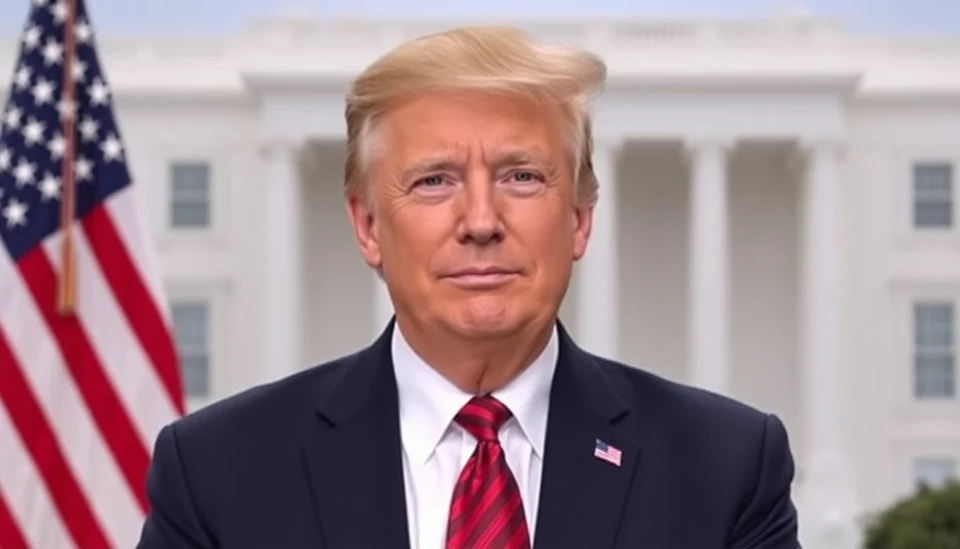

In a recent announcement that has sparked significant interest in financial circles, former President Donald Trump is advocating for an expansion of public-private market interactions. This initiative, outlined by the chief investment officer at Franklin Templeton, Michael Johnson, aims to harness the dynamism of private investments alongside public resources to stimulate economic growth and innovation.

Johnson emphasized that Trump's proposal could potentially reshape the landscape of investment strategies, benefiting not only large institutional investors but also retail investors who may gain access to a broader array of opportunities. This move comes at a time when economic recovery post-pandemic is still underway, and there is a pronounced need for innovative funding solutions that can drive entrepreneurial ventures and infrastructure projects.

According to Johnson, the fusion of public resources with private capital is essential for unlocking new avenues of growth. This approach could expedite capital flow into critical sectors, such as technology, renewable energy, and healthcare, where private investment often exceeds public funding capabilities. Johnson pointed out that this could lead to enhanced infrastructure projects, aimed at modernizing the country’s assets and addressing the pressing challenges posed by climate change and social equity.

Furthermore, the initiative seeks to address the imbalance in financing opportunities that often leave smaller businesses with limited access to capital. By incentivizing public institutions to collaborate more closely with private entities, the Trump-led strategy would aim to democratize investment, making it more inclusive and accessible to entrepreneurs from diverse backgrounds.

While the potential benefits of this strategy are clear, Johnson also acknowledged the risks involved. He stressed the importance of maintaining rigorous oversight and transparency in transactions to prevent mismanagement of funds and ensure that the investments actually deliver value to the public. In light of historical instances of public-private partnerships falling short of expectations, Johnson underscored the need for a framework that holds all parties accountable.

As the financial community continues to react to Trump’s proposal, the focus will likely remain on how these ideas can be effectively implemented. Investors will be keenly watching advocacy efforts and potential legislative changes that may arise. The ability of this initiative to gain traction will depend heavily on bipartisan support and the willingness of public financial institutions to embrace innovative partnerships with private capital.

In summary, Trump's strategy to enhance public-private market collaborations, as discussed by Franklin Templeton’s John Johnson, presents a bold vision for revitalizing the U.S. economy through a fresh lens of investment opportunity, unless adequately managed, could pose significant risks. As stakeholders deliberate on this multifaceted approach, the implications for the broader economic landscape will undoubtedly unfold in the months to come.

#Trump #PublicPrivatePartnerships #InvestmentStrategy #EconomicGrowth #FranklinTempleton #MichaelJohnson #CapitalMarkets #Innovation #Infrastructure #SmallBusiness #BipartisanSupport

Author: Victoria Adams