Fed and FDIC to Reassess Community Reinvestment Act Rules Amid Banking Scrutiny

The Federal Reserve (Fed) and the Federal Deposit Insurance Corporation (FDIC) have announced plans to withdraw a final rule related to the Community Reinvestment Act (CRA), a pivotal law that encourages banks to meet the credit needs of underserved communities. This withdrawal comes at a time when both agencies are under increased pressure to evaluate the effectiveness of banking regulations in promoting fair lending and equitable access to financial services.

Continue reading

Kuwait Makes Historic Move to Allow Banks to Offer Mortgages

In a groundbreaking development for the financial landscape of Kuwait, the Central Bank has announced plans to allow local banks to offer mortgage lending for the very first time. This significant policy shift is poised to revolutionize access to home ownership for many Kuwaitis and enhance the overall functionality of the housing market.

Continue reading

IMF Urges New Zealand to Ensure Banking Reforms Maintain Stability

The International Monetary Fund (IMF) has issued a crucial warning regarding New Zealand’s impending banking reforms, emphasizing the necessity of preserving financial stability within the nation’s banking sector. This advisory comes at a time when New Zealand is contemplating adjustments to its banking regulations, aiming to enhance resilience against potential future financial crises.

Continue reading

New Zealand's Finance Minister Calls for Overhaul of Bank Capital Rules

In recent developments, New Zealand's Finance Minister, Grant Robertson, has initiated a process to evaluate potential changes to the nation's bank capital rules. This move comes amidst rising concerns regarding the financial stability and resilience of banks amid fluctuating economic conditions and global uncertainties.

Continue reading

Ex-Credit Suisse Banker Escapes Prison in Tuna Bond Scandal

In a surprising turn of events, a former banker at Credit Suisse, who was linked to a controversial tuna bond scandal, has narrowly avoided a prison sentence. This decision comes after the individual was found guilty of participating in a scheme that deceived investors while raising significant funds for a tuna fishing company in Mozambique.

Continue reading

UK Considers Relaxation of Leverage Ratio Regulations for Smaller Banks

The UK government is exploring the option to alleviate the stringent leverage ratio regulations that currently apply to smaller banking institutions. This potential move is aimed at promoting lending capabilities among these lenders, thereby driving economic growth, particularly in underserved markets.

Continue reading

Major Financial Blunder: Citi's $6 Billion Mistake Due to Copy-Paste Error

In a staggering turn of events, Citibank nearly dispatched $6 billion to an incorrect account due to a simple copy-paste error. This incident has raised eyebrows and concerns regarding the internal checks and balances of one of the world's leading financial institutions.

Continue reading

ECB Mulls Changes to Bank Oversight in Response to Mounting Criticism

The European Central Bank (ECB) is contemplating significant adjustments to its approach to bank inspections as it faces growing scrutiny over its oversight practices. This deliberation comes in light of a series of challenges that have raised questions about the effectiveness and transparency of the ECB's regulatory framework.

Continue reading

Citi’s Board Rewards CEO Jane Fraser with a 33% Pay Increase Amid Strategical Overhaul

In a significant move reflecting the ongoing strategic transformation at Citigroup, the bank's board has approved a substantial pay increase for CEO Jane Fraser. Her compensation has been raised by 33%, bringing her total earnings for the year to an impressive $34.5 million. This decision speaks volumes about the board's confidence in Fraser's leadership as she steers the institution through a period of critical changes aimed at bolstering the bank's profitability and market position.

Continue reading

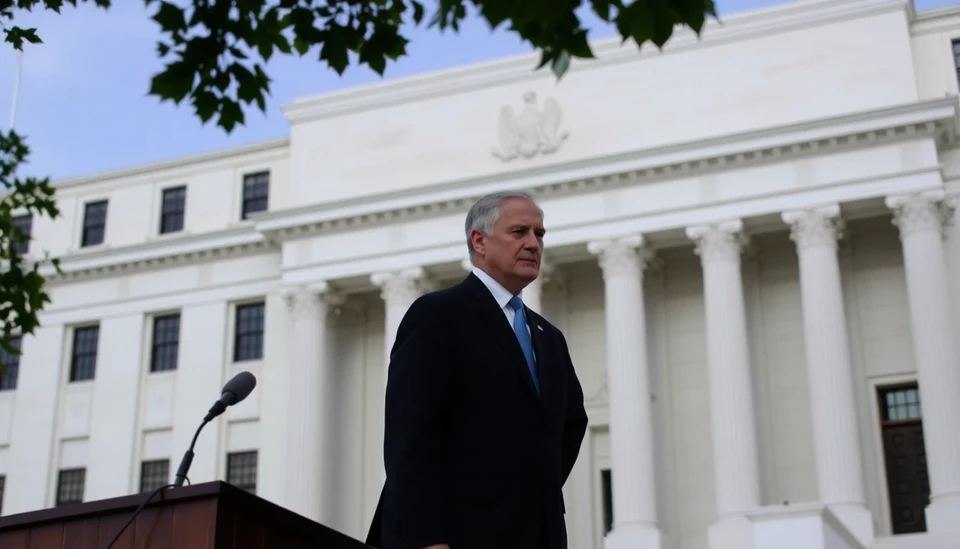

Fed Chair Jerome Powell Seeks Clarity Amid Debanking Concerns

In a significant address delivered on February 11, 2025, Federal Reserve Chairman Jerome Powell emphasized the necessity of simplifying the language used by the Federal Reserve, particularly in light of rising apprehensions regarding debanking practices in the financial sector. Powell's remarks shed light on the institution's proactive approach to ensure better communication and understanding of monetary policy among the public and market participants.

Continue reading