CME Launches New Futures Contracts Aimed at Retail Traders

The Chicago Mercantile Exchange (CME) has unveiled a new suite of smaller and longer-duration futures contracts designed specifically to capture the interest of retail traders. This innovative move comes as the CME aims to broaden its market appeal and provide individual investors with more accessible options amidst a backdrop of growing interest in trading futures and hedging strategies.

Continue reading

CME Group Explores Google’s Blockchain Technology Through 24-Hour Trading Experiment

In an intriguing move that could shape the future of financial trading, the CME Group has initiated a trial using Google's advanced blockchain technology to facilitate around-the-clock trading. This experimental phase is designed to enhance market efficiency and provide traders access to more flexible trading hours, responding to the evolving needs of participants in an increasingly global and digital trading landscape.

Continue reading

Loyalty Test for UK Labour Party as Critical Week Dawns for Chancellor

As the political landscape in the United Kingdom continues to evolve, the Labour Party is bracing for a crucial week that will present significant challenges for its Chancellor. With the government facing mounting pressure over economic policies and public opinion, the decisions made in the coming days could have lasting implications for party unity and its electoral prospects.

Continue reading

Tech Titans Clash: Musk and Lutnick's Gamble on GDP and the New Economy

In a bold financial maneuver that has stirred conversations across the economic landscape, Elon Musk and Howard Lutnick are making headlines with their unconventional approaches to navigating the ever-evolving dynamics of GDP in the age of technology. Their differing philosophies underscore a broader debate on how digital innovation intersects with traditional economic metrics.

Continue reading

New Investigation Reveals Toxic Chemicals in Beauty Products: A Risk to Health

A recent investigation has raised alarming concerns about the presence of toxic substances, including benzene and heavy metals, in a range of popular personal care products such as shampoos, sunscreens, and tampons. These findings have ignited discussions about the safety of items that millions of consumers use daily, often without understanding the potential risks associated with them.

Continue reading

Bank of Thailand Forecasts Inflation Will Stay Below 3% Until 2026

The Bank of Thailand (BoT) has shared its projection that inflation in the country will remain within the range of 1% to 3% until 2026. This outlook signals a stabilizing economic environment, providing some reassurance to both consumers and businesses as they navigate the post-pandemic landscape.

Continue reading

CME Group Secures Approval as Futures Commission Merchant, But Faces Significant Backlash

The Chicago Mercantile Exchange (CME) Group has recently received regulatory approval from the National Futures Association (NFA) to operate as a Futures Commission Merchant (FCM). This decision marks a significant step in the firm's expansion into the realm of futures trading. However, the approval has not come without considerable controversy, prompting backlash from several stakeholders in the financial market ecosystem.

Continue reading

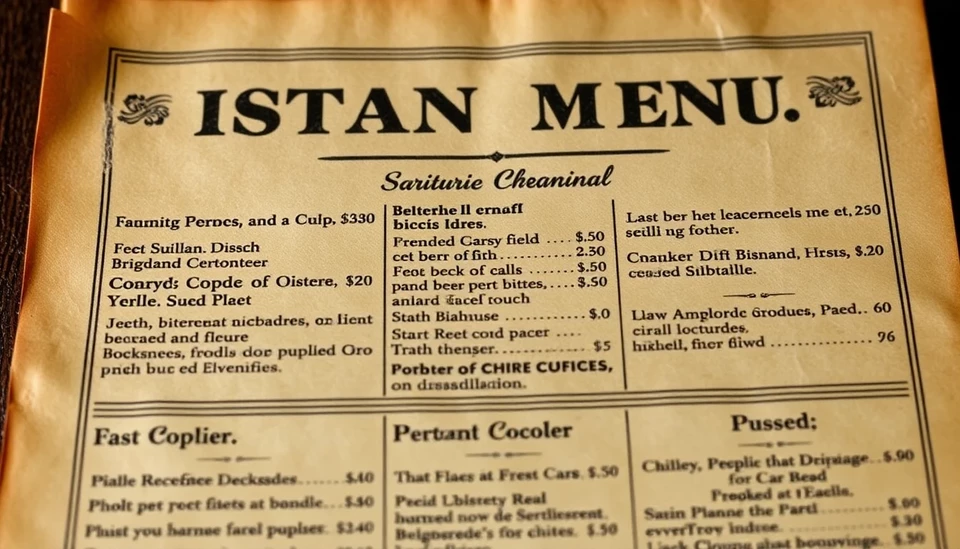

The Fascinating Insights Behind a 100-Year-Old Restaurant Menu and Its Message on Inflation

In a captivating exploration of economic history, a century-old restaurant menu has emerged as a unique narrative on inflation and the evolution of consumer prices. This menu, which dates back to the vibrant years of the early 20th century, opens a window into the past, showcasing not only the culinary delights of the time but also shedding light on how far prices have come in a century and what this means for today’s economy.

Continue reading

CME Seeks Yellen's Guidance in Race for US Treasury Market Supremacy

The Chicago Mercantile Exchange (CME) is making significant moves as it aims to secure its position at the forefront of the U.S. Treasury market. In a strategic initiative, CME has turned to former U.S. Treasury Secretary Janet Yellen, seeking her expertise and insight to navigate the complex and highly competitive landscape of U.S. Treasury securities trading.

Continue reading

Breakthrough RNA Editing Trials Propel Biotechnology Stocks to New Heights

In a significant development within the biotechnology sector, companies involved in RNA editing have witnessed a remarkable surge in their stock prices following the release of positive trial data. This groundbreaking progress could potentially reshape the landscape of genetic treatments and enhance the overall market enthusiasm surrounding this innovative field.

Continue reading