PetroChina Reports Slight Profit Growth Amid Rising Oil Production

In a recent announcement, PetroChina, one of the largest oil and gas companies in the world, revealed a modest increase in its profits for the fiscal year 2024. The company reported a profit rise of approximately 2%, attributing this growth primarily to enhanced oil production capabilities. The findings reflect PetroChina's ongoing efforts to boost its production levels and adapt to fluctuating market demands.

Continue reading

Vitol Acquires Eni’s Ivory Coast and Congo Assets in $1.65 Billion Deal

In a strategic move aimed at bolstering its presence in the African oil market, Vitol, the prominent global energy and commodities trading firm, has announced the acquisition of assets in Ivory Coast and the Republic of Congo from the Italian multinational oil and gas company Eni for a substantial $1.65 billion. This deal marks a significant milestone for Vitol as it seeks to expand its portfolio in West Africa's oil-rich landscape.

Continue reading

Alberta's Premier Smith Assures No Slowdown in Oil Production Amid Tariff Concerns

In a recent statement, Alberta’s Premier Danielle Smith has confidently assured that the oil production levels in the province will not be adversely affected by potential tariffs imposed on Canadian crude exports. This announcement comes amidst growing concerns over market fluctuations and trade policies that could impact the province's significant oil sector.

Continue reading

Texas Faces Critical Fire Hazards in Oil-Rich Permian Basin

As critical fire conditions loom for Texas, the impact is being felt most acutely in the oil-rich Permian Basin. The region, which is a vital hub for oil production, faces heightened risks due to a combination of dry weather, high winds, and low humidity levels. Such conditions are particularly concerning as they significantly increase the probability of wildfires, threatening both the environment and the infrastructure of one of America's most crucial oil fields.

Continue reading

Saudi Arabia Faces IMF Growth Downgrade Amid OPEC Supply Adjustments

In a significant turn of events, the International Monetary Fund (IMF) has revised its growth forecasts for Saudi Arabia, reflecting the impact of the nation’s recent adjustments to its oil production strategy as part of the OPEC pact. The updated prognosis has raised concerns among analysts about the kingdom's economic resilience as it navigates the complexities of fluctuating oil prices and global energy demands.

Continue reading

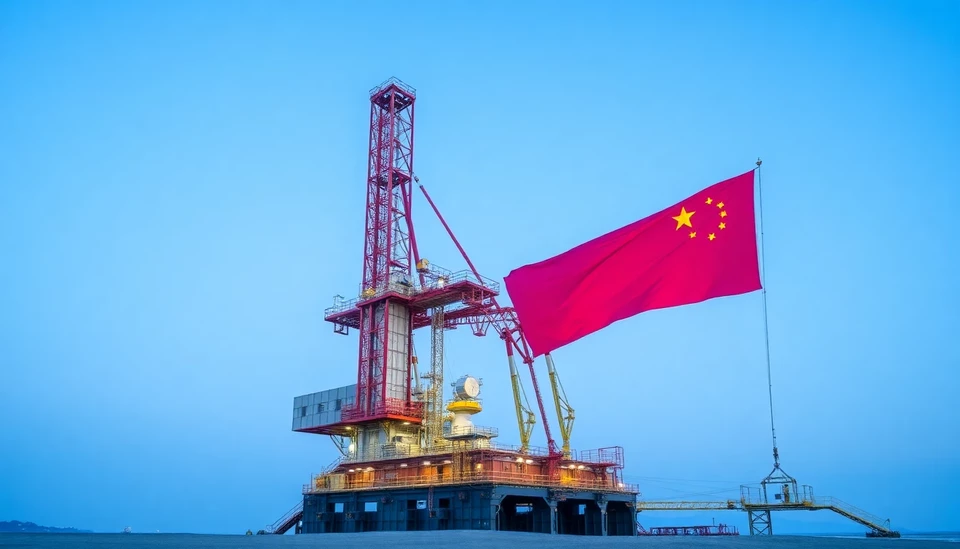

CNOOC Maintains Steady Capital Spending Following Historic Production Levels

In a significant announcement, China National Offshore Oil Corporation (CNOOC) has declared its intention to keep its capital expenditure (capex) flat for the upcoming fiscal year. This decision comes on the heels of the company achieving its sixth consecutive year of record production levels, solidifying its position as a leading player in the global energy market.

Continue reading

Senegal's Economic Surge Fueled by Booming Oil Production

Senegal has recently witnessed an impressive spike in its economic growth, largely attributed to the commencement of production at two major oil fields. The anticipated economic transformation is grounded in the critical role that hydrocarbons are expected to play in shaping the nation’s financial landscape. With new revenue streams from oil, Senegal stands on the brink of a potential economic revolution, promising to elevate its status within the region.

Continue reading

Exxon Mobil Sets Higher Capital Spending for 2025 Amid Anticipated Global Oil Glut

In a significant move that reflects the current dynamics of the oil market, Exxon Mobil Corp has announced plans to boost its capital expenditures for 2025. The company's strategic decision is aimed at navigating a landscape expected to see a surplus in global oil supply, which could impact pricing and operational strategies.

Continue reading

Missing Oil Barrels Create Uncertainty in IEA's Bearish 2025 Oil Market Outlook

The International Energy Agency (IEA) is facing challenges in its bearish oil market forecast for 2025, largely due to the mysterious disappearance of millions of barrels of oil that have not been accounted for. This discrepancy raises significant questions regarding the IEA's analysis and projections for the global oil market.

Continue reading

Can the U.S. Transform Its Role as a Leading Oil Producer in the Fight Against Climate Change?

In a groundbreaking effort to reconcile its position as the world's foremost oil producer with global climate goals, the United States is taking proactive steps to lead in climate action. The initiative comes amidst increasing pressure from both international and domestic fronts to address the challenges posed by climate change while maintaining economic growth derived from fossil fuel production.

Continue reading