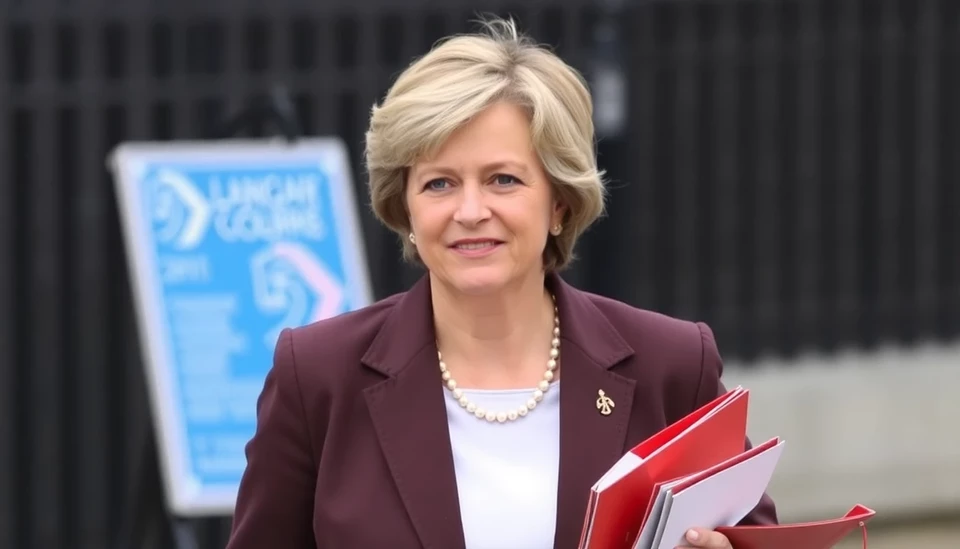

The Chicago Mercantile Exchange (CME) is making significant moves as it aims to secure its position at the forefront of the U.S. Treasury market. In a strategic initiative, CME has turned to former U.S. Treasury Secretary Janet Yellen, seeking her expertise and insight to navigate the complex and highly competitive landscape of U.S. Treasury securities trading.

As the U.S. Treasury market remains one of the largest and most vital sectors for global finance, CME recognizes the imperative to adapt and innovate in order to maintain and enhance its dominance in this critical space. The exchange has been under mounting pressure from competitors and evolving trading dynamics, prompting its decision to engage Yellen, whose extensive experience in economic policy and fiscal matters renders her a valuable asset in addressing current challenges.

Yellen, who has held prominent roles in both the public and private sectors, brings a wealth of knowledge about economic trends, regulatory frameworks, and the intricacies of Treasury trading. Her appointment signals CME's commitment to understanding the nuances of investor behavior in the aftermath of fluctuating interest rates and geopolitical uncertainties that have characterized recent market conditions.

Analysts observe that with increasing volumes of Treasury trading migrating to off-exchange platforms and alternate venues, CME is attempting to bolster its trading infrastructure and offerings. The collaboration with Yellen is seen as a proactive step towards enhancing CME’s competitive advantage by potentially diversifying its product range and improving its technological capabilities to better serve market participants.

This strategy also reflects a broader trend amongst financial institutions to steer through volatility and uncertainty by leveraging experienced professionals who can provide guidance in tumultuous financial climates. Beyond just maintaining current market share, CME aims to capture a larger segment of the growing demand for Treasury trading among institutional investors, particularly as they navigate the post-pandemic recovery and shifting monetary policies.

Furthermore, analysts expect that under Yellen’s guidance, CME could explore new avenues for regulatory engagement, which may lead to more favorable conditions for trading Treasury securities. This is an important factor as market participants increasingly look for transparency and efficiency in their trading operations.

In conclusion, CME’s strategic collaboration with Janet Yellen underscores the importance of innovative leadership in the competitive U.S. Treasury market. As the exchange adapts to the changing landscape, the insights provided by Yellen could be pivotal in redefining their approach to Treasury trading, ensuring they not only maintain relevance but also enhance their standing in the global financial arena.

In a rapidly evolving market where agility and foresight are vital, the efforts of CME signal a crucial turning point for both the exchange and the broader Treasury market. Stakeholders and investors will undoubtedly be monitoring this partnership closely as the future of U.S. Treasury trading continues to unfold.

#CME #JanetYellen #USTreasury #FinanceNews #MarketTrends #InvestmentStrategies #EconomicPolicy

Author: John Harris