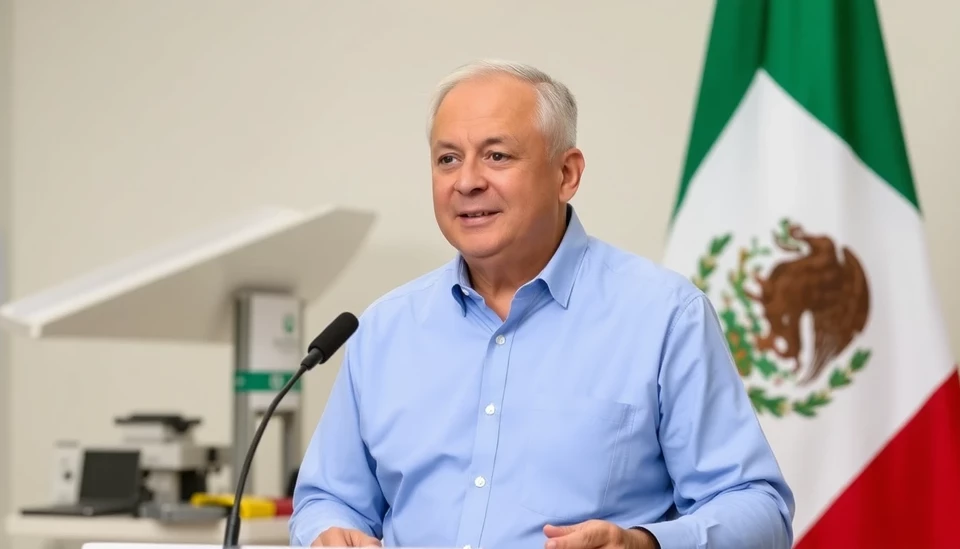

In a significant corporate leadership change, the new CEO of Petroleos Mexicanos (Pemex), Mexico's state-owned oil company, has found himself at the forefront of a monumental task: rehabilitating one of the most inefficient oil companies in the world. This transition comes at a time when the Mexican oil industry is navigating through turbulent waters marked by operational setbacks, financial troubles, and a declining production landscape.

An immediate challenge for the CEO will be reversing years of mismanagement that have plagued Pemex, affecting both its production capabilities and its financial health. The company has been under pressure to restore its reputation and viability, amidst increasing scrutiny over its operational inefficiencies and the hefty debts it carries.

The urgency of the situation is underscored by Pemex's continuous struggles to increase oil production in light of rising global demand. This predicament is compounded by the fact that Pemex is not just any oil company; it plays a critical role in Mexico's economy, accounting for a substantial portion of government revenue. Thus, the stakes are exceedingly high for California-based oil firms reliant on the company's stability.

As the new CEO steps into this complex role, he is expected to implement strategic changes aimed at addressing these inefficiencies. Industry experts anticipate a thorough review of the current operational processes and an emphasis on technology adoption to modernize workflows. There may also be discussions around attracting foreign investment, which has been severely curtailed due to reforms aimed at nationalizing the sector.

The recent history of Pemex is filled with missed opportunities and failed projects, leading to skepticism about the future trajectory of the company. Critics argue that without a paradigm shift in management strategy and operational excellence, Pemex's struggles will continue. There is hope that the new leadership can initiate a renaissance of sorts, promoting a culture of accountability and innovation that Pemex desperately requires.

Investors, too, are keenly observing how the leadership transition unfolds, particularly as they weigh their options in a volatile oil market. Any signs of improvement could signal a rebound not just for Pemex, but for Mexico's wider economy. However, achieving sustainability and profitability will take more than just leadership changes; it will require a concerted effort to reshape the company’s operational blueprint and rebuild stakeholder confidence.

As the implications of Pemex's operational restructuring are felt throughout the industry, attention will be focused on how swiftly and effectively the new CEO can address these critical issues. The future of one of the world's largest oil companies hangs in the balance, and its fate may well dictate the direction of Mexico's economic landscape.

In summary, as the new CEO of Pemex embarks on this challenging journey, the world watches closely, mindful of the stakes involved not only for the company but for the broader economic fabric of Mexico.

#Pemex #OilIndustry #Mexico #Leadership #Inefficiency #EnergySector

Author: Victoria Adams