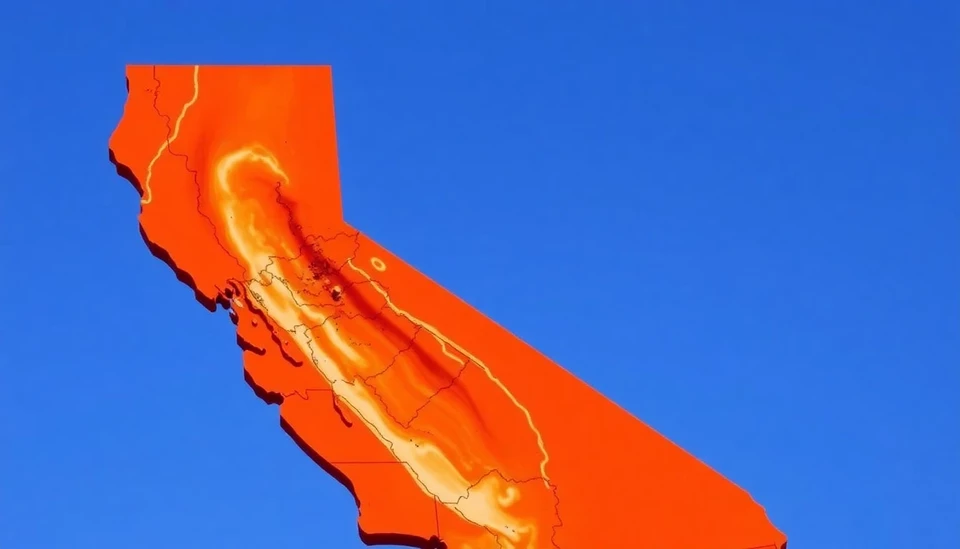

In a significant move aimed at protecting homeowners from the escalating risks posed by natural disasters, California has announced the addition of more zip codes to its insurance cancellation ban. This decision comes at a time when wildfires, floods, and other climate-related events are increasingly threatening property and livelihoods across the state.

The California Department of Insurance revealed that, effective immediately, the state's insurance regulations will keep homeowners in more areas protected from the loss of coverage due to climate-related hazards. This expansion of the ban is directly linked to the growing frequency and intensity of wildfires and extreme weather events that have ravaged communities in recent years.

Specifically, the new zip codes, which have been identified as high-risk areas for natural disasters, will now be exempt from cancellations, non-renewals, and new policy restrictions imposed by insurers. The state's commission has noted that regions historically affected by wildfires and flooding will particularly benefit from this legislative change, ensuring that residents have access to stable insurance options in an unpredictable climate.

Insurance experts and consumer advocates have praised the move as a necessary step towards maintaining housing stability in the face of increasing environmental challenges. They argue that without these protections, many families would be forced into precarious situations, either having to cope with insurance gaps or facing potentially unsellable homes.

The ban on cancellations was first implemented last year and has resulted in a temporary halt to insurance companies withdrawing policies from homeowners in certain fire-prone regions. The recent addition of more zip codes reflects California's commitment to safeguarding its residents as climate change continues to pose significant challenges to safety and stability.

Governor Gavin Newsom emphasized that the state is committed to supporting its residents against the impacts of climate change, stating that “We cannot allow our communities to suffer because of factors beyond their control.” He highlighted the importance of the insurance industry adapting to the realities of California's changing environment.

The expansion of the insurance cancellation ban is expected to affect numerous homeowners who might otherwise find themselves without coverage, potentially leading to financial distress or even forcible displacement. The move aligns with broader initiatives aimed at increasing resilience in the face of climate change, a pressing issue that is increasingly impacting real estate markets and community planning across the state.

In addition to the cancellation ban, California's Department of Insurance is encouraging insurers to explore innovative solutions, including reinsurance and state-supported options, to help mitigate the risks associated with fires and flooding. This move is expected to provide a more stable coverage landscape for homeowners, promoting both resilience and recovery in affected communities.

As more Californians seek refuge from the chaos of climate risks, the state continues to reassess its preparedness and response strategies, ensuring that residents can not only survive but thrive despite the many challenges posed by their environment.

As discussions around climate adaptation and insurance policies evolve, California stands at the forefront of a movement that prioritizes the protection of its communities, a model that could inspire other regions grappling with similar challenges across the nation.

Residents are advised to stay updated on the developments regarding the new zip codes included in the ban and to reach out to their insurance providers to understand how these changes might directly affect their policies.

With the ongoing cycles of disaster and recovery, California's proactive approach could serve as a blueprint for other states battling the compounded effects of natural disasters, paving the way for more sustainable and equitable insurance solutions moving forward.

###

#California #InsurancePolicy #ClimateChange #Homeowners #Wildfires #EnvironmentalProtection #Insurance #NaturalDisasters #GavinNewsom #InsuranceCancellationBan #ClimateResilience

Author: John Harris