Franklin Templeton's Strategic Revamp Amidst Massive Outflows

In a significant turn of events, Franklin Templeton is undertaking a major restructuring initiative in response to an alarming $120 billion in outflows from its WAMCO division. This dramatic shift highlights the pressures and competitive challenges facing asset management firms in today’s volatile market.

Continue reading

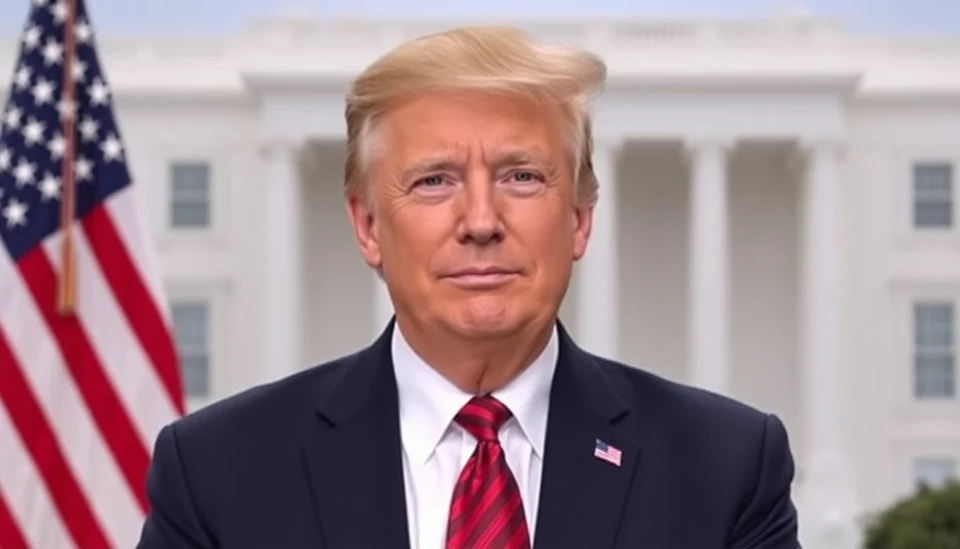

Trump's Strategic Move to Enhance Public-Private Markets: Insights from Franklin Templeton's Johnson

In a recent announcement that has sparked significant interest in financial circles, former President Donald Trump is advocating for an expansion of public-private market interactions. This initiative, outlined by the chief investment officer at Franklin Templeton, Michael Johnson, aims to harness the dynamism of private investments alongside public resources to stimulate economic growth and innovation.

Continue reading

Franklin Templeton's Johnson Advocates for Premium Valuation of Private Credit

In a recent statement, Franklin Templeton’s Chief Investment Officer, Dave Johnson, emphasized the growing importance and value of private credit markets, suggesting that these assets should be trading at a premium compared to traditional public credit markets. This perspective comes amid evolving economic conditions and an increasing allocation of capital toward non-public debt sources.

Continue reading

Franklin Shares Plummet Amidst $53 Billion Outflows from WAMCO and CFTC Investigation

In a turbulent turn of events for Franklin Templeton Investments, the financial giant experienced a significant downturn in its share price following reported outflows of $53 billion from its WAMCO (Western Asset Management Company) subsidiary. The outflows have raised eyebrows in the industry, particularly amidst a looming investigation by the Commodity Futures Trading Commission (CFTC) into the firm’s trading practices. This unsettling combination has placed Franklin Templeton under intense scrutiny from investors and analysts alike.

Continue reading