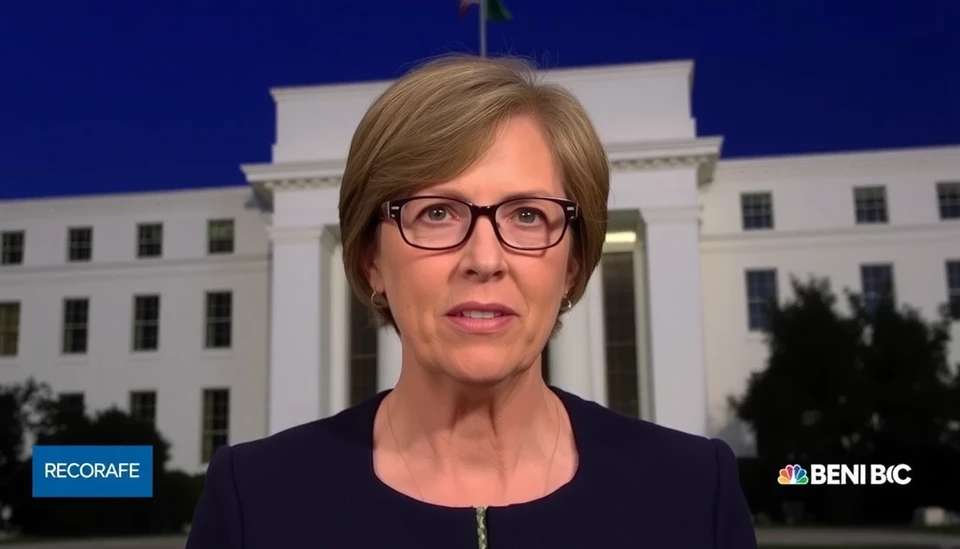

In a recent discussion, Mary Daly, the President of the San Francisco Federal Reserve Bank, provided her insights regarding the Federal Reserve's most recent interest rate cut. This decision, aimed at stimulating economic activity, reflects the central bank's response to a combination of factors, including persistently slow economic growth and inflation rates that have shown signs of easing. Daly's remarks shed light on the Fed's evolving approach in a complex economic landscape.

Daly emphasized that the rate cut is a strategic move designed to foster an environment conducive to investment and consumer spending. She pointed out that while inflation has been a top concern, recent data suggests a downward trend, which allowed the Fed more flexibility in adjusting monetary policy. This decision to reduce rates aims to encourage borrowing and spending, particularly in key sectors such as housing and consumer goods, which have been sluggish in recent months.

During her commentary, Daly also acknowledged the challenges posed by global uncertainties, including geopolitical tensions and ongoing supply chain disruptions. These factors have contributed to a cautious economic outlook, making the Fed's decision to cut rates even more critical in ensuring sustained economic momentum. According to her, the central bank is committed to monitoring indicators closely and is prepared to adjust its policy stance as new data emerges.

Furthermore, Daly addressed the potential impacts of the rate cut on the banking sector and financial markets. She reassured stakeholders that while lower rates can compress margins for banks, they also provide much-needed support to borrowers, especially small businesses and households facing financial strain. Daly highlighted the importance of balancing the needs of financial institutions with the overarching goal of promoting economic growth.

As President of the San Francisco Fed, Daly plays a pivotal role in shaping monetary policy decisions, and her perspective reflects broader trends observed among Fed officials. Her insights also resonate with concerns regarding the Fed's approach to inflation targeting and its implications for long-term economic stability.

In closing, Daly reiterated the Fed's commitment to adaptability in the face of evolving economic conditions. She expressed optimism that the current rate cut would serve as a catalyst for growth, urging businesses and consumers to leverage the favorable borrowing environment to drive spending and investment. The Federal Reserve's proactive measures illustrate its ongoing dedication to fostering a robust economy, even amidst challenges.

As the economic landscape continues to shift, all eyes will remain on the Federal Reserve and its leadership as they navigate the complexities of monetary policy in 2024 and beyond.

#MaryDaly #FederalReserve #InterestRates #EconomicGrowth #FinanceNews #RateCut #SanFranciscoFed #MonetaryPolicy

Author: Daniel Foster