assets. Reeves indicated that the government should not only support but actively promote such initiatives, underlining the necessity of public-private partnerships in revitalizing infrastructure and undertaking technological advancements possible through coordinated investments.

Moreover, the proposed measure could significantly increase funding for green projects, aligning with global trends prioritizing sustainability. Reeves firmly believes that the UK must play a vital role in the global shift towards green energy solutions, which in turn will create new employment opportunities and foster innovation across various sectors.

Despite the potential benefits outlined by Reeves, the proposal may face skepticism from various parties regarding the risk factors associated with larger investments in less traditional areas. Experts within the industry and policymakers will likely engage in debates regarding the framework and regulations guiding these megafunds. Conversely, proponents argue that the move could mark a foundational change in how pension assets are utilized, paving the way for a more dynamic economic future.

In summary, Rachel Reeves' push for pension megafunds signifies a proactive approach to tackle the economic uncertainties facing the UK. By unlocking investment potential within pension assets, her plan illustrates a strategic pivot that seeks to align financial resources with national growth priorities. As discussions continue, the implementation of this vision could reshape the landscape of pension investment in the UK and set a benchmark for economies worldwide.

#PensionMegafunds #UKEconomy #InvestmentStrategy #RachelReeves #InfrastructureInvestment #SustainableGrowth #EconomicRecovery

Author: Daniel Foster