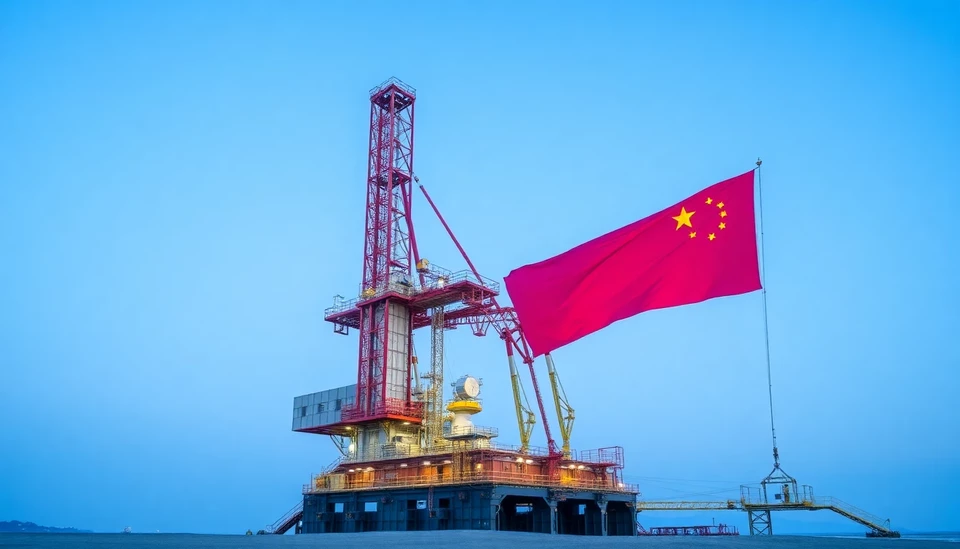

In a recent announcement, PetroChina, one of the largest oil and gas companies in the world, revealed a modest increase in its profits for the fiscal year 2024. The company reported a profit rise of approximately 2%, attributing this growth primarily to enhanced oil production capabilities. The findings reflect PetroChina's ongoing efforts to boost its production levels and adapt to fluctuating market demands.

The company’s revenue generation has been significantly influenced by its strategic drilling operations and increased efficiency in extracting and processing oil. This surge in production output comes during a period marked by rising global energy demands, showcasing PetroChina's ability to navigate the complexities of the current oil market.

PetroChina's improved performance can largely be attributed to its continued investment in technology and infrastructure, aimed at maximizing output from its existing fields. By modernizing its drilling techniques and enhancing its refining capabilities, the company has managed to position itself favorably against competitors and respond adeptly to both national and international market pressures.

Despite the profit growth, analysts remain vigilant regarding the volatility of the oil market and the potential impact of geopolitical tensions on future production stability. As countries around the world navigate energy security concerns and adapt to shifting consumption patterns, companies like PetroChina must continuously innovate and evolve their operational strategies.

Furthermore, the report indicates that PetroChina is also focusing on diversifying its energy portfolio, which includes investments in renewable energy sources. This multifaceted approach aims to mitigate risks associated with reliance on fossil fuels and ensure long-term sustainability for the company's growth trajectory.

Market analysts will be keeping a close watch on PetroChina’s forthcoming quarterly results to assess whether the company can sustain this positive momentum amid the challenges posed by global economic fluctuations and environmental regulations. As the demand for energy transitions into cleaner sources, the adaptability of major oil companies will be a crucial determinant of their future success.

In conclusion, while PetroChina’s recent profit growth is a positive indicator of its operational efficiency and market responsiveness, the company faces ongoing challenges within a steadily evolving energy landscape. Its focus on enhanced production, technological advancements, and diversification strategy will be pivotal in navigating the future of the energy industry.

#PetroChina #ProfitGrowth #OilProduction #EnergyMarket #Sustainability #RenewableEnergy #Investment

Author: Samuel Brooks