In a significant development for the financial industry, Canada’s six largest lenders have increased their bonus pools by 12%, showcasing a robust financial performance despite economic uncertainties. This boost adds to the ongoing conversation about remuneration in the banking sector, particularly when juxtaposed against the backdrop of rising living costs and inflation across the country.

The banks involved in this increase include the Royal Bank of Canada, Toronto-Dominion Bank, Bank of Nova Scotia, Canadian Imperial Bank of Commerce, National Bank of Canada, and Bank of Montreal. These institutions have reported strong earnings, fueled by rising interest rates and a solid demand for loans. As they navigate a complex economic landscape, their financial resilience is reflected in their willingness to reward employees, particularly those in investment banking and wealth management.

This surge in bonus allocations arrives at a time when many Canadians are feeling the pinch from elevated prices, raising questions about equity and fairness within the economy. While the banks claim that these bonuses are deserved due to the hard work and dedication of their employees, critics argue that such increases can seem disproportionate when viewed against the struggles of average consumers.

Royal Bank, for instance, reported a significant year-on-year increase in profits, allowing it to allocate more towards bonuses, which are now seen as a critical tool to attract and retain top talent in a competitive market. Investment banking sectors have particularly benefited from heightened activity, including mergers and acquisitions, which have proven lucrative in the current financial climate.

Market analysts anticipate that this trend could signal further increases in bonuses across the banking sector as financial institutions adjust and compete for skilled professionals in a tightening labor market. This has prompted broader discussions about the future of compensation within financial services, especially in how it aligns with societal expectations and corporate governance standards.

As the Canadian economy faces various pressures, including geopolitical tensions and a fluctuating real estate market, the response from banks reflects their adaptive strategies. By increasing bonus pools, they not only bolster morale within their ranks but also reinforce their status as strong players on the global financial stage. The impending budget discussions and regulatory reviews may also consider these factors, as stakeholders call for a more equitable distribution of financial resources.

This 12% rise in bonuses draws attention not just within the banking industry but also among policymakers and citizens alike, who are keenly observing how these trends will impact the broader economic landscape as Canada moves forward into 2024.

#Canada #Banking #Bonuses #Finance #EconomicTrends #InvestmentBanking #CorporateGovernance #RBC #TD #Scotiabank

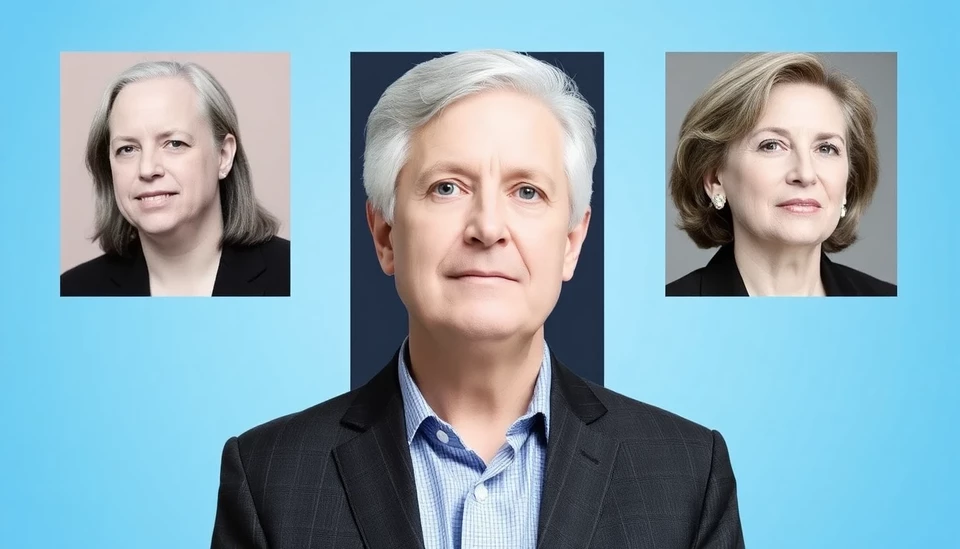

Author: John Harris