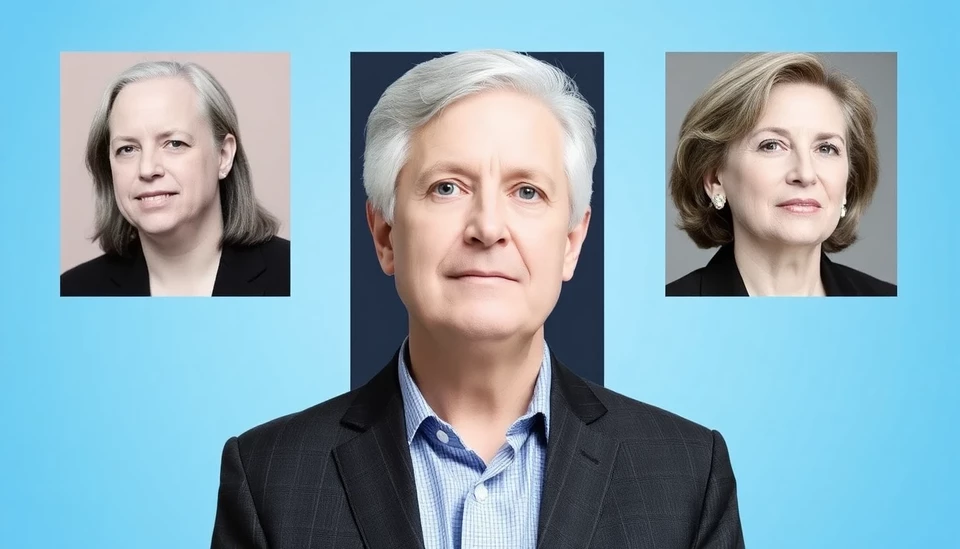

Scotiabank Economists Critique Canada's Major Political Platforms Ahead of Election

In a striking evaluation that has garnered significant attention ahead of Canada’s upcoming election, economists from Scotiabank have expressed strong criticisms of the platform policies released by both major political parties. This rare public stance comes at a time when the economic landscape is already fraught with challenges, leading experts to call for a more responsible approach to both fiscal and economic policies.

Continue reading

Scotiabank Surpasses Financial Expectations Amid Credit Challenges

Scotiabank has reported a significant financial performance that has exceeded analysts' expectations, driven largely by robust loan income. The Canadian bank has seen its net income rising, even as it contends with setbacks in its credit provisions. This latest financial report highlights both the strength and unpredictability of the banking sector in the current economic climate.

Continue reading

Scotiabank to Incurring $980 Million Loss Amid Colombia Unit Transfer

In a significant turn of events for Scotiabank, the Canadian financial institution is set to absorb a hefty charge of $980 million linked to the transfer of its Colombian operations. This decision has raised eyebrows in the financial community, as it reflects strategic shifts amid the bank's ongoing global realignment.

Continue reading

Surge in Banker Bonuses: Canada’s Top Six Lenders Boost Pool by 12%

In a significant development for the financial industry, Canada’s six largest lenders have increased their bonus pools by 12%, showcasing a robust financial performance despite economic uncertainties. This boost adds to the ongoing conversation about remuneration in the banking sector, particularly when juxtaposed against the backdrop of rising living costs and inflation across the country.

Continue reading

Scotiabank's Earnings Shift: Higher Expenses and Chinese Investment Impacts Performance

In a recent financial disclosure, Scotiabank revealed an earnings miss attributed to increased expenses and a substantial charge associated with its Chinese banking operations. The third quarter results from the Canadian financial giant fell short of analysts' expectations, highlighting the difficulties the bank is currently facing in managing operational costs amid its international expansion efforts.

Continue reading

Scotiabank Advises Investors to Reconsider Their Portfolios Ahead of Tax-Loss Selling Season

As the year draws to a close, Scotiabank is encouraging investors to take proactive measures with their portfolios in light of the impending tax-loss selling season. This annual event sees numerous investors offloading underperforming stocks to realize losses for tax purposes. The financial institution's insights aim to guide investors in optimizing their investment strategies as the market shifts.

Continue reading

Scotiabank Economist Warns of Potential Economic Crisis Under Trump’s Leadership

In a recent analysis, Derek Holt, an esteemed economist with Scotiabank, has raised alarms about the potential ramifications of Donald Trump's return to office. His comments come amid discussions surrounding the upcoming 2024 presidential election, where Trump remains a front-runner for the Republican nomination. Holt suggests that Trump’s past economic policies could lead to destabilizing effects on both the U.S. and global economy.

Continue reading